Debt Levels vs. Interest Rates: Which is Driving Farm Interest Expense Higher?

One of the biggest stories out of the U.S. economy has been the recent Federal Reserve interest rate hikes. In 2018, the Fed decided to raise rates four times. These rate hike announcements sparked concerns about the impact of higher interest rates on farm interest expense. This week’s post takes a look at farm interest expense and the two key drivers; interest rates and debt levels.

Farm Interest Expense

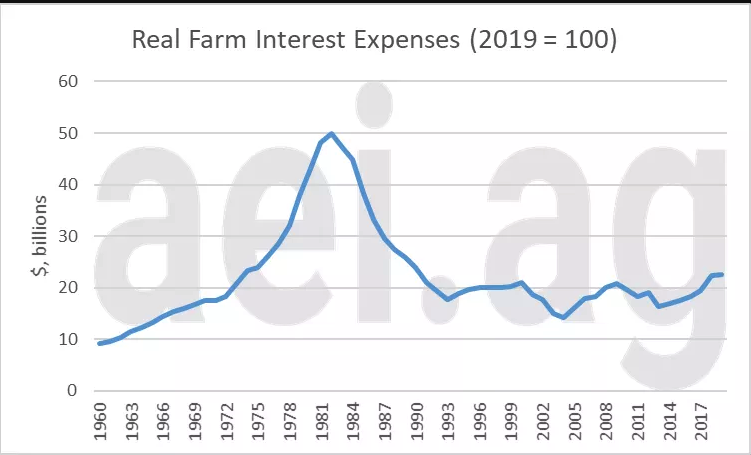

Figure 1 shows real, or inflation-adjusted, farm interest expense from 1960 to 2019. For 2019, interest expense is estimated to reach $22.6 billion. Since 2013, real interest expense has trended higher, up nearly $6 billion (38%). The uptick in interest expense in recent years has been noteworthy, especially as revenues and farm incomes have fallen during this period.

While the uptick is concerning, context is helpful. On the one hand, $22 billion is the highest level observed since 1990 when farm interest expense was $23 billion. Second, 2019 marks the sixth-time interest expense exceeded $20 billion since 1990 (1990, 1991, 2000, 2009, 2018, 2019).

On the other hand, farm interest expense peaked at $49.9 billion (in 2019 dollars) during the farm financial crisis of the 1980s. While real farm interest expense has only exceeded $20 billion a few times in recent years, this level was a level regularly exceeded in the past. From 1973 to 1991, real farm interest expense exceeded $20 billion for 19 consecutive years.

Figure 1. Real Farm Interest Expense, 1960 to 2019F (2019 dollars). Data Source: USDA ERS

Farm Debt

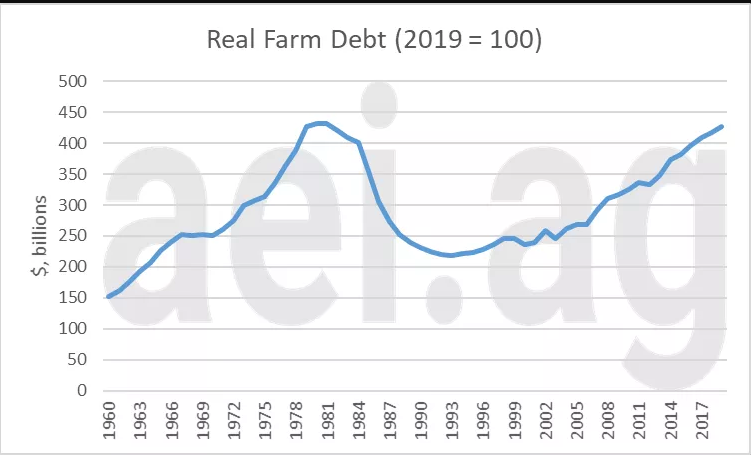

Contributing to higher interest expense has been higher debt levels. Figure 2 shows the total real farm debt since 1960. Like interest expense, this measure is sector-wide and across all producers. Additionally, this measure has been moving higher since the mid-1990s and exceeded $400 billion in 2018. Before 1990, real farm debt exceeded $400 billion between 1979 and 1984. Farm debt peaked at $431 billion in 1980.

Interest expense (figure 1) and total farm debt (figure 2) portray two different stories. While farm debt has trended sharply higher over the last two decade –approaching 1980s’ levels – interest expense remains well below 1980s levels.

Figure 2. Real Farm Debt, 1960 to 2019F (2019 dollars). Data Source: USDA ERS.

Interest Rates

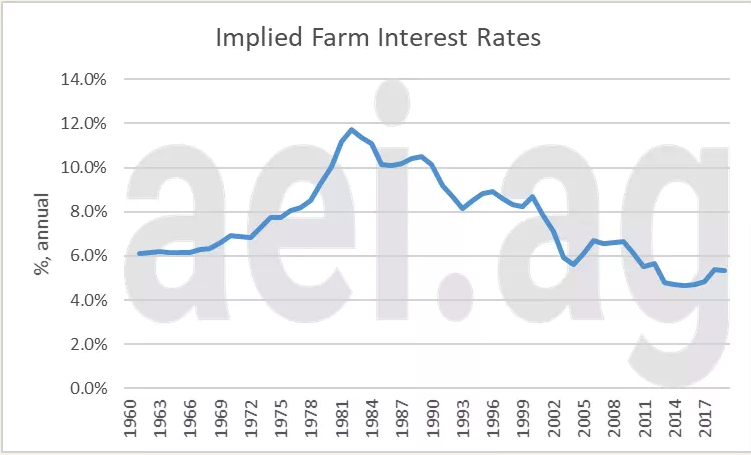

The relationship between total debt and interest expense is, of course, interest rates. To consider this relationship, we took annual interest expenses divided by average total farm debt for a given year[1]. This measure is an implied average annual interest rate across all farm debt.

