Chinese Ag Purchases Still Foggy

Uncertainty Lingers Regarding Chinese Purchases of U.S. Farm Goods

Bloomberg writers Mike Dorning and Michael Hirtzer reported last week that, “President Donald Trump’s phase-one trade deal with China offers the promise of more overseas sales for American farmers, but the impact of the agreement remains unclear.

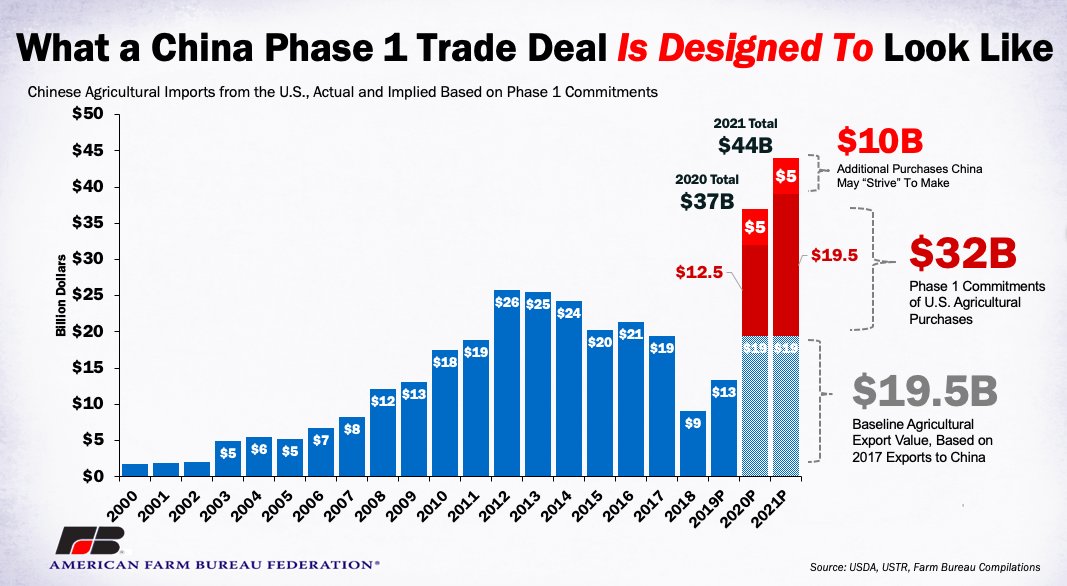

“Trump has promoted a commitment by China to purchase $40 billion to $50 billion annually in farm products for the next two years. That compares with $24 billion in agricultural and related products that China imported from the U.S. in 2017, before the trade war began.

“In an agreement signed Wednesday at the White House, China committed to importing at least $12.5 billion more agricultural goods this year than in 2017, rising to $19.5 billion next year. The Asian nation will also ‘strive’ to purchase an additional $5 billion a year in farm products. That could get total purchases next year toward the $50 billion mark.”

The Bloomberg article indicated that, “But doubts have surfaced on whether China will meet that target, particularly since the two governments have said they will keep secret the purchase benchmarks for individual commodities. China hasn’t committed to specific tariff reductions under the agreement and may simple step up waivers to enable increased purchases of U.S. goods.”

‘Until we see some big purchases, many in the market are going to remain skeptical,’ said Joseph Glauber, former chief economist for the U.S. Department of Agriculture.

Financial Times writer Gregory Meyer reported last week that, “The agreement also allows China to make purchases ‘at market prices based on commercial considerations’ and consider ‘market conditions’ in timing them.

“The latter provision raised questions about the whether China would follow through between now and 2021, said Ken Morrison, an agricultural markets analyst based in St Louis.”

Putting #Phase1 into perspective…IF all commitments were made U.S. #agricultural exports to #China would reach $44B in 2021. (They bought $33B from #Brazil in 2018) @FarmBureau #AFBF2020

The FT article noted that, “‘I think the market’s reaction to the phase one trade agreement with China can be characterised as, ‘If something looks too be good to be true, it probably is,” Scott Irwin, an agricultural economist at the University of Illinois, said on Twitter. He held out the possibility that China could surprise the market with strong purchases, but noted the ‘escape clause’ allowing adjustments for market prices.”

