Farmer Sentiment Improves As Fall Harvest Gets Underway

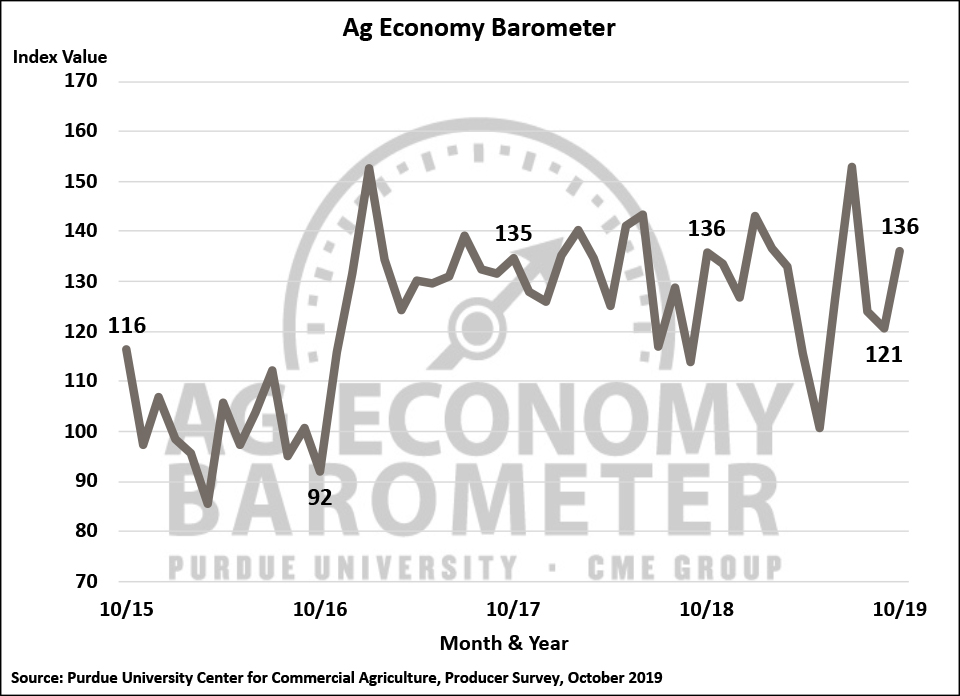

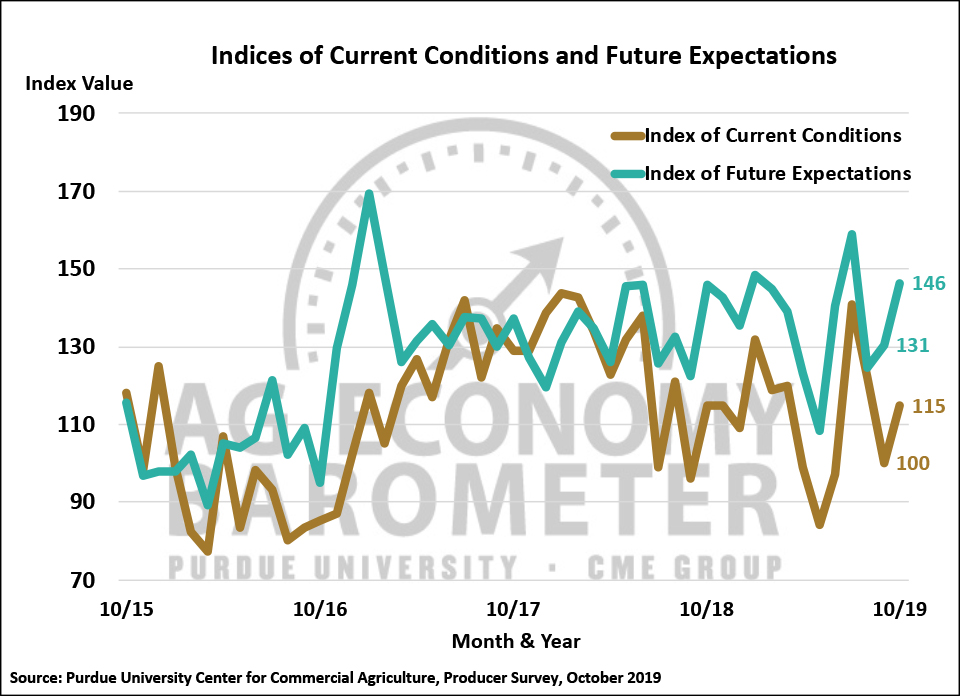

The Ag Economy Barometer improved to a reading of 136 in October, up 15 points compared to September, which pushed the barometer back to the same level observed in October 2018. This month’s upswing in the ag economy sentiment index was driven by an improvement in ag producers’ assessments of both current and future economic conditions in agriculture. The Index of Current Conditions rose from 100 in September to 115 in October and the Index of Futures Expectations also rose 15 points to a reading of 146. The Ag Economy Barometer and related indices