95 Million Acres of Corn in 2020?

As attention shifts to the 2020 planting season, questions about U.S. acreage – and the potential for the more than 95 million acres of corn- will come into focus. On the one hand, 95 million would be a substantial increase over the 90 million acres planted in recent years. On the other hand, 95 million is a significant step back from the 100 million acres pondered and rumored last summer. In this week’s post, we’ll consider the potential for the U.S. to plant 95 million acres of corn in 2020.

Acreage

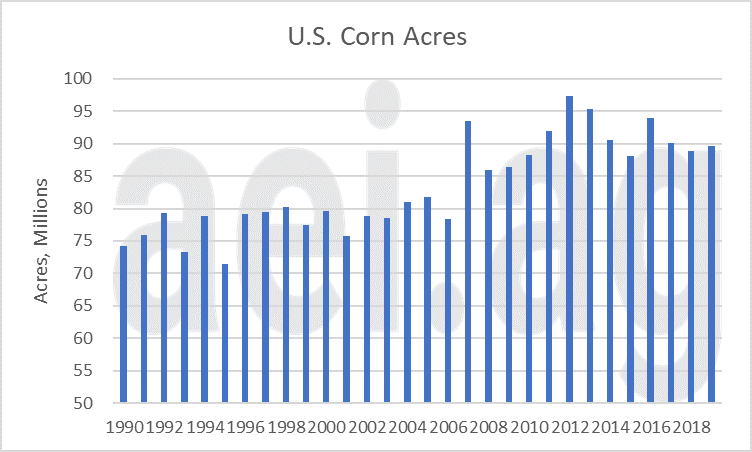

Figure 1 shows planted U.S. corn acres since 1990. Over the past 30 years, corn acreage has trended higher, from 75 million acres crops in 1990 to 90+ million acres crops in the 2010s. During this time frame, the U.S. has only planted more than 90 million acres of corn seven times, first occurring in 2007 (93.5m). Furthermore, the U.S. has only planted more than 95 million acres twice; 2012 (97.3m) and 2013 (95.4m).

Figure 1. Planted U.S. Corn Acres, 1990- 2019. Data Source: USDA NASS.

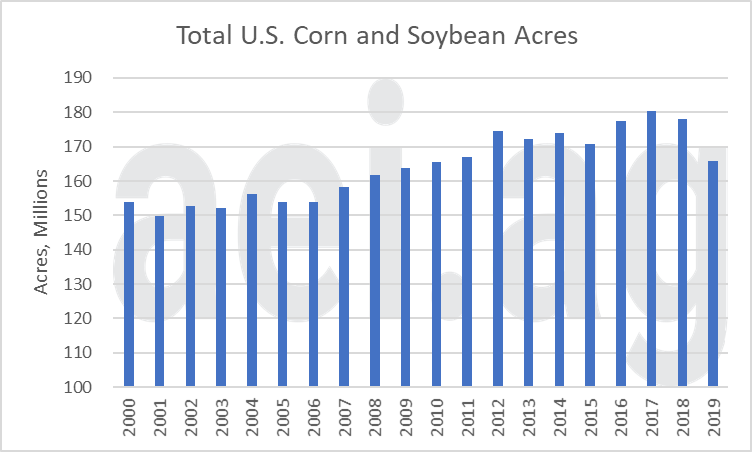

As corn acres shifted higher, so did soybeans. Combined corn and soybean acres have increased by nearly 30 million acres (20%) over the last two decades (figure 2). In the early 2000s, it was common for combined acres to equal 150 million, whereas 180 million acres is common today.

Figure 2. Total U.S. Corn and Soybean Acres, 2000- 2019. Data Source: USDA NASS.

Potential for 2020

When thinking about potential 2020 acreage, we find it helpful to consider two questions:

- What will be total corn and soybean acres?

- What share of those combined acres will be planted to soybeans?

Or, in other terms, how big is the corn+soybean pie, and what share – or slice- will soybeans represent?

To answer the first question, 180 million acres seems like a reasonable starting point. Combined acres were recently 180.3m (2017) and 178.0m (2018). If you assumed a typical year of prevented planting, combined acreage in 2019 was roughly equal to 179.8m[1]. While acreage of other crops – cotton, spring wheat, etc. – could impact this, winter wheat acres are mostly unchanged. That all said, 180 million is a reasonable starting point.

