Ag Barometer Declines Sharply As Commodity Prices Weaken

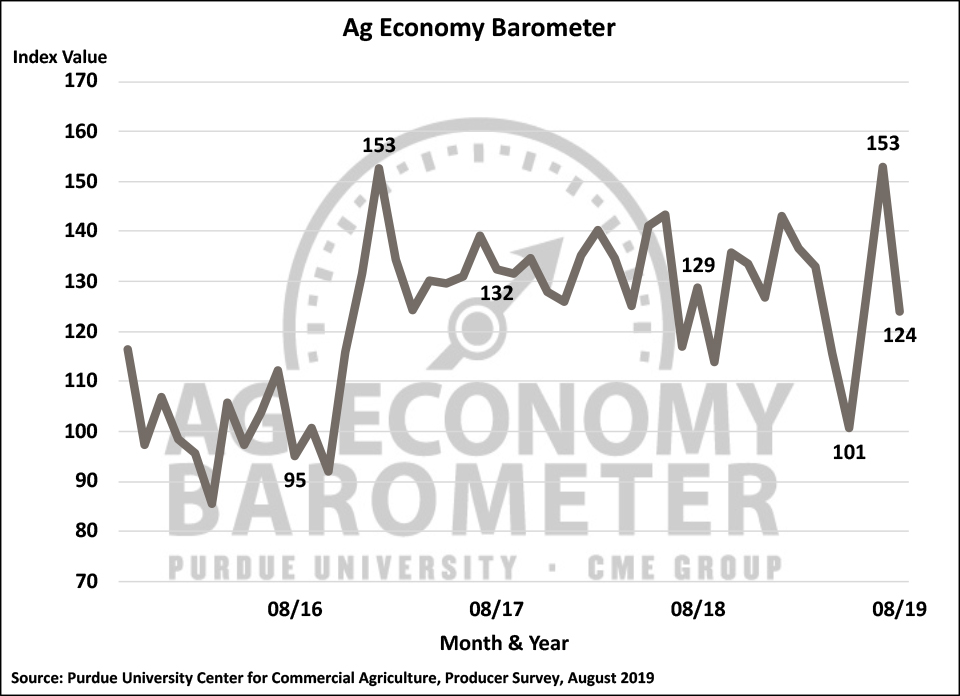

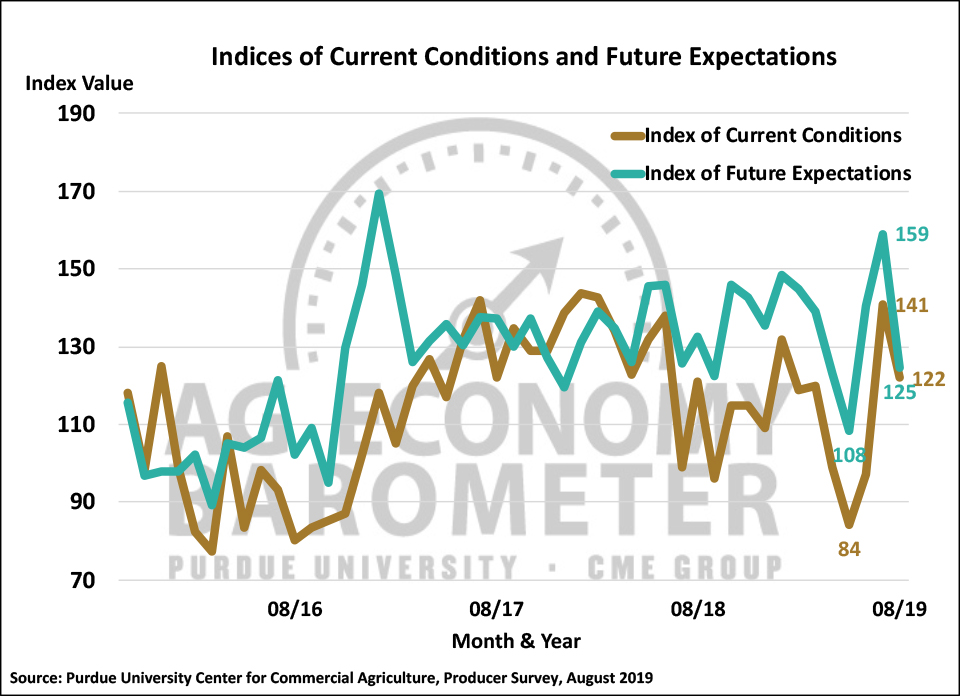

After rising sharply two months in a row, the Ag Economy Barometer weakened significantly in August falling back to a reading of 124, down 29 points compared to a month earlier and just slightly below the June reading of 126. The barometer’s decline was attributable to declines in both the Index of Current Conditions, which dropped 19 points below the previous month, and especially the Index of Future Expectations, which fell 34 points below its July reading. This month’s nationwide survey of 400 U.S. agricultural producers for the Ag Economy Barometer was conducted from August 12 through August 20, 2019. Weaker sentiment was fueled in part by both crop and livestock price declines that took place during late July and early August. In particular, prices for corn and soybeans fell sharply