are based upon results from a nationwide telephone survey of 400 U.S. crop and livestock producers. This month’s survey was conducted from October 14-22, 2019.

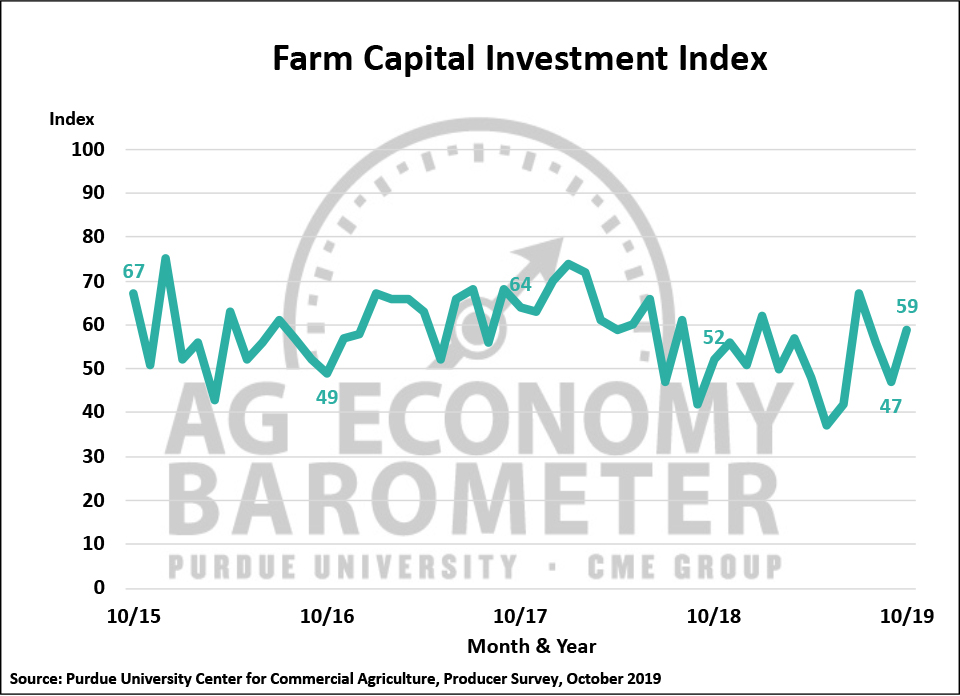

Producers had a more favorable view regarding making large investments in their farming operations when surveyed in October compared to September. The Farm Capital Investment Index rose to a reading of 59, 12 points higher than a month earlier. The investment index has been relatively volatile in recent months, dipping to a low of 37 in May before rebounding sharply in early summer. The October reading takes the investment index back to within 8 points of its July 2019 peak of 67.

