Margin Coverage Option (MCO) is margin coverage made simple.

The Margin Coverage Option (MCO) crop insurance endorsement is meant to take the simplicity of Enhanced Coverage Option (ECO) and combine it with the unique capability to insurance against reduced margins as introduced by Margin Protection (MP).

MCO is an endorsement product and provides area-based coverage. MCO attaches to the underlying crop policy.

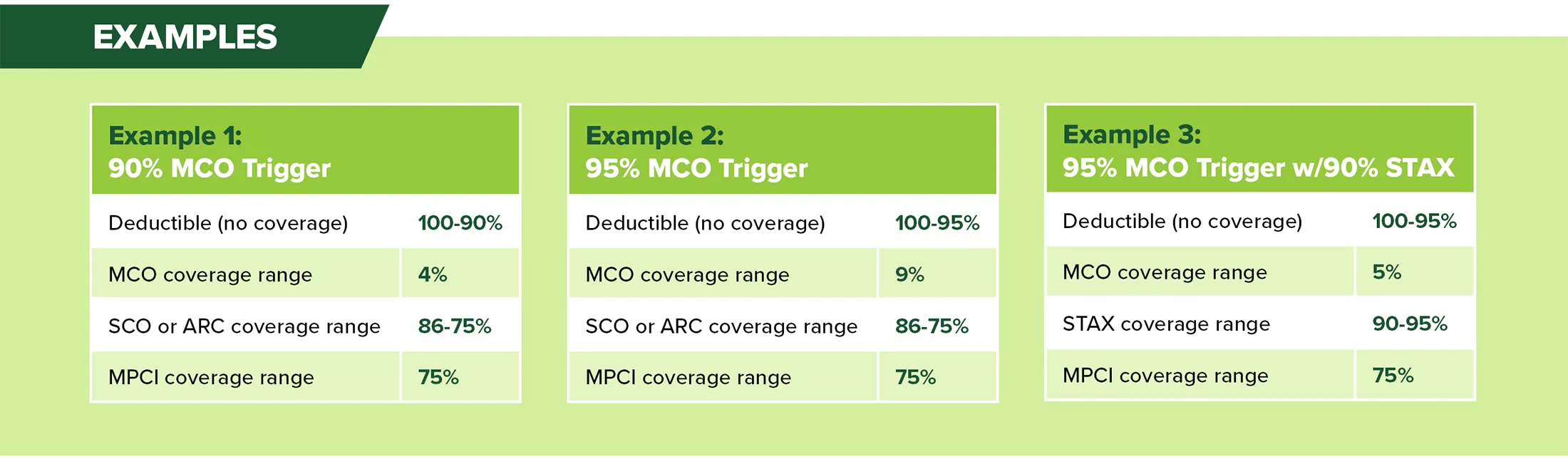

MCO is offered in two primary coverage bands, each starting at 86% coverage level and extending up to 90% or 95%. The STAX 90% endorsement has an available 5% band.

The Margin Coverage Option (MCO) endorsement was approved at the 80%* premium subsidy rate. (MGR-25-006)

What is the Margin Coverage Option (MCO) endorsement?

