Pasture, Rangeland, and Forage insurance (PRF insurance) was designed to help protect a producer’s operation from the risks of forage loss due to the lack of precipitation.

The Pasture, Rangeland, Forage Pilot Insurance Program provides insurance coverage on your pasture, rangeland, or forage acres grown for the intended use of grazing by livestock or haying. This program is designed to give producers the ability to buy insurance protection for losses of forage produced for grazing or harvested for hay, which result in increased costs for feed, destocking, depopulating, or other actions. The PRF program utilizes a rainfall index to determine precipitation for coverage purposes and does not measure production or loss of products themselves.

How PRF Works

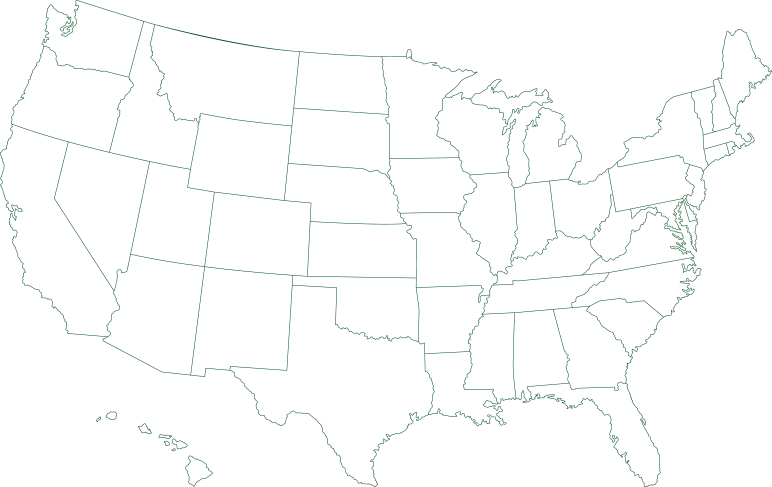

PRF insurance is available in the 48 contiguous states with the exception of a few grids that cross international borders.

The Rainfall Index uses National Oceanic and Atmospheric Administration Climate Prediction Center (NOAA CPC) data and each grid covers an area equal to .25º in latitude by .25° in longitude. Acres will be assigned to one or more grids based on the location to be insured. A producer must select at least two, 2-month periods where precipitation is most critical to their operation. These periods are called index intervals. It is important for ranchers and farmers to understand that payments are not based on individual rain gauges on their farm or a single weather station, but the interpolated data for the entire NOAA CPC grid which may not be traced back to a single reporting station.

The Pasture, Rangeland, and Forage insurance was designed to help protect a producer’s operation from the risks of forage loss due to the lack of precipitation, which is why it is sometimes referred to as PRF rainfall insurance. However, it is not designed to insure against ongoing or severe drought, as the coverage is based on precipitation expected during specific intervals only.

Pasture, rangeland, and forage cover approximately 55 percent of all U.S. land. Forage grows differently in different areas, so it’s important for farmers and ranchers to know which types and techniques work best for their region.

How are PRF insurance payments determined?

Insurance payments are determined by using NOAA CPC data for their grid(s) and index intervals that were chosen to insure. When the final grid index falls below the policyholder’s “trigger grid index”, the producer may receive an indemnity. This insurance coverage is for a single peril — lack of precipitation. Coverage is based on the experience of the entire grid. It is not based on individual farms or ranches or specific weather stations in the general area.

What PRF Insurance Tools are Available to ProAg Agents?

Producers need to make several choices when insuring their grazing or hay production, including coverage level, index intervals, irrigated practice, productivity factor, and number of acres. Producers should work with their crop insurance agent to view the PRF Grid ID Locator map and index grids for their area and assign acreage to one or more grids based on the location and use of the acreage to be insured. RMA encourages the use of the Grid ID Locator, historical indices tool, and decision support tools available on RMA’s website to help decide whether PRF is the right insurance coverage for a producer’s operation.

Robust quoting tools are available within ProAg’s PRF quoting system which provides numerous data points and historical indices, as well as decision support tools available on RMA’s website. This data helps producers decide whether PRF is the right insurance coverage for their operation.

Is PRF drought insurance?

No. The RI-PRF is not “drought insurance” and does not insure against abnormally “high temperatures” or “windy conditions.” While a drought may cause a decline in the index value to the point that an indemnity payment is issued to eligible insured producers, a drought being declared in a state, county or area does not, by itself, trigger an indemnity payment under the RI-PRF.

"*" indicates required fields