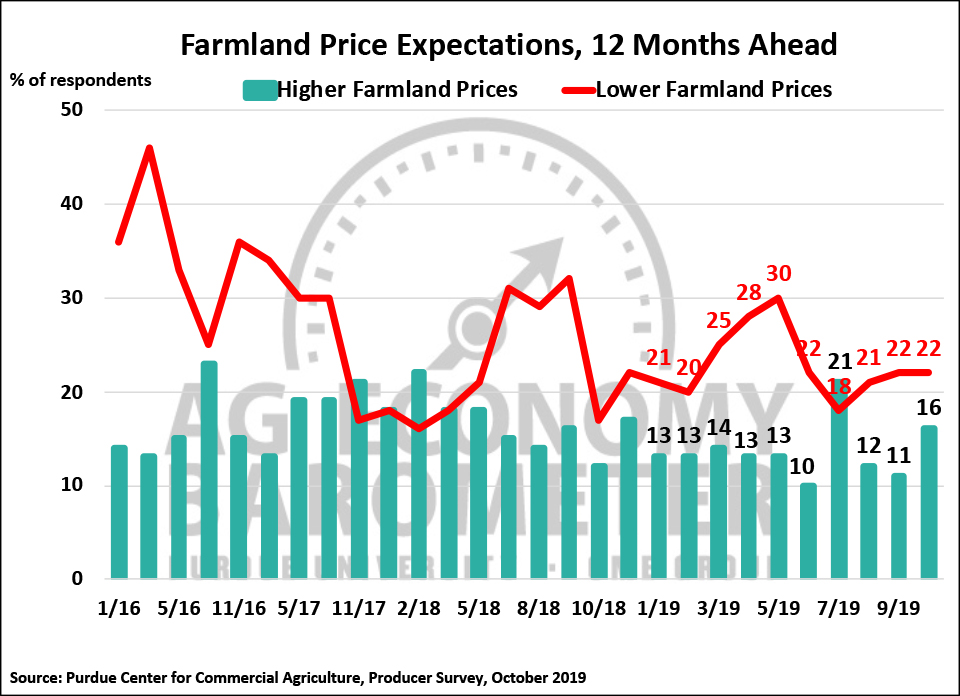

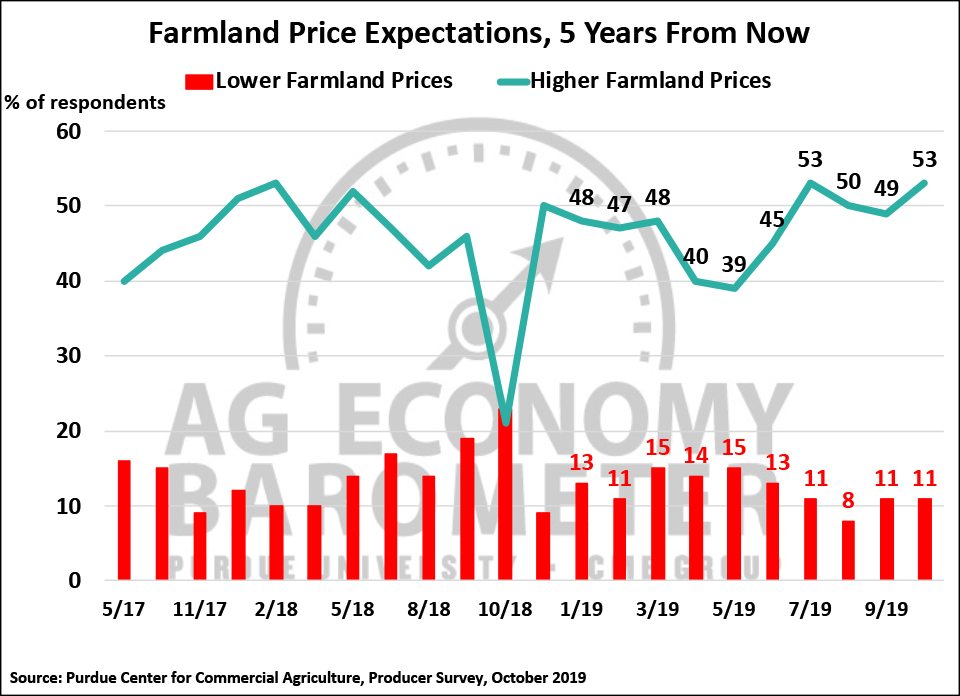

Producers’ expectations for farmland values, both in the upcoming 12 months and over the next 5 years, improved in October from September. For both forecast timeframes, the percentage of producers expecting lower farmland values was unchanged in October from September, but the percentage of producers expecting higher values rose. Looking ahead one year, 16 percent of producers said they expect farmland values to rise compared to 11 percent that felt that way in September. When asked about their outlook for the next 5 years, 53 percent of producers indicated they expect farmland values to increase compared to 49 percent on the September survey. So, in both cases, the increase in producers expecting higher values occurred because of a shift away from expecting no change to occur to becoming more optimistic about farmland values.

Producers perspective on farmland values appeared to be consistent with their expectations for cash rental rates in the upcoming year. In particular, there was a sizable increase in the percentage of producers that said they expect no change in rental rates over the next year. In October, 79 percent of respondents said they expected no change