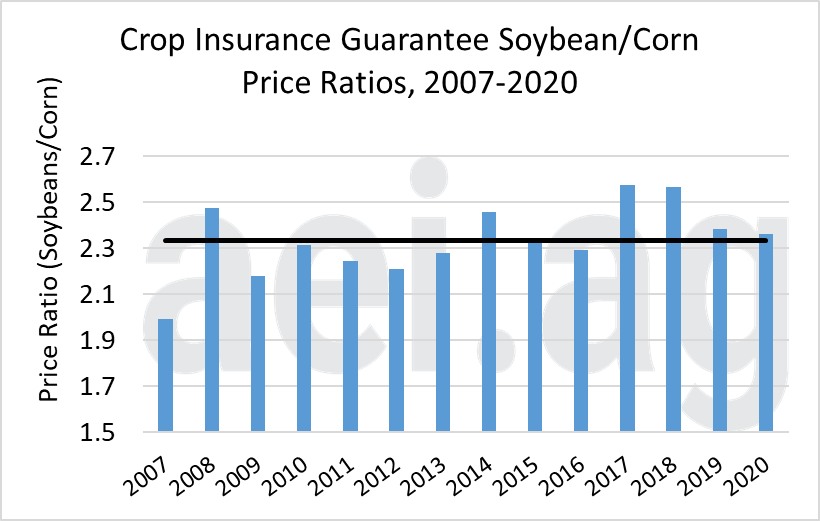

To answer the second question, it’s important to consider how favorable soybeans are. A common way of doing this is the soybean/corn price ratio (figure 3). For 2020, the price ratio is 2.36, which is above the 13-year average of 2.33. This is to say that relative soybean prices are higher in 2020 than average. The higher the price ratio, the more favorable soybeans are.

What is the implication for soybeans’ share of combined acres? Figure 4 plots the relationship between the crop insurance price ratio and soybeans’ share of combine corn+soybean acres (since 2007). As expected, there is an upward trend; a higher price ratio translates into a large share of corn+soybean acres planted to soybeans.

For 2020, the model in figure 4 suggests nearly 46.9% of combined corn+soybean acres will be planted to soybeans. Or, for a potential 180 million combined acres, an allocation of 95.6 million to corn, 84.4 million to soybeans.

Figure 3. Crop Insurance Price Ratio, Soybeans Divided by Corn. 2007-2020. Average (shown in black): 2.33.

Figure 4. Relationship Between Soybean/Corn Price Ratio and Plantings, 2007-2019 (2020 price ratio denoted by the star).

Considerations

95+ million acres of corn in 2020 would be a lot of corn –the second or third largest crop in recent years. Such an estimate seems almost unfathomable, especially since the price ratio favors soybeans. Further to that point, the price ratio for 2012 and 2013 – when acres last exceeded 95 million – was 2.21 and 2.28, respectively.

Keep in mind that the price ratio in recent years has been historically favorable to soybean. Levels in 2017 and 2018 (2.57) were the highest observed in the thirteen years of data and were sufficiently high enough to result in roughly equal planting of corn and soybeans (soybeans share of combined acres reached 50%). This is to say that while the price ratio in 2020 favors soybeans, it’s considerably less favorable than what was observed in 2017 and 2018.

Most importantly, corn acreage in 2020 is being driven mostly by the uptick in combined corn and soybean acres. When corn acres last exceeded 95 million, combined acres were lower; 174.5 (2012) and 172.2 (2013). While corn is not nearly as attractive as it was in 2012 and 2013, the reality is for 2020 is there are 5.5 to 7.8 million acres to allocate this year.

To use the pie analogy again, corn acres in 2020 will undoubtedly account for a smaller share of combined acres compared to 2012 and 2013. However, the 2020 pie will be considerably larger, with more acres to allocate.

Wrapping it Up

A lot can – and will – happen between now and the June 2020 planting report. That said, 2020 is facing a unique set of conditions. First, combined acres are likely to remain at or near historical highs of 180 million. Secondly, soybeans are less favorable than in recent years. The combination of factors sets the stage for corn acres to potentially make a run at 95+ million acres. Of course, similar conditions prevailed in 2019, before Mother Nature intervened and dramatically changed the projected ending stocks situation.

Click here to subscribe to AEI’s Weekly Insights email and receive our free, in-depth articles in your inbox every Monday morning.

You can also click here to visit the archive of articles – hundreds of them – and to browse by topic. We hope you will continue the conversation with us on Twitter and Facebook.

Source: David Widmar, Agricultural Economic Insights