Figure 3 shows the implied interest expense from 1960 to 2019. Based on the USDA forecasts of farm debt and interest expense in 2019 – which are subject to future adjustments- the implied interest rate in 2019 was 5.3%. This is an uptick from lows of 4.6% in 2015.

The average implied interest rate over the last ten years (2010 to 2019) was 5.2%. Over the last six decades, the average implied interest rate was 7.6%. While farm interest rates have turned higher, they remain well below the long-run average, and in line with the 10-year average.

Annual interest rates have been much higher in the past. During the farm financial crisis of the 1980s, the implied farm interest rate reached nearly 12% in 1982. It is also worth nothing interest rates were consistently above 8% from 1976 to 2000, or 25 years.

Another way of thinking about the current interest rate environment is considering how frequently rates have fallen below 6%. While implied farm interest rates have been below 6% for the last 9 years, rates this low are quite uncommon historically. Previously, rates only briefly fell below 6% in 2003 and 2004. In total, rates below 6% have occurred 11 out of the 60 years (18% of the time) Current interest rates have been- and remain- among the lowest observed for many producers’ careers.

The divergence between the farm debt story – which is nearly at 1980s levels- and annual interest expense – well below 1980s levels – is interest rates.

Figure 3. Implied Farm Interest Rates, 1960- 2019F. Data Source: USDA ERS.

Rates vs. Debt Levels

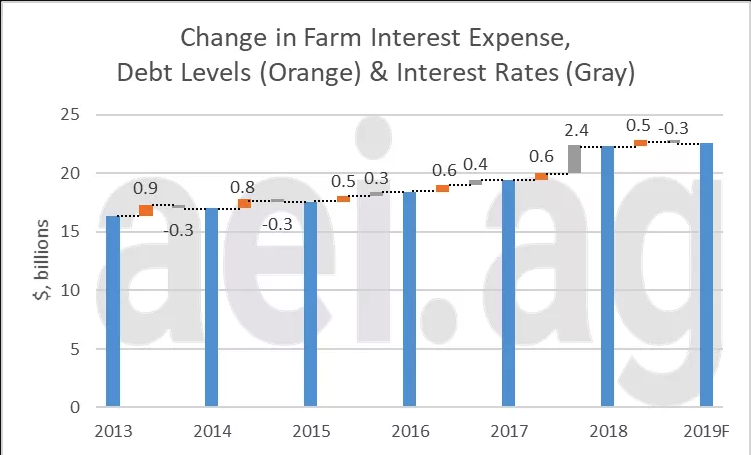

Rising debt levels and higher interest rates have both impacted farm interest expense. Figure 4 shows annual interest expenses from 2013 to 2019, but also breaks out the annual changes to show the impact of interest rate and debt-level changes.

From 2013 to 2019, total farm interest expenses increased by $6.2 billion, up 38%. Of that, a majority of the increase ($4 billion) was due to increasing debt levels while higher interest rates accounted for $2.2 billion of the increase.

Again, figure 4 shows these changes over time. Rising debt levels have steadily pushed interest expense higher. Over the six years, the impact from higher debt level has been small on an annual basis (less than $1 billion annually) but has been consistently pushing the expense higher.

On the other hand, interest rate changes have been very small or negative in most years. The one exception, and it is a big expectation, was 2018. From 2017 to 2018, interest rates pushed interest expense $2.5 billion higher. A significant one-year change. The jump came as implied interest rates increased from 4.8% (2017) to 5.4% (2018).

Figure 4. Annual Changes in Farm Interest Expense, Debt Levels (Orange) and Interest Rates (Gray). Data Source: USDA ERS.

Wrapping it Up

Higher interest expense has been a headwind for the U.S. farm economy. The two drivers of interest expense – higher debt levels and higher interest rates- have both trended unfavorably in recent years.

Since 2013, higher levels of debt have contributed to a majority (64%) of the $6.2 billion increase in interest expense. Higher debt levels have steadily increased interest expense each year. On the other hand, the impact of higher interest rates was most evident in 2018, underscoring concerns about higher interest rates and the potential impact on farm budgets and the farm economy.

While higher interest rates seem to receive much of the attention and blame for higher farm interest expense, higher levels of debt are also a factor. In recent years, these two factors have contributed to changes in interest expense differently.

Looking ahead, higher interest rates have the potential of impacting agriculture beyond interest expenses. As Brent wrote about earlier, higher interest rates can also impact capital asset values, such as farmland.

While the Federal Reserve recently announced no plans for rate hikes in 2019, this does not mean agriculture is out of the woods. Creditworthiness and total debt will continue to be factors in 2019 and beyond.

Interested in learning more? Follow AEI’s Weekly Insights by clicking here. Also, follow AEI on Twitter and Facebook.

[1] Average annual farm debt was calculated using beginning-of-year and end-of-year debt levels reported by the USDA.

Source: David Widmar, Agricultural Economic Insights