Federal Reserve Ag Credit Surveys-2020 First Quarter Farm Economy Conditions

On Thursday, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of 2020. Earlier this month, the Federal Reserve Bank of Minneapolis released its first quarter agricultural credit conditions survey, while the Federal Reserve Bank of Dallas released its Agricultural Survey for the first quarter of 2020 earlier this year.

Federal Reserve Bank of Chicago

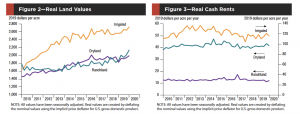

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “District agricultural land values were 1 percent higher in the first quarter of 2020 than in the first quarter of 2019, though they were unchanged from the fourth quarter of 2019 (see table and map below).

“Illinois, Indiana, and Iowa saw year-over-year increases in farmland values, while Wisconsin saw a decrease. Moreover, Wisconsin experienced a quarterly decline in farmland values. After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), District agricultural land values moved down on a year-over-year basis for the 23rd consecutive quarter in the first quarter of 2020; however, this decrease was the smallest one since 2017.”

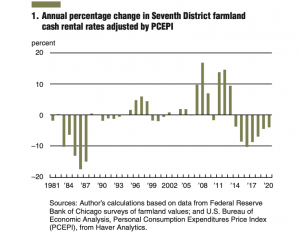

The AgLetter stated that, “There was a 2 percent decrease in cash rental rates for District agricultural ground from 2019 to 2020. For 2020, average annual cash rents for farmland were down 3 percent in Illinois, 3 percent in Iowa, and 4 percent in Wisconsin; such rents were unchanged in Indiana (and not enough survey responses were received from bankers in Michigan to report a numerical change for that state). After being adjusted for inflation with the PCEPI, District cash rental rates dipped 4 percent from 2019 (see chart 1). This was the seventh straight year of declining cash rents (in both nominal and real terms)—extending the longest such downturn since 1981 (when the survey started to track cash rents).”

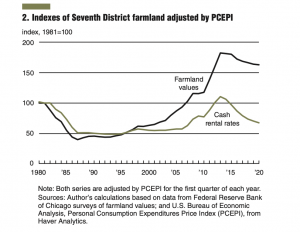

The Chicago Fed pointed out that, “Even though the current streak of decreasing real cash rental rates is the longest one on record in the survey, the District’s index of inflation-adjusted cash rental rates fell by more in percentage terms during the 1980s (see chart 2).

“The index of real cash rents was reduced by almost 50 percent from 1982 to 1987.

In nominal and real terms, both the index of farmland cash rental rates and the index of agricultural land values peaked in 2013.

“As of 2020, the index of real cash rents had fallen 39 percent below its level in 2013, reaching its lowest level since 2007; the index of real farmland values had fallen only 11 percent from its 2013 peak (and was last lower in 2012).”

Mr. Oppedahl added that, “The overall decline in agricultural credit conditions for the District deepened in the first quarter of 2020 after showing some signs of improvement in the fourth quarter of 2019. As one Indiana banker noted, ‘The impact of Covid-19 has created significant price deterioration for all commodities, and at this point we do not know what the recovery time frame will be.’”

Federal Reserve Bank of Kansas City

and

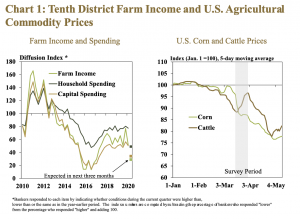

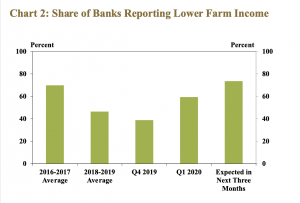

Thursday’s update stated that, “After improving slightly at the end of 2019, the share of bankers reporting lower farm income increased sharply in the first quarter. About 60 percent of respondents across the region indicated that farm income was lower than the same time a year ago, the highest share since early 2017.”