as crop conditions improved and USDA released larger than expected crop production estimates on the August Crop Production report. Virtually all of this month’s survey responses were collected following USDA’s release of the August 12 Crop Production report.

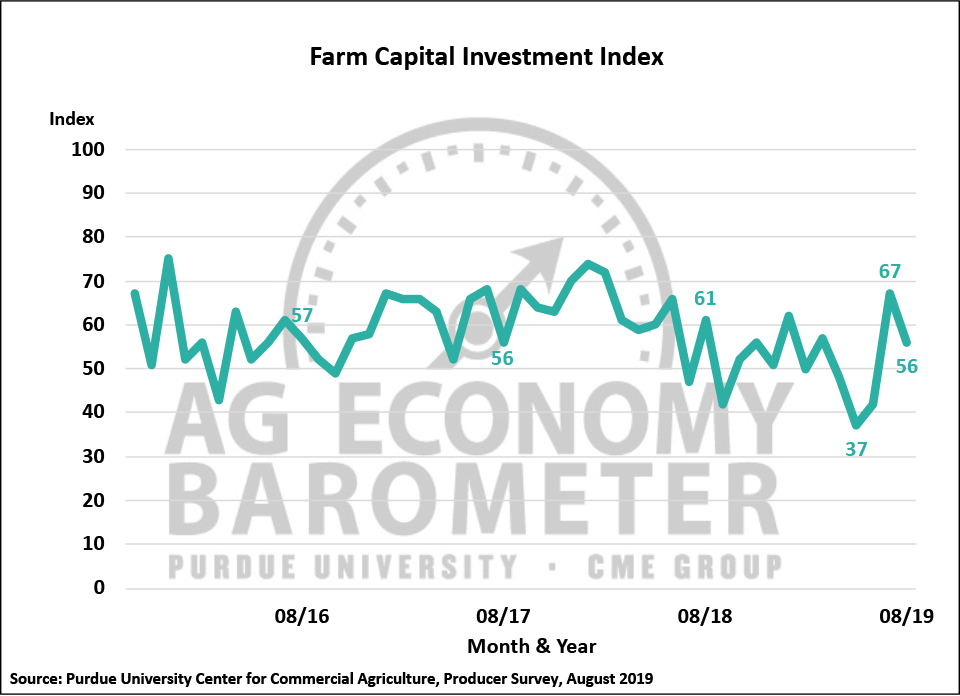

Producers’ concerns about the future of the farm economy led to a more negative outlook on both the advisability of making capital investments in their farming operation and on their short-run farmland value outlook. The Farm Capital Investment Index (formerly known as the Large Farm Investment Index) fell to a reading of 56 in August, 21 points lower than a month earlier, but still well above readings from June (42) and May (37) of this year, as farmers’ weaker expectations for future economic conditions on their farms made them less inclined to believe now is a good time to make large investments in buildings and farm machinery.

