A Closer Look at U.S. Meat Production from USDA’s Economic Research Service

Last week, USDA’s Economic Research Service (ERS) released its monthly Livestock, Dairy, and Poultry Outlook, which included updated information regarding meat production.

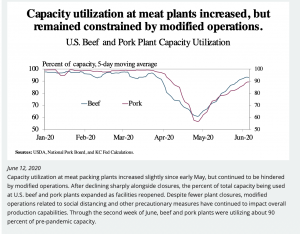

In part, the ERS update stated that, “Over the past 2 months, U.S. beef packers had to implement new health protocols for dealing with COVID-19 that might have hindered their ability to process cattle. However, they have recouped much of the lost slaughter capacity in a very timely manner since hitting the lowest levels at the end of April. At the lowest point, steer and heifer slaughter fell by as much as 41 percent below a year ago, and the slaughter of cows and bulls dropped to 9 percent below a year ago.

Based on USDA, Agricultural Marketing Service estimated weekly slaughter for the week ending June 13, steer and heifer slaughter recovered to 4 percent below the same week a year ago, and cow and bull slaughter improved to 7 percent above the same week last year.

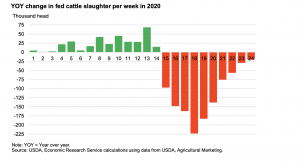

“The chart below illustrates the volume difference in fed cattle slaughtered year over year through the first 24 weeks of 2020. In the face of gains by meatpacking facilities in recovering capacity utilization at their plants, this chart would suggest that many market-ready cattle likely remain in feedlots since the first week of April, waiting to be slaughtered.”

The Outlook added that, “As mentioned, packing facilities have recovered much of their capacity from last year’s levels, and this has occurred faster than projected in last month’s analysis. Accordingly, the anticipated pace of slaughter for 2020 was raised for the remainder of this quarter and the second half of the year. The beef production forecast for second-quarter 2020 was raised by 370 million pounds to just over 6 billion pounds, 12 percent below last year and the lowest for the quarter since 2015. The production forecast for second-half 2020 was raised from last month on the expectation that beef packing facilities will maintain capacity just below year-ago levels. As a result, the annual beef production forecast for 2020 was increased 910 million pounds from last month to 26.7 billion pounds, about 2 percent below 2019 levels.”

Last week’s update also pointed out that, “In the second quarter, the capacity of beef packing plants to slaughter fed cattle was reduced by as much as 41 percent, which prompted lower prices for fed cattle. As beef production declined, wholesale beef prices skyrocketed, which greatly expanded packer margins. However, as packers’ capacity to slaughter began to rebound at the beginning of May, increasing demand for cattle, it likely increased their willingness to pay higher prices for cattle (see chart below).

“Currently, wholesale beef prices have declined rapidly from recent peaks, as suggested by the comprehensive beef cutout value (down 27 percent for the week ending June 5 from its peak). This would result in declining packer margins as fed cattle prices rose over the same period. As the volume of fed cattle slaughter has risen close to year-ago levels, analysis suggests that prices should weaken seasonally, particularly given the volume of market-ready cattle that have backed up in feedlots in the second quarter.”

Weekly #Livestock, #Poultry & #Grain Market Highlights, June 22nd, https://t.co/wnR9OVBc0a @USDA_AMS

* #Pork Production.

* #Beef Production. pic.twitter.com/HhBfT9APIc

— Farm Policy (@FarmPolicy) June 22, 2020

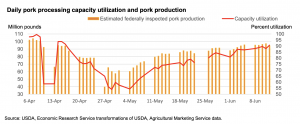

Turning to pork, ERS indicated that, “Capacity utilization in the U.S. pork processing industry is on the rebound as plant laborforces, earlier infected by COVID-19, recover and return to work and the sector adapts to recommended U.S. Government guidelines. Starting on April 6 with the temporary closure of a major plant in Iowa, virus- related laborforce absences have caused a succession of plant slowdowns and temporary closures. However, USDA, Agricultural Marketing Service data show that since April 29─when capacity utilization bottomed-out at 53.9 percent with estimated federally inspected pork production of 60 million pounds— capacity utilization has averaged 76.4 percent, with daily pork production averaging almost 84 million pounds. For the week ending June 12, capacity utilization averaged 76.4 percent, with estimated federally inspected pork production of almost 84 million pounds.

“Lower capacity utilization in pork processing plants is slowing second-quarter pork production. After declining almost 11 percent on a weekly basis in April, estimated federally inspected pork production in May was about 1.8 billion pounds, about 9 percent below a year earlier, on a weekly basis adjusted for 2 less slaughter days this year. For the second quarter, USDA is forecasting commercial pork production at about 6.2 billion pounds, almost 7 percent below the same period last year.”

The Outlook added that,

For the balance of 2020 and into 2021, processing sector implementation of guidances issued by the Centers for Disease Control and Prevention and the Occupational Safety and Health Administration are likely to hold capacity utilization to below pre-pandemic levels.

“Third-quarter pork production is expected to be about 7 billion pounds, more than 4 percent above year-ago volumes, as processors work through the backlog of hogs. Fourth-quarter production is forecast at about 7.2 billion pounds, more than 4 percent below production in the fourth quarter of 2019. Total expected commercial pork production for 2020 is about 27.8 billion pounds, less than 1 percent above year-earlier production. Next year, first-quarter production is likely to be about 7.1 million pounds (almost 5 percent below a year earlier). For the balance of 2021 commercial pork production is expected to accelerate, with the total for the year forecast at about 28.2 billion pounds, 1.7 percent above 2020.”

National Daily #Hog and #Pork Summary, June 19, https://t.co/ETf5PTZZdT @USDA_AMS

* #Pork production,

* 2020, 2019, and five-year average (2020 recovering). pic.twitter.com/3giJHLyuzB

— Farm Policy (@FarmPolicy) June 21, 2020

With respect to other variables impacting the U.S. meat balance sheet, Bloomberg writer Michael Hirtzer reported late last week that, “China’s move to test imported meat for the novel coronavirus is threatening to snarl trade with the world’s largest pork consumer, hurting livestock farmers who had seen booming shipments of pork and beef.

“Port authorities in the Asian nation are conducting nucleic acid tests on shipments of imported meat even as experts caution that food poses little risk of spreading the virus. Officials are testing inbound containers of meat at the port of Tianjin, said Darin Friedrichs, an analyst at INTL FCStone in Shanghai.”

The Bloomberg article noted that, “Record-large U.S. pork shipments to China had been a positive for farmers who earlier this year were hit by slaughter disruptions after thousands of meat-plant workers fell ill. While plants boosted processing rates this month, there’s still an ongoing labor crunch due to high absenteeism.”

And Bloomberg writer Isis Almeida reported on Monday that, “The obvious obstacles in America’s food-supply chain — from shuttered meat plants to restocking delays and panic buying — have largely dissipated. But shock waves remain.

“There are millions of pigs that need to get processed fast, before their weights become too burdensome, or farmers will be forced to euthanize the animals.”

Source: Keith Good, Farm Policy News