in rental rates compared to 67 percent that reported that in September. However, compared to last month, fewer producers said they expect rental rates in the upcoming year to decline (14 percent in October vs. 22 percent in September). At the same time, there was a small decline in the percentage of producers in the October survey that said they expect cash rental rates to increase compared to responses received in September.

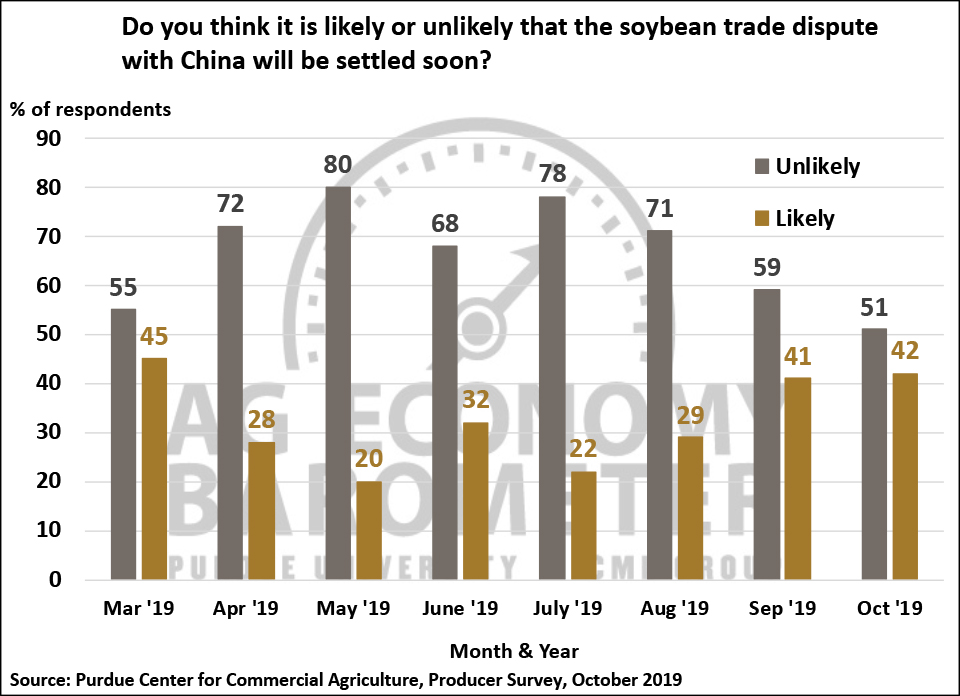

When queried about the likelihood that the soybean trade dispute with China will be resolved soon, farmers were less pessimistic in October than they were in September. In October, 51 percent of respondents said that resolution soon was unlikely, which was down from a reading of 59 percent in September and 71 percent in August. The percentage of respondents that expect the trade dispute to be resolved quickly was virtually unchanged in October (42 percent) compared to September, although it remained much higher than in August (29 percent). Comparing October’s results to September’s, the primary shift in opinion was attributable to fewer respondents saying they felt quick resolution was unlikely to saying that they were uncertain as to whether or not the dispute would be resolved soon.