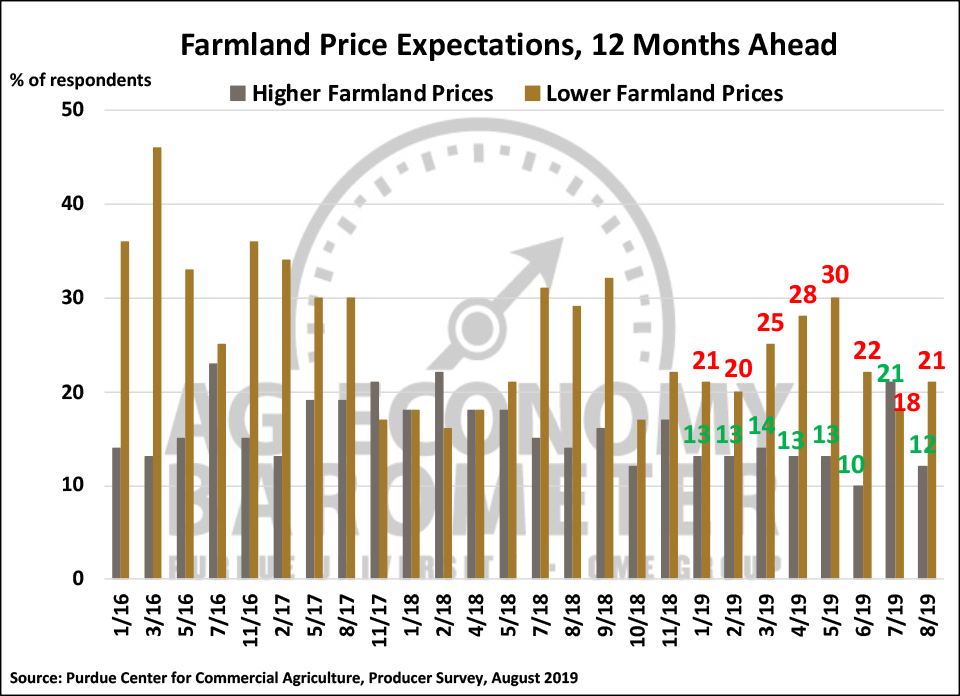

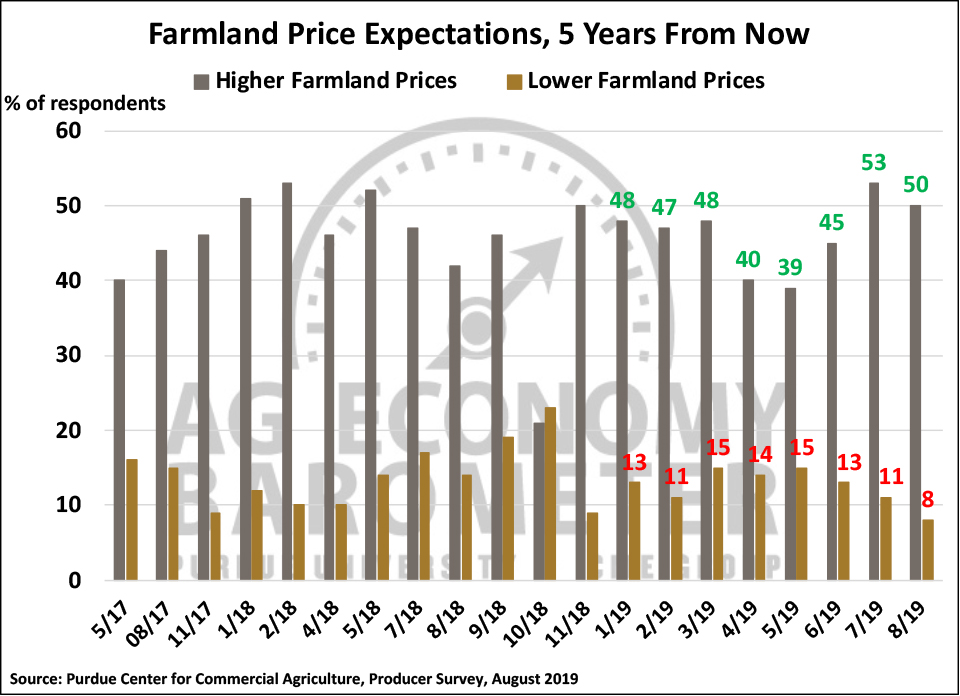

Producers’ short-run expectations for farmland values also weakened from mid-July to mid-August. The percentage of respondents expecting farmland values to rise over the next 12 months declined from 21 percent in July to 12 percent in August and the percentage expecting lower farmland values in the upcoming year increased from 18 to 21 percent. Although farmers short-run outlook on farmland values weakened since the last Ag Economy Barometer survey, their longer-run (5-years ahead) perspective on farmland values changed little from a month earlier. The percentage of producers expecting higher farmland values 5-years ahead declined somewhat, to 50 percent in August, compared to 53 percent in July, but the percentage of respondents expecting lower farmland values over the same period declined to 8 percent from 11 percent in July, suggesting that overall sentiment regarding the longer-term outlook for farmland values was unchanged.

