Doubts Emerge About Chinese Agricultural Purchases of $40-$50 Billion After Initial Deal, “How Would They Do It?”

Don Lee and Alice Su reported in Saturday’s Los Angeles Times that, “The United States and China reached a preliminary trade agreement that includes the rollback of some tariffs on Chinese imports and a commitment by Beijing to make a substantial increase in purchases of American farm goods and other products and services.

Don Lee and Alice Su reported in Saturday’s Los Angeles Times that, “The United States and China reached a preliminary trade agreement that includes the rollback of some tariffs on Chinese imports and a commitment by Beijing to make a substantial increase in purchases of American farm goods and other products and services.

“A final settlement on the so-called Phase 1 deal could help defuse tensions after a long-festering trade war that has convulsed financial markets, hampered the global economy and added to deepening strains between the two superpowers.

“Trump hailed the agreement Friday as a ‘phenomenal deal.’ Minutes earlier, at a late-night news conference in Beijing, Chinese officials confirmed there was an agreement.”

All you need to know about the “phase one” China trade deal, in one video: https://www.wsj.com/video/us-china-trade-deal-what-left-to-negotiate/150ADE16-928C-4791-A1D4-E5DE9B090304.html …

‘There is no doubt that China will increase purchases of high-quality agricultural products from the U.S.,’ said Ning Jizhe, vice chairman of the National Development and Reform Commission, a key economic planning agency. ‘As for the specific details and statistics of the agreement, they will be released later.’

Saturday’s article also noted that, “And I say, affectionately, the farmers are going to have to go out and buy much larger tractors, because it means a lot of business, a tremendous amount of business,’ Trump said Friday from the Oval Office.

“Chinese officials, however, were more circumspect. Pressed at the news conference in Beijing, they declined to provide specifics on the amount, type or timing of purchases of U.S. agricultural products by China, saying only that the increase would be by a ‘notable margin.’”

Agricultural Purchases- “Doubts” Emerge

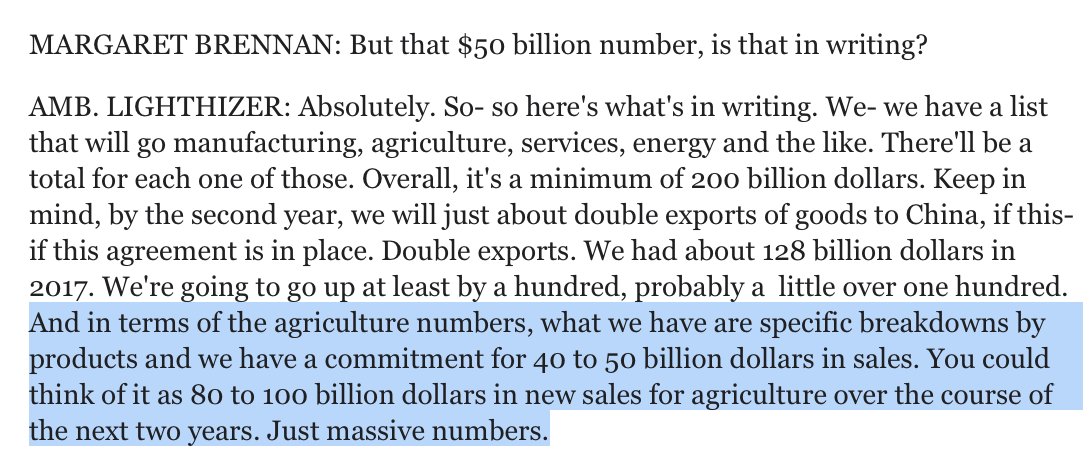

David J. Lynch and Anna Fifield reported on the front page of Saturday’s Washington Post that, “In the next two years, Beijing is committed to buying an extra $200 billion in U.S. agricultural, energy and manufactured goods, [U.S. Trade Representative Robert Lighthizer] said.

The agreement contains specific figures for individual products such as poultry and animal feed, which are not being made public to avoid disrupting commodity markets, he added.

“Some agriculture experts doubt whether U.S. farmers can quickly pivot to meet increased demand as quickly as envisioned. China’s has promised to buy an extra $16 billion in farm goods in the deal’s first year, well short of the cumulative financial losses farmers have suffered since the trade war began.”

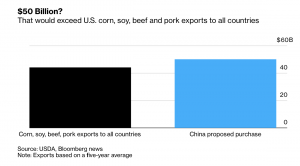

Kayla Tausche reported on Friday at CNBC Online that, “Lighthizer told reporters that China pledged to buy a total of $40 billion in agricultural products, although he said the administration would make its ‘best efforts’ to get to $50 billion, which is the amount Trump himself is calling for.”

Here’s how Lighthizer described the ag purchase math to reporters:

$24b/yr — baseline purchases made by China (using 2017 data)

ADDL $16b/yr for two years

PLUS “best efforts” on another $5-10b each yearSo China will be purchasing $40b in ag total/yr. Possibly more.

“As part of the agreement, Beijing agreed to buy roughly $16 billion more in American agricultural products in each of those years, adding to the 2017 baseline of $24 billion, Lighthizer added, but Beijing agreed to strive for some $5 billion in additional purchases each year.

“That would add up to the $40 billion to $50 billion in added Chinese agriculture purchases that President Donald Trump had promised when he first announced the agreement on Oct. 11.”

