Could Wheat Acres Hit a 110-Year Low in 2020?

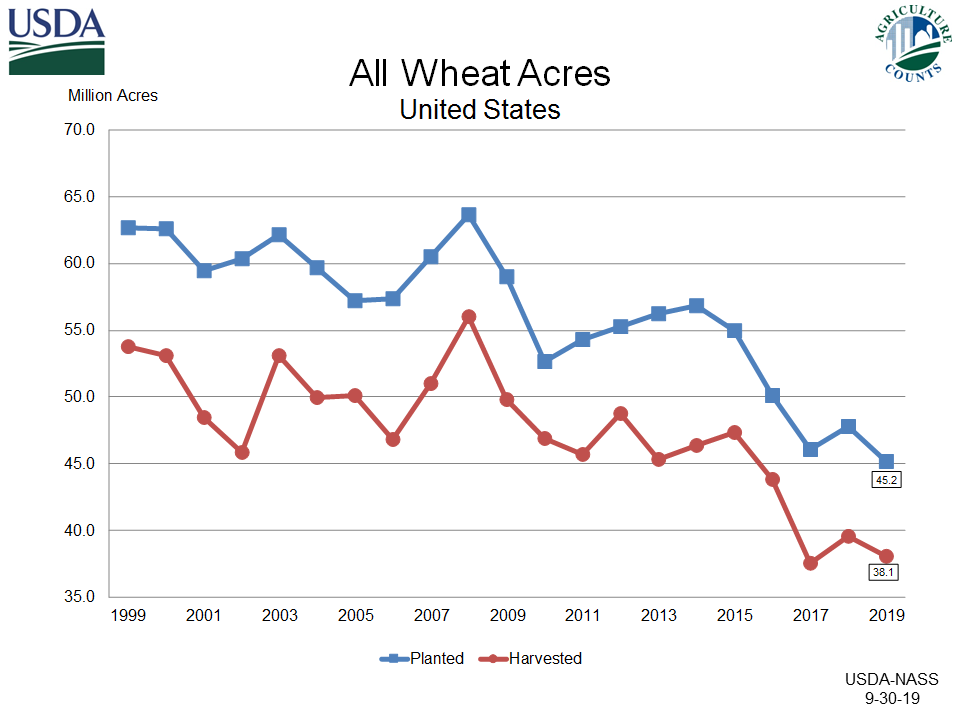

For the past two years, wheat acres have dipped to a 100-year low. For 2020, acres could challenge the 110-year low. The reason for the decline is easy to spot.