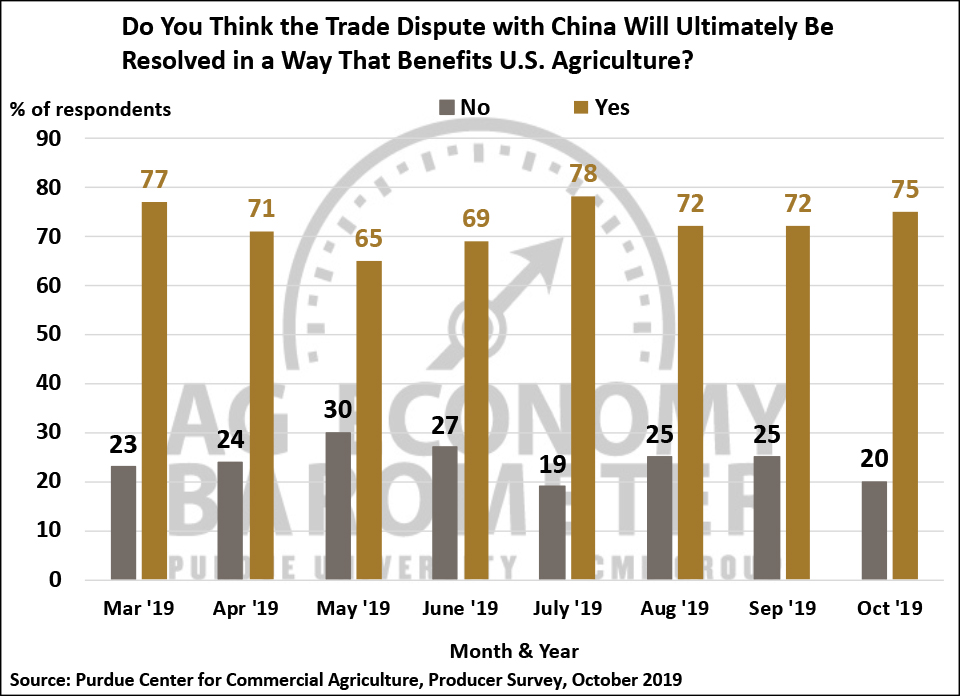

Beginning last spring we’ve also been posing a follow-up question regarding the trade dispute by asking farmers if they think the dispute will ultimately be resolved in a way that’s beneficial to U.S. agriculture. In October, 75 percent of the farmers in our survey said yes to this question while just 20 percent said no. This compares to 72 percent of respondents saying yes to this question in both August and September. We’ve asked this question every month since March 2019 and in 6 of the 8 months over 70 percent of respondents said yes, they expect the dispute to ultimately be resolved in a way that benefits U.S. agriculture.

Although the U.S.-Mexico-Canada Trade Agreement has been agreed upon by trade negotiators for all three countries, it has yet to be approved by the U.S. Congress. Ninety-six percent of respondents on our October survey told us that the three-country trade agreement was either important or very important to the U.S. ag economy, but only a slim majority (55 percent) of respondents said they expect the agreement to be approved soon. Similarly, 97 percent of the respondents in October indicated the recently announced trade agreement with Japan is important to the U.S. ag economy. Unlike the U.S.-Mexico-Canada agreement, the pact with Japan does not need to be approved by the U.S. Congress.