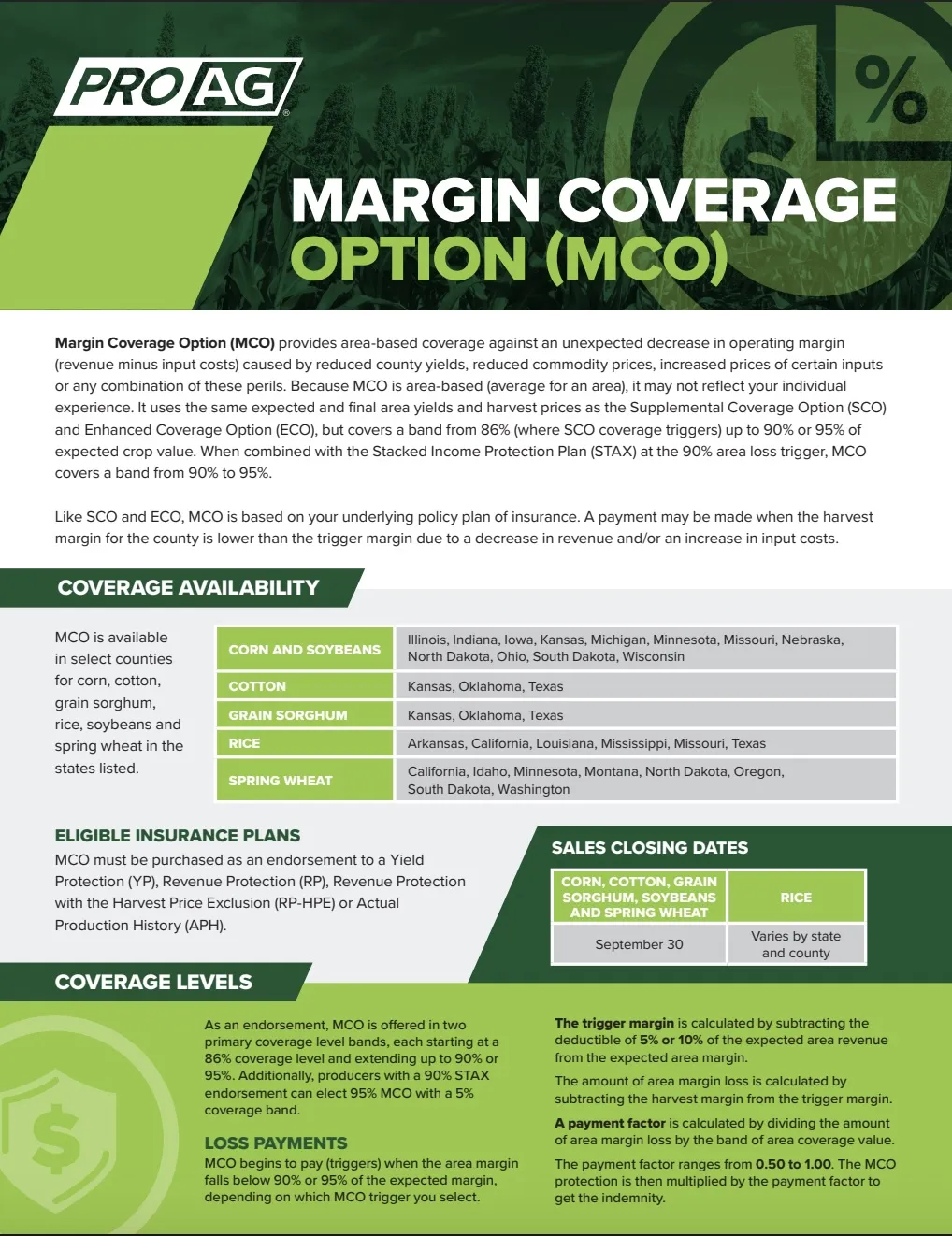

Margin Coverage Option (MCO) provides area-based coverage against an unexpected decrease in operating margin (revenue minus input costs) caused by reduced county yields, reduced commodity prices, increased prices of certain inputs or any combination of these perils. Because MCO is area-based (average for an area), it may not reflect your individual experience.

It uses the same expected and final area yields and harvest prices as the Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO), but covers a band from 86% (where SCO coverage triggers) up to 90% or 95% of expected crop value. When combined with the Stacked Income Protection Plan (STAX) at the 90% area loss trigger, MCO covers a band from 90% to 95%.

Like SCO and ECO, MCO is based on your underlying policy plan of insurance. A payment may be made when the harvest margin for the county is lower than the trigger margin due to a decrease in revenue and/or an increase in input costs.

Where is MCO coverage available?

MCO is available in select counties for corn, cotton, grain sorghum, rice, soybeans and spring wheat in the states listed below. The sales closing date for corn, cotton, grain sorghum, soybeans and spring wheat is September 30. The sales closing date for rice varies by state and county.

| CROP(S) | STATES (Check actuarial documents for specific counties) |

| CORN AND SOYBEANS | Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, Wisconsin |

| COTTON AND GRAIN SORGHUM | Kansas, Oklahoma, Texas |

| RICE | Arkansas, California, Louisiana, Mississippi, Missouri, Texas |

| SPRING WHEAT | California, Idaho, Minnesota, Montana, North Dakota, Oregon, South Dakota, Washington |

MCO must be purchased as an endorsement to a Yield Protection (YP), Revenue Protection (RP), Revenue Protection with the Harvest Price Exclusion (RP-HPE) or Actual Production History (APH) policy.

What coverage levels are available for Margin Coverage Option (MCO)?

As an endorsement, MCO is offered in two primary coverage level bands, each starting at a 86% coverage level and extending up to 90% or 95%. Additionally, producers with a 90% STAX endorsement can elect 95% MCO with a 5% coverage band.

You may choose any coverage level shown on the actuarial documents on a crop-by-county basis and by irrigation practice. Coverage levels cannot be varied by type and will apply to all applicable (insurable) acres.

How is the margin determined for Margin Coverage Option (MCO)?

Inputs may include diesel fuel, natural gas, and certain fertilizers for which projected and harvest prices can be obtained from third-party markets. Price changes for these inputs, along with area yield changes and changes in the price of the commodity, determine whether an indemnity is paid. Inputs by crop are:

- Corn, Cotton, Grain Sorghum, Rice and Wheat: diesel, natural gas, diammonium phosphate, urea, potash.

- Soybeans: diesel, natural gas, diammonium phosphate, potash.

As a reminder, individual farm input costs are not used in these calculations.

How do losses work with MCO?

MCO begins to pay (triggers) when the area margin falls below 90% or 95% of the expected margin, depending on which MCO trigger you select. Any indemnities owed will be paid when final county yields are available in the spring of the following year.

- The trigger margin is calculated by subtracting the deductible of 5% or 10% of the expected area revenue from the expected area margin.

- The amount of area margin loss is calculated by subtracting the harvest margin from the trigger margin.

- A payment factor is calculated by dividing the amount of area margin loss by the band of area coverage value.

- The payment factor ranges from 0.50 to 1.00. The MCO protection is then multiplied by the payment factor to get the indemnity.

Pro Ag Management, Inc.* (collectively with its corporate affiliates, “ProAg®”) is a managing general agency representing several risk bearing insurance companies, including Producers Agriculture Insurance Company and U.S. Specialty Insurance Company and doing business as Pro Ag Insurance Services, Inc. in California, CA Entity License #0F34212. The insurance products described on this website may not be a complete list of all products offered and may not be offered in all states. The provided information does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by ProAg or any of its subsidiaries; always refer to the policy provisions. Actual coverages will vary based on the terms and conditions of the policy issued.