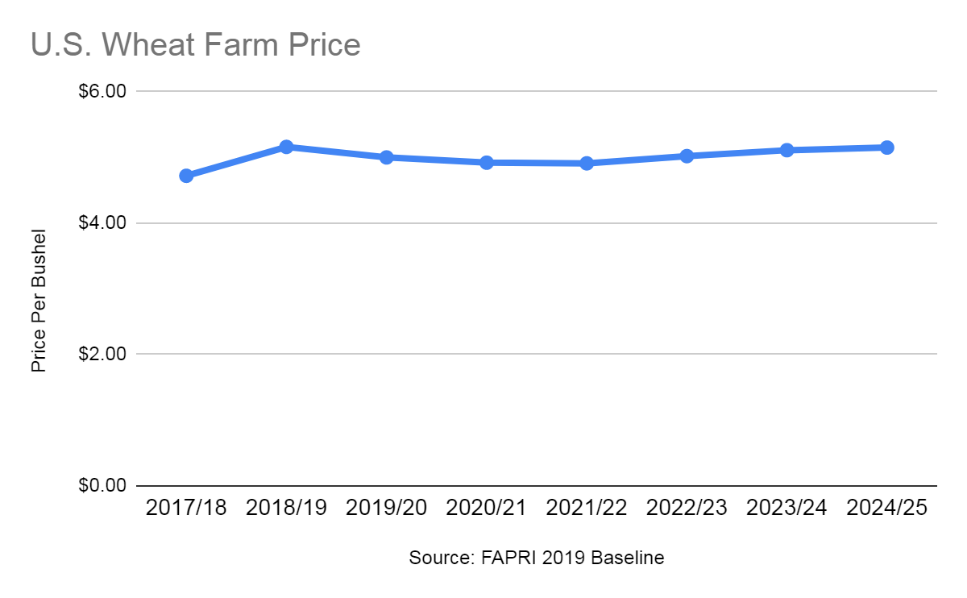

“Prices are poor, and profit is non-existent for some farmers,” says Kim Anderson, Oklahoma State University Extension economist.

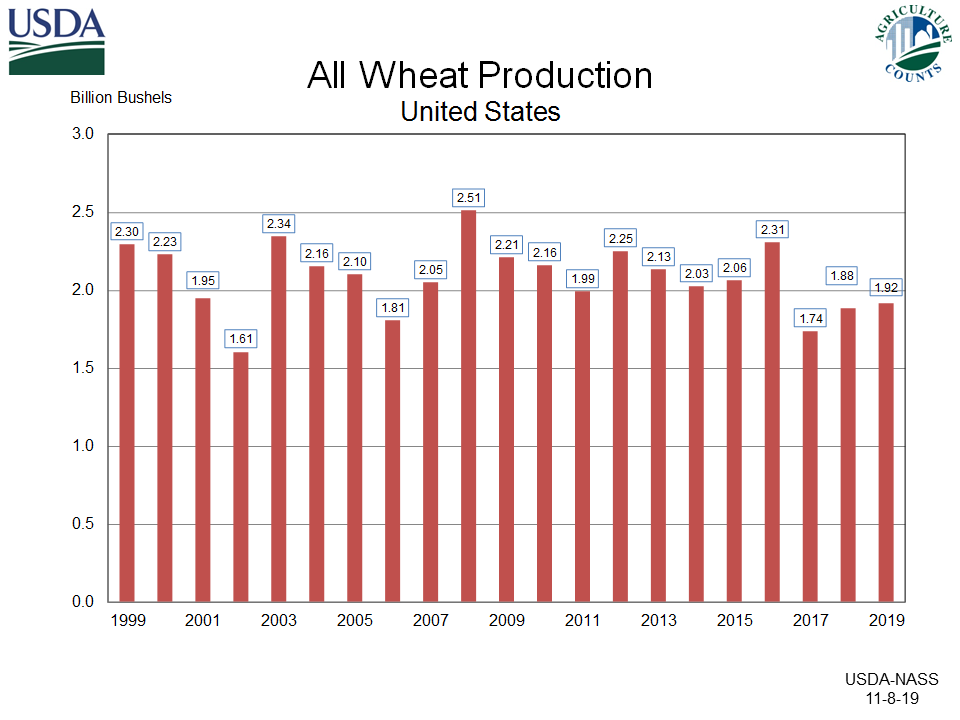

In 2019, all wheat acres totaled 45.2 million, which is a 5% decline from 2018. Wheat acres have been on a steady decline in the U.S. for the past decade. For instance, in 2008, all wheat acres equaled 65 million.