Meanwhile, Bloomberg writer Tatiana Freitas reported last week that, “More likely, traders and analysts say, harvesting cycles and price differentials will push the market back to the old status quo. That means Brazilian supplies will be in high demand in the first half of the year, when the nation reaps its crop and therefore has the competitive edge. The U.S. will dominate in the second half, when its output gains steam and it can better compete on price.”

The Bloomberg article noted that, “U.S. trade adviser Tom Kehoe said last month that China will follow the market’s cues once U.S. purchases resume, meaning it’ll go with whoever sells cheapest. There’s also the question of those 30% retaliatory tariffs. China plans to keep the levies in place on American imports, matching a similar promise from Trump on Chinese goods. And although China issued waivers on U.S. soybeans in the run up to the signing, the Asian nation also kept buying from Brazil.”

Also last week, Reuters writers Hallie Gu and Shivani Singh reported that, “China’s other suppliers of agricultural commodities will not be impacted by the Sino-U.S. trade deal since buying will be based on market principles, Vice Premier Liu He said, according to a report from state-owned CCTV on Thursday.”

However, Reuters columnist Karen Braun pointed out on Thursday that, “If China plans to buy at least $36.5 billion worth of U.S. farm goods in 2020, a great deal of that would have to be soybeans. Given China’s slower feed demand of late following a sharp decline in its hog herd from African swine fever, a major increase in U.S. soybeans to China would probably have to cut in to Brazil’s share to the Asian country.”

And earlier this week, a Reuters News article reiterated that, “China will negotiate with American companies and increase imports of U.S. goods and products according to market principles, an official with its state planner said on Sunday.”

In a closer look at market price reaction to the China trade deal, Wall Street Journal writer Jon Hilsenrath reported on Sunday that, “The price of a bushel of soybeans is lower than it was when Donald Trump was elected president in November 2016. It is little changed from when Mr. Trump ramped up his trade confrontation with China and has lost ground in the days since the deal was announced. Prices for wheat, pork and dairy products have been similarly stable.”

And in a brief point about how things could play out if the China deal goes awry, Associated Press writer Paul Wiseman reported on Sunday that, “And things could get nasty if the United States decides China isn’t living up to its commitments. In an unusual move, the two countries did not arrange to let any disputes go to a neutral arbitrator. Instead, they will try to work out their differences in a series of consultations. If they can’t, the United States could impose tariffs — and the deal could unravel.”

President Trump provided additional perspective on the trade agreement in a speech on Sunday to the American Farm Bureau Federation’s annual convention in Austin, Texas.

I will be going to Austin, Texas. Leaving soon. Always like (love!) being in the Lone Star State. Speaking to our great Farmers. They hit “paydirt” with our incredible new Trade Deals: CHINA, JAPAN, MEXICO, CANADA, SOUTH KOREA, and many others!

Reuters writer Steve Holland reported this week that, “President Donald Trump sought on Sunday to assure American farmers and ranchers hit by a protracted tariff war with China that a trade agreement he signed with Beijing will lead to major purchases of U.S. agricultural products.”

“Trump said the initial trade deal he signed with China last Wednesday would be a boon for farmers, whom he thanked for sticking with him after he twice had to allocate multibillion-dollar bailouts for producers targeted by Chinese tariffs,” the Reuters article said.

And Associated Press writer Darlene Superville reported on Monday that, “In Austin, Trump described the trade agreement with China as ‘groundbreaking‘ and said, ‘We’re going to sell the greatest product you’ve ever seen.’”

“Beijing will ease hormone-limit requirements for beef imports within a month as part of the phase-one agreement that was signed Wednesday. Previously, most U.S. meat couldn’t be exported to China because it wouldn’t comply with stricter restrictions.”

The Bloomberg article explained that, “China reopened the door to U.S. beef in 2017 after a years-long ban triggered by a case of mad cow disease in Washington state. Since then, exporters have only been sending meat from cattle raised in hormone-free programs, which make up a minuscule portion of American output.”

Source: Keith Good, Farm Policy News