Since March 2019, we’ve been monitoring farmers’ perspective regarding how quickly they expect the soybean trade dispute with China to be resolved. Back in March, farmers were almost evenly split on this issue with 55 percent indicating they felt it was unlikely, and 45 percent saying it was likely, that the trade dispute would be resolved soon. In subsequent months, the percentage of farmers saying they think it is unlikely that the trade dispute will be resolved soon increased, ranging from a high of 80 percent in May to a low of 68 percent in June. In August, there was a modest sentiment shift as the percentage of producers expecting resolution soon rose to 29 percent from 22 percent a month earlier and the percentage of producers who felt resolution soon was unlikely declined to 71 percent from 78 percent in July.

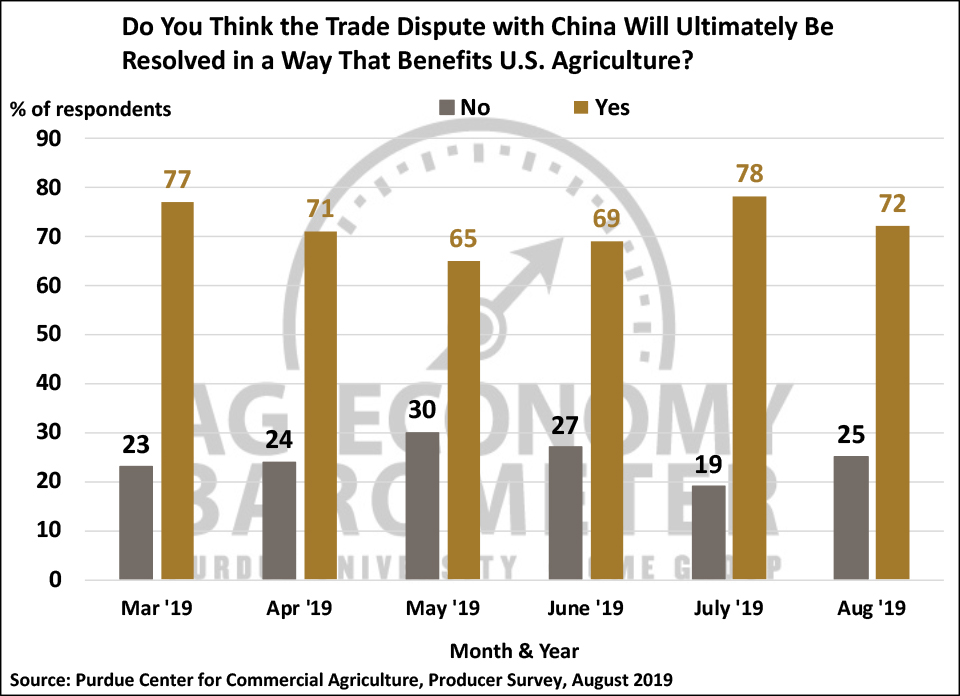

We’ve also been monitoring whether or not farmers think the trade dispute will ultimately be resolved in a way that benefits U.S. agriculture. In March, over three-fourths (77 percent) of farmers in our survey expected a beneficial outcome to the trade dispute with that percentage subsequently declining to 65 percent in May before rebounding in July to 78 percent. Again, there was a modest sentiment shift in August as the percentage of farmers expecting a positive outcome for agriculture to the dispute slipped to 72 percent while the percentage who said they did not expect a favorable outcome for U.S. agriculture rose from 19 percent in July to 25 percent.