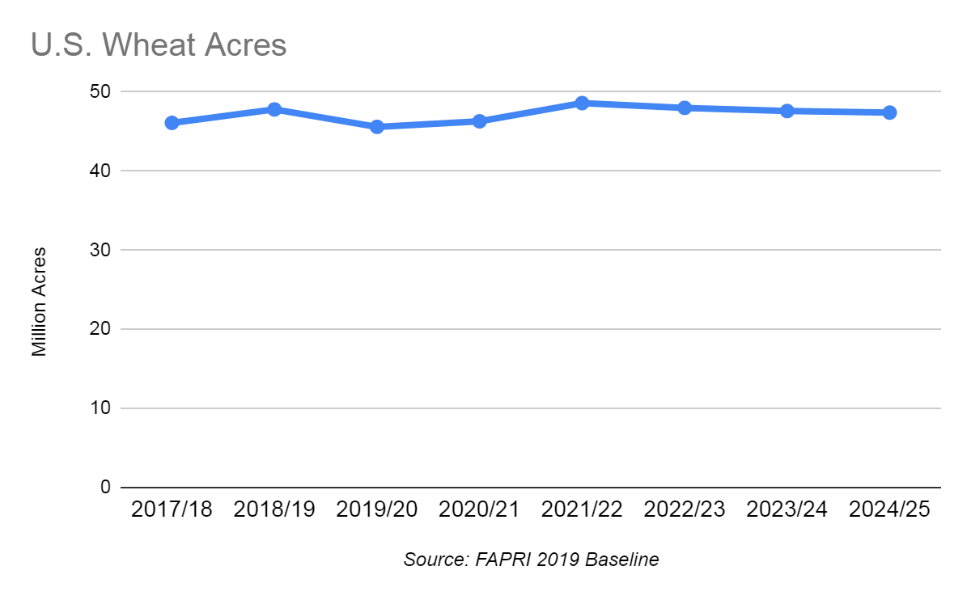

Going forward, acres are expected to stay close to the current level of around 45 million, according to the 2019 U.S. Baseline Outlook compiled by the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri.

Prices are also expected to level out. For 2019/20, FAPRI estimates the U.S. wheat farm price to stick around $5. That price will likely be the average over the next several years.

Forces at Play: Quantity and Quality

Wheat supply and quality are the two major factors influencing price, Anderson says. From a quality standpoint, U.S. wheat is facing stiff competition.

“In the U.S., our 2019 hard red winter wheat crop averaged 11.3% in protein; the Black Sea region, continually ships 12.5% protein,” he says. “So, you have quality issue.”

- Global wheat production is at a record 28.1 billion bushels.

- World ending stocks are at a record level of 10.6 billion bushels.

- Wheat’s global stocks-to-use ratio is at 38.2%, another record level.

The good news in the global data, Anderson says. The Black Sea region (Russia, Ukraine, Kazakhstan) will have a stocks-to-use ratio of 9.6%.

“That tells you if they have problems with 2020 production, they don’t have any room to spare,” he says. “If they have a poor crop, we could see wheat prices get profitable again. But we won’t really know the state of their crop until June/July/August.”

Positive Demand Signs

The bright side of lower prices is they are incentivizing an increase in purchase volume, says Ken Zuckerberg, lead economist, grain and farm supply at CoBank

“Human consumption of wheat has been stable,” he says. “Wheat consumption for feed is increasing, since its price is low in absolute terms and relative to corn.”

USDA expects global wheat consumption to remain at record high levels in 2018/19 due to increased human consumption. Human wheat consumption is expected to reach a record high 602 million metric tons, which is 4% above the five-year average. In the past decade, global human wheat consumption has increased 90 million metric tons, while feed wheat usage has increased 16 million metric tons.

This trend of high consumption could be a positive market signal in the year ahead, Zuckerberg says. It’s beginning to pay off for farmers, as feedlots buy more wheat. “With the shortage of high-quality wheat for next year, we’ve seen an increase in demand, which has caused tight basis especially in Kansas.”

Another encouraging trend in the wheat market is a continuing production efficiency story. “We’ve seen greater yields produced on fewer acres,” he says.

All wheat produced in the U.S. for 2019 hit 1.92 billion bushels, which is higher than 2018’s production on more acres.

As wheat farmers plan their future crops, Zuckerberg encourages them to think about how to capture niche or supplier-driven contracts.

“Wheat is in so much of our value-added food,” he says. “Wheat farmers can be more consumer centric, and we could see a reinvention of the wheat business.”

Source: Sara Schafer, AgWeb.com