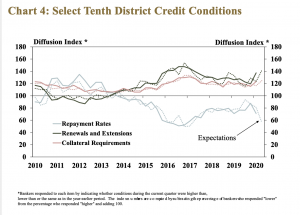

Kauffman and Kreitman also noted that, “After showing some signs of stabilizing in previous survey periods, credit conditions also deteriorated more quickly in the first quarter. Similar to farm income, farm loan repayments declined at a faster rate than recent quarters.”

The Kansas City Fed noted that,

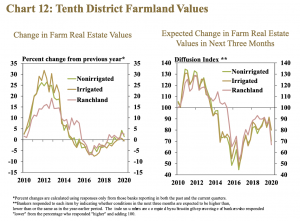

Despite a more pessimistic environment for farm income and credit conditions, farmland values remained relatively steady.

“Both nonirrigated cropland and ranchland values increased slightly for the second consecutive period.”

In summary, Thursday’s report stated that, “The initial effect of developments surrounding the COVID-19 pandemic weakened the outlook for the agricultural economy considerably and weighed on farm finances. The share of bankers reporting lower farm income and loan repayment rates increased sharply and expectations for coming months also turned more pessimistic….However, government payments appear likely to provide notable relief to segments of the farm sector again in 2020.”

Federal Reserve Bank of Minneapolis

Joe Mahon indicated earlier this month (“COVID-19: Agriculture’s ominous feeling about the pandemic“) that, “The COVID-19 pandemic came at a particularly bad time for agriculture. After multiple years of low commodity prices and a trade war that constricted access to overseas markets, the extreme disruption in the broader economy was the last thing farmers wanted to see. ‘Coronavirus decreasing grain market, oils and commodities markets,’ said a Minnesota agricultural lender.”

The closure of several livestock and poultry slaughter plants due to virus outbreaks among workers had many livestock producers concerned about the impacts on the food supply chain and whether there would be markets for animals. ‘If the meat packing industry does not change, it could be the final nail for most producers,’ one South Dakota banker said.

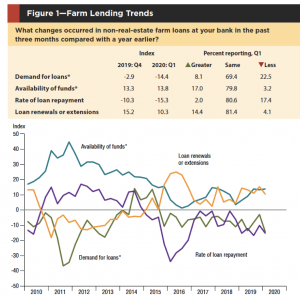

Mr. Mahon noted that, “More than two-thirds of district lenders surveyed (69 percent) reported that farm incomes decreased in the first quarter of 2020 compared with the first quarter of 2019. A similar proportion of respondents said capital spending by farming operations was down.”

“Given tight finances for farmers, the rate of repayment on agricultural loans dropped, while renewals increased.”

With respect to land values, the Fed update explained that, “Agricultural land values continued to retreat further from their peaks of about six years ago, though they remain strong relative to historical levels. Ninth District nonirrigated cropland values fell by 2.3 percent on average from the first quarter of 2019. Irrigated land values increased slightly less than 1 percent, while ranchland values were nearly unchanged. The district average cash rent for nonirrigated land was also nearly unchanged from a year ago. Rents for irrigated land and ranchland rents increased 1.4 percent and 1.6 percent, respectively.”

This month’s report also stated that,

‘In 2019, most producers survived because of MFP payments,’ wrote a South Dakota lender, in reference to the Market Facilitation Program that the U.S. Department of Agriculture has used to support farmers negatively impacted by the trade disruptions. ‘If no payments are made in 2020 and commodity prices remain challenged, 2020 will see significant stress in the ag sector among the bottom 20 percent of producers.’

Federal Reserve Bank of Dallas

Earlier this year, the Federal Reserve Bank of Dallas released its Agricultural Survey for the first quarter of 2020, which stated that, “Demand for agricultural loans continued to decline, with the loan demand index registering its 18th quarter in negative territory. Loan renewals or extensions increased, and the rate of loan repayment continued to decline. Loan volume fell across all major categories compared with a year ago.”

The Dallas Fed added that, “All district land values increased this quarter.”

“The anticipated trend in farmland values index was flat in first quarter 2020 after increasing slightly in fourth quarter 2019,” The Survey said.

Source: Keith Good, Farm Policy News