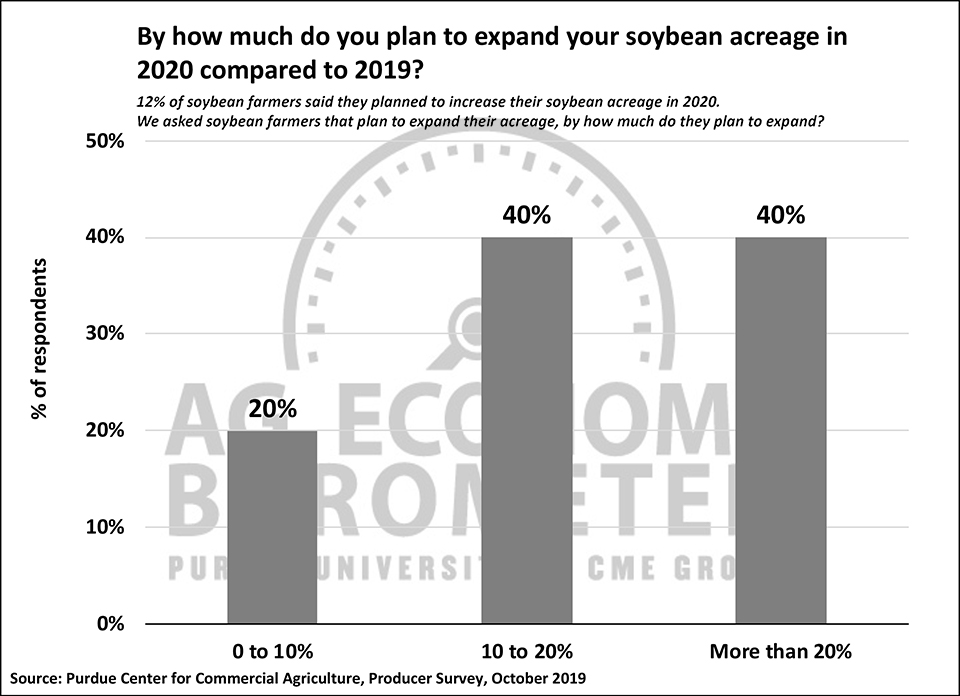

Given the large prevented plantings of both corn and soybeans in 2019, there could be a large increase in U.S. planted acreage in 2020. To learn more about farmers spring planting plans we asked farmers that grew corn or soybeans this year if they intended to increase, decrease or keep their acreage of those two crops the same in 2020? Approximately three-fourths of both corn and soybean producers said they did not plan to increase or decrease their acreage of those two crops in 2020. However, 14 percent of corn growers and 12 percent of soybean growers in our survey said they intended to increase their acreage of those two crops, respectively. We followed up with farmers that plan to increase their crop acreage and asked them by how much do they expect to increase their acreage in 2020 compared to 2019? Two-thirds of corn growers who told us they will increase corn acreage in 2020 said they intend to increase their corn acreage by 10 percent or more and one-third of them said they planned to increase corn acreage by more than 20 percent. Eighty percent of soybean growers who told us they will increase their soybean acreage in 2020 told us they expect to increase their soybean acreage by 10 percent or more and 40 percent of them said they actually intended to increase their acreage by more than 20 percent.

Sign-up for the 2019 Market Facilitation Program (MFP) is still underway and many producers have already received the first of three possible 2019 MFP payments. Since 2019 is the second year in a row that USDA has provided MFP payments, we asked producers whether or not they anticipate USDA providing MFP payments to U.S. farmers for the 2020 crop year? Sixty-two percent of producers in the October survey said they do expect another round of MFP payments for the 2020 crop, up slightly, compared to the 58 percent of farmers that told us in August they expect another round of MFP payments for the 2020 crop.

Wrapping Up

The Ag Economy Barometer rose 15 points in October as producers became more optimistic about both current and future economic conditions on their farms. Farmers in October were more inclined to think now is a good time to make large investments in their farming operations, and more farmers said they expect farmland values to rise, than in September. Although three-fourths of farmers in this month’s survey said they expect the soybean trade dispute with China to be resolved in a way that is favorable to U.S agriculture, 62 percent of producers said they expect to receive another round of MFP payments for the 2020 crop year. Finally, in an early look at planting intentions for spring 2020, 14 percent of corn growers and 12 percent of soybean growers said they plan to increase their acreage of those two crops compared to 2019. Most growers that plan to increase their acreage of corn or soybeans are planning substantial acreage increases.

Source: James Mintert and Michael Langemeier. Purdue University