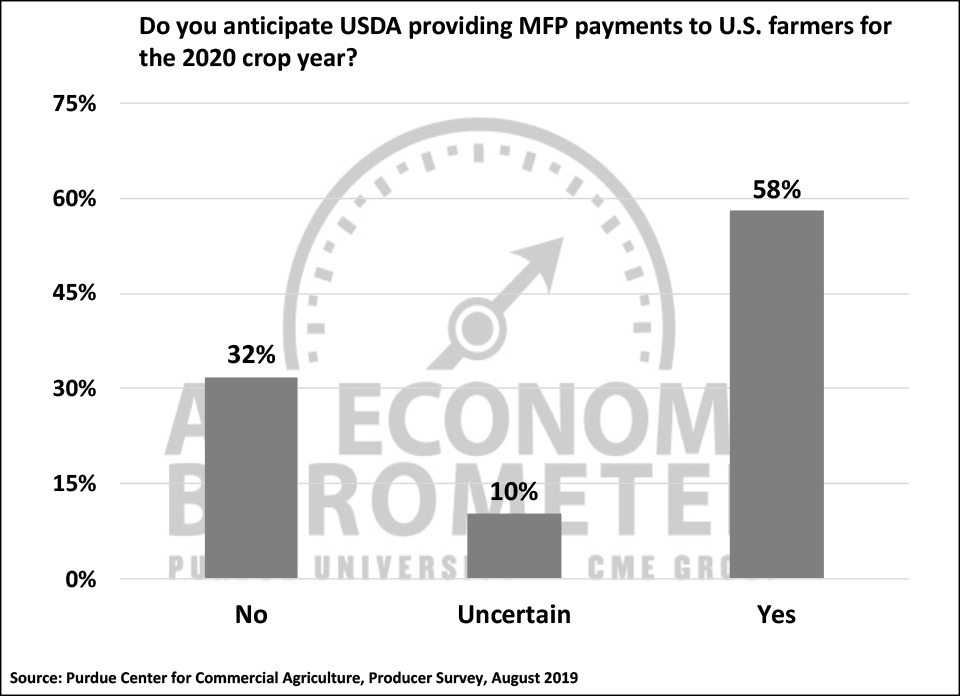

USDA announced the per planted acre payment rates by county for the 2019 Market Facilitation Program (MFP) in late July. Payments are to be made in three tranches with the first payment to be made this summer and subsequent payments to be made in late fall 2019 and early 2020, if deemed necessary by the USDA. To learn more about how farmers view the MFP payments, we posed two questions on the August survey. First, we asked to what degree does $16 billion in MFP payments to U.S. farmers relieve your concerns about the impact of tariffs on your 2019 farm income? Second, in a follow-up question, we asked whether or not respondents expect USDA to provide payments to U.S. farmers for the 2020 crop year?

Responses indicated that over two-thirds (71 percent) of farmers feel that the 2019 MFP program will either completely or somewhat relieve their concerns about the impact of tariffs on 2019 farm income. However, nearly three out of ten respondents said “not at all” in response to this question, indicating that they felt the MFP payments fell short of making up for income losses attributable to the ongoing tariff battles. Looking ahead to 2020, 58 percent of farmers in our August survey said they expect another MFP payment to be made to U.S. farmers for the 2020 crop year.

Wrapping Up

Producer sentiment weakened sharply in August as the Ag Economy Barometer declined 29 points compared to a month earlier. Farmers were less optimistic about current economic conditions on their farms and, especially, about their expectations for future conditions. In particular, producers were much less inclined to think now is a good time to make capital investments on their farms and had a more negative outlook on short-run changes in farmland values than they had just one month earlier. However, producers long-run outlook for farmland values on the August survey was virtually unchanged from that recorded in July. Farmers in August were slightly more optimistic that the trade dispute with China will be resolved soon than in July, although a large majority of producers still think resolution of the dispute will not come quickly. The percentage of farmers who expect the trade dispute to be resolved in a way that favors U.S. agriculture has ranged from a low of 65 percent (May) to a high of 78 percent (July) with this month’s reading falling in the middle at 72 percent. Finally, over two-thirds of U.S. farmers said they expected USDA’s 2019 MFP payments to either completely or at least somewhat relieve their concerns regarding tariffs impact on farm income. Looking ahead to the next crop year, 58 percent of farmers in our survey expect to receive an MFP payment for their 2020 crop.

Source: James Mintert and Michael Langemeier, Purdue University