Farm Lending Down Again

Kansas City Fed: Farm Lending Declines For a Second Consecutive Quarter

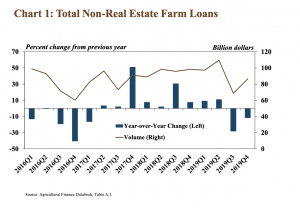

In an update last week from the Federal Reserve Bank of Kansas City (“Farm Lending Declines at End of 2019“), Nathan Kauffman stated that, “The volume of agricultural lending at commercial banks remained elevated, but declined for a second consecutive quarter. Total non-real estate farm loans decreased about 12 percent in the fourth quarter and declined over consecutive quarters for the first time since early 2017.”

In an update last week from the Federal Reserve Bank of Kansas City (“Farm Lending Declines at End of 2019“), Nathan Kauffman stated that, “The volume of agricultural lending at commercial banks remained elevated, but declined for a second consecutive quarter. Total non-real estate farm loans decreased about 12 percent in the fourth quarter and declined over consecutive quarters for the first time since early 2017.”

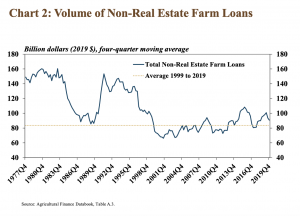

“Despite decreasing from a year ago, farm lending volumes remained higher than the 20-year average. Total volume of non-real estate loans averaged about $90 billion in 2019 and was about 8 percent above the average since 1999,” the Fed update said.

Dr. Kauffman explained that, “Overall, persistent weaknesses in the farm sector have continued to stimulate strong demand for agricultural lending, although Market Facilitation Program payments in the second half of 2019 and relatively strong crop yields may have curbed demand in the fourth quarter. In fact, on a rolling four-quarter basis, farm lending has been above the recent historical norm for all but three quarters since 2014.”

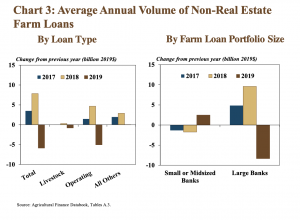

More narrowly, last week’s update pointed out that, “The slight pullback in agricultural lending during 2019 was driven by a decrease in the volume of operating loans and lending at banks with large farm loan portfolios. Nearly all of the $6 billion decline in the average volume of non-real estate loans in 2019 was attributed to operating loans.”

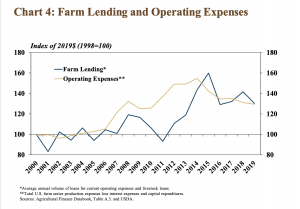

The Fed update noted that, “In addition to recent government payments and increased production, lower production expenses likely also have limited demand for farm loans. Adjusted for inflation, 2019 agricultural production expenses were more than 15 percent lower than the historical highs in 2014. Similarly, farm operating and livestock loans have edged lower in 2019 and have declined about 9 percent since 2014.”

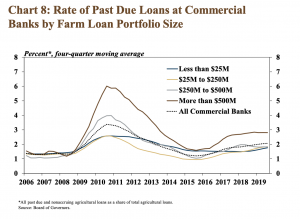

Dr. Kauffman also pointed out that, “Delinquency rates on farm loans continued to increase at a modest pace through the third quarter alongside elevated levels of farm debt. While remaining historically low, loans that were considered past due at banks with the largest farm loan portfolios were higher than at institutions smaller in size.”

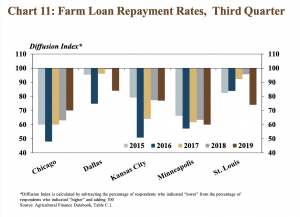

“Alongside a slight increase in farm loan delinquency rates, regional contacts continued to report declines in farm loan repayment rates. The pace of decline in repayment rates increased from a year ago in all Districts expect Chicago.”

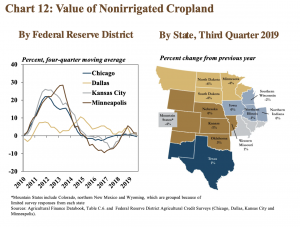

And with respect to farmland values, the Fed update stated that, “Similar to recent quarters, farm real estate values remained relatively stable. The average value of non-irrigated farmland in all participating Districts changed less than 2 percent in the third quarter.”