Federal Reserve-Observations on the Ag Economy-May 2019

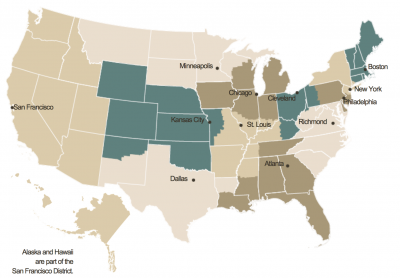

Earlier this month, the Federal Reserve Board released its May 2019 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions across the District were mixed. Recent reports indicated much of the District was drought-free although parts of Alabama, Georgia, and the Florida panhandle experienced abnormally dry to moderate drought conditions.

“Conversely, recent heavy rains interfered with fieldwork in Louisiana and Mississippi where both soybean and rice planting were behind the five-year averages. Alabama, Georgia, and Tennessee were ahead of the five-year average in cotton planting, while Alabama, Florida, and Georgia were ahead of their five-year planting averages in peanuts.

Several contacts reported that the combination of low commodity prices and some rising input costs were resulting in compressed margins.

“The May Florida orange forecast was down from the prior month’s forecast, but continued to be higher than last season’s production. On a year-over-year basis, prices paid to farmers in March were up for corn, cotton, and beef but down for rice, soybeans, broilers, and eggs.”

* Seventh District- Chicago– “Wet weather and low prices continued to be challenges for farmers in April and early May. There were reports of planting delays throughout the District because fields were too wet. Contacts indicated that it would soon be too late to plant corn in some areas and that switching to soybeans, while possible, would be costly due to wasted fertilizer and the low price of soybeans. Contacts also noted that the poor field conditions were adding to some farmers’ financial distress. In other market segments, hog and dairy prices were up, while cattle prices were down. Hay prices moved higher as the slow development of pastures this spring meant livestock required supplemental feeding. Contacts believed that the removal of Mexican and Canadian tariffs on U.S. livestock would boost exports.”

* Eighth District- St. Louis– “Agriculture conditions declined moderately from our previous report and have significantly worsened relative to the same time last year. The number of acres planted experienced significant declines compared with previous years, which contacts have attributed to significant flooding along the Mississippi River. As of mid-May, the percentages of planned acreage planted for corn and soybeans were around 50 percent lower than this time last year and about 30 percent lower for rice and cotton.

Contacts have continued to report concerns over depressed crop prices and the effects of renewed trade tensions with China.

* Ninth District- Minneapolis– “District agricultural conditions weakened heading into the growing season.

Heavy spring rains significantly delayed crop planting across the District, with contacts expressing concerns that some farmers might not be able to get a crop in the ground at all this year.

“Respondents to the Minneapolis Fed’s first-quarter (April) survey of agricultural credit conditions indicated that farm income and capital spending decreased relative to a year earlier, with further declines expected for the coming three months.”

* Tenth District- Kansas City– “Farm income and agricultural credit conditions weakened slightly in the Tenth District. Specifically, regional contacts indicated that farm income decreased modestly and farm loan repayment rates slowed slightly since the last survey period. Conditions deteriorated more in Missouri and Nebraska, where contacts reported a moderately faster decline in income and slower rate of loan repayment. District contacts also commented that low commodity prices continued to strain working capital, and recent severe flooding and blizzards may have significantly impacted some borrowers. Cattle, soybean and wheat prices decreased slightly over the period, while corn prices increased moderately and hog prices increased significantly, which could improve revenues for some producers moving forward. Alongside weaknesses in farm finances, interest rates on farm loans increased modestly throughout the District, but farmland values in the region remained relatively stable.”

* Eleventh District- Dallas– “Wet weather over the reporting period allowed moisture conditions to remain adequate or even in surplus across most of the district. While causing late plantings in some areas, overall, the rain impact was positive as it boosted growing conditions. The wheat crop was in great shape, though prices remained weak. Pasture conditions remained favorable for livestock grazing. Contacts expect a big cotton crop this year, but prices have moved lower than the cost of production for many producers.

Trade discussions have put a strain on agricultural markets in general, and raised concern from agricultural industry leaders.

“Several agricultural producers in southern New Mexico expressed concern over the lack of labor force growth and the strain that immigration restrictions have imposed on their current workforce. They also mentioned that the recent authorization of hemp production provides an opportunity as an alternative to pecan production, as the pecan industry has been negatively impacted by tariffs.”

* Twelfth District- San Francisco– “Conditions in the agriculture sector improved modestly. Many contacts reported stable demand and adequate supply throughout the District, with inventories and planted acreage remaining at healthy levels. Domestic demand for agricultural products remained steady, although a contact in the peach and apricot markets reported increased competition from producers in states outside the District. Concerning export demand, contacts noted that continued trade policy tensions affected some products more intensely than others. Contacts in California and the Mountain West mentioned that demand from abroad has declined for grain, potatoes, walnuts, and cattle markets. Contacts in the swine market reported that the outbreak of a particular strand of swine fever in foreign markets has constrained global supply and increased demand for domestically produced pork products, putting upward pressure on prices. One contact in Central California continued to express concern over higher-than-expected rainfall and its potential effects on the output of crops that are nearing harvest season, such as cherries.”

Source: Keith Good, Farm Policy News