.@margbrennan asks @USTradeRep Robert Lighthizer about USDA estimates that the U.S. soybean industry — impacted in the trade war – might not recover until 2026. His answer: https://cbsn.ws/36DpdqJ

“‘China has yet to confirm this pledge or provide any details on how they will meet it,’ said Brian Kuehl co-executive director of Farmers for Free Trade, which backs removing tariffs and opening markets. ‘There are rightfully many doubts about the president’s claim that China will purchase $50 billion in ag products in a single year—more than twice the level of pre-trade war annual purchases.’”

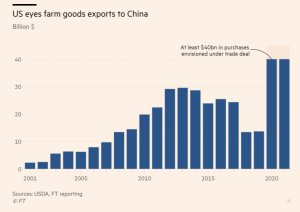

Gregory Meyer and James Politi reported on Saturday at The Financial Times Online that, “US claims that China will purchase $40bn of American agricultural goods were greeted with scepticism over the feasibility of a deal that would surpass all previous shipments by at least $10bn.”

“Doubts raised over US claim of $40bn China farm purchases,” by Gregory Meyer and James Politi. The Financial Times (December 14, 2019).

The FT article noted that, “There were questions about the practicality of the agreement, however. Joseph Glauber, a former chief economist at the US Department of Agriculture, said silence on China’s commitments by individual commodity could prove confusing to farmers deciding what to plant. ‘The details still remain very obscure,’ he said.

“Annual US farm exports to China had exceeded $20bn until 2018, when they dropped to $13.4bn mainly because of retaliatory duties on soyabeans and pork.”

Meyer and Politi stated that, “Reaching $40bn in sales could prove a challenge in current market conditions. When the US exported a record $29.6bn in agricultural goods to China in 2013, the soyabean price was more than $14 a bushel. When prices are lower, volumes need to be higher to boost overall sales.

“‘To get to $40bn seems like a pretty big number unless we have a major change in commodity prices between now and 2021,’ said Stephen Nicholson, vice-president of grains and oilseeds at Rabobank in St Louis.”

Phase One of the #ChinaTrade deal “is totally done”, @USTradeRep Robert Lighthizer says, adding that there is *NOT* a date set for when Phase Two negotiations will begin. https://cbsn.ws/2PTy4Ou

But doubts are surfacing whether that’s even possible, bolstered by China’s reluctance to confirm the figure.

The Bloomberg article noted: “‘I have been very skeptical,’ said Joseph Glauber, a former chief economist at the U.S. Department of Agriculture. ‘How would they do it?‘”

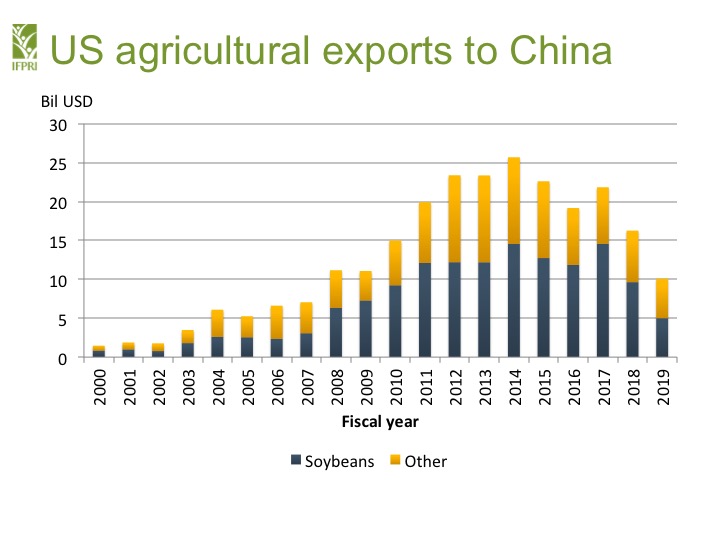

2. US soybean exports to China have really grown over the past 20 years, but so too have exports from Brazil.

JoeGlauber–IFPRI@JoeGlauber17. So it seems unlikely to me that much of the $16 bil projected boost from 2017 export levels is going to come from bean exports. China has said that additional corn, wheat and rice imports would be limited by their TRQs. They could import more cotton, more meats and dairy but

8. it will be very hard to get to the $40 bil (let alone $50 bil) promised. Getting back to 2017 levels is not trivial after the past 2 years of poor exports. Hopefully there are improvements in GMO approvals and other non-tariff issues which will improve future trade prospects

“Doubts Surface on $50 Billion in China Farm Buys Touted by Trump,” by Mike Dorning. Bloomberg News (December 13, 2019).

Reuters writer Karl Plume reported on Friday that, “U.S. farmers and traders were reluctant to celebrate news of an interim U.S.-China trade deal on Friday, saying it remained unclear how China would manage to buy another $32 billion of additional farm products over two years as promised.”

The Reuters article stated that, “Sharply increasing protein purchases would be essential, particularly as a deadly pig disease wipes out much of China’s hog herd and increases demand for meat imports while decreasing the need for soybeans fed to pigs, traders and analysts said.

“China would also need to buy more grains and biofuels like ethanol, they said.”

.@USTradeRep Robert Lighthizer on @FaceTheNation, December 15, 2019 https://cbsn.ws/35pgsQW

Source: Keith Good, Farm Policy News