House Appropriations Subcommittee on Agriculture Hearing on the Rural Economy

On Tuesday, the House Appropriations Subcommittee on Agriculture held a hearing titled, “The Rural Economy.” Today’s updates provides a brief recap of some of the issues that were discussed at the Subcommittee meeting.

In his opening remarks, Subcommittee Chairman Sanford D. Bishop, Jr. (D., Ga.) pointed out that, “This discussion comes at a critical time for our farmers, ranchers, producers, and rural communities. Recent natural disasters across the country – including hurricanes and tornados in my home state of Georgia and unprecedented flooding in Nebraska, the home state of our Distinguished Ranking Member [Jeff Fortenberry (R., Neb.)] – have created stress and uncertainty, on top of impacts from the ongoing tariff situation.”

Congressman Sanford D. Bishop, Jr. (GA-02), Chairman of the U.S. House Appropriations Subcommittee on Agriculture, Rural Development, Food and Drug Administration, and Related Agencies, convened a hearing on Tuesday titled, “The Rural Economy.”

“And that is not to mention the fact that farmers have faced years of declining commodity prices. I’ve heard from my constituents, as I’m sure my colleagues have too, and there is a lot of anxiety out there right now. Farmers and ranchers are resilient by nature, but for many the future holds a lot of unknowns.”

Chairman Bishop added that, “Even with all that uncertainty there are reasons to be optimistic. In 2017, the Farm Credit System made more than $9 million in loans for young farmers and more than $12 million for beginning farmers. In total, $86.9 million in new loans were made to young, beginning and small farmers. Investing in the future of agriculture, whether it be research or people, is a priority of this committee.”

While the current credit stress level in the System’s loan portfolio is well within its risk-bearing capacity, asset quality is expected to decline in 2019 from relatively strong levels in 2018.

“Factors supporting the overall condition of the FCS continue to be stable earnings, a strong capital base, and reliable access to debt capital markets.”

Mr. Jensen noted that, ” Across much of our service territory, major snowstorms and historic flooding have taken lives, ruined machinery and equipment, destroyed critical infrastructure and damaged homes and livelihoods. Unfortunately, there is risk of more flooding in the days and weeks ahead as significant snowmelt continues and we experience spring moisture. It likely will take months to fully assess the damage, but the need for assistance is immediate.”

While producers in many areas of our territory benefited from strong yields in 2018, the industry continues to be challenged by compressed margins. For producers who rent farmland, softening in the market places downward pressure on cash rental rates which will help their bottom line.

And Rod Hebrink, the President and CEO at Compeer Farm Credit, explained to the Subcommittee that, “The crop and livestock sectors we serve in agriculture are best described as volatile. While commodity prices have always been cyclical due to the influence of weather and markets, the current economic downturn facing agriculture has been prolonged. This downturn has impacted farmers of all ages, experience levels and sizes. Certainly the ongoing tariff and trade disputes have contributed to the volatility and we’re hopeful these challenges will soon be resolved. We’re grateful for the support of Congress in passing a new Farm Bill, which will provide much needed financial support and maintain important risk management tools such as crop insurance.”

During the discussion portion of Tuesday’s hearing, Chairman Bishop queried,

Your excellent and frank testimony seems to raise at least a flashing yellow light with respect to our rural economy, which is the subject of our hearing today.

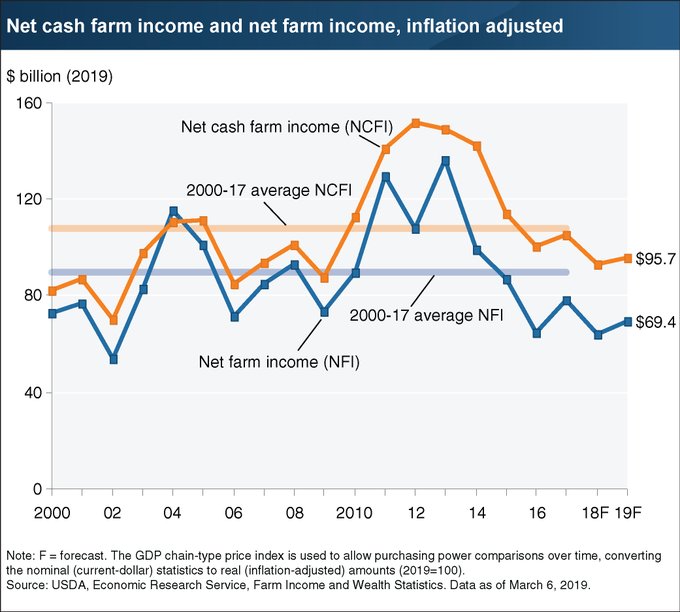

“You cite a 9% decline in U.S. ag exports in the fourth quarter of 2018, labor availability concerns, net cash farm income that is well below the level achieved five years ago. Somewhat lower cropland prices for the rest of 2019, 4% increase in total farm debt, and a rise in farm bankruptcy rates. Thank you for noting the serious impact that extreme weather events have had on farmers in many parts of the country. Taken together, all of this is very, very concerning.

“Would you say that we are at a tipping point in 2019? What would you say are the major warning signs that we should be paying attention to, as we go forward, preparing for 2020?”

Mr. Tonsager noted that, “Yes, I think there’s a great concern, especially related to net farm cash income. That number alone should cause all of us engaged in helping agriculture concern.

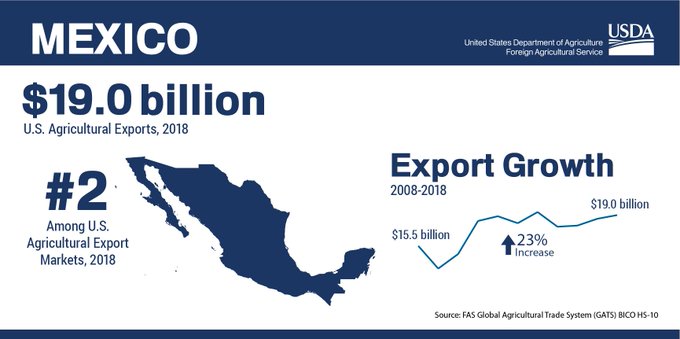

And Rep. Henry Cuellar (D, Tex.) stated yesterday that, “Mr. Tonsager, let me ask you, in your written testimony you mentioned the tariffs that the administration has imposed on China and other countries. And as you know, they’ve resulted in retaliatory tariffs on many of the American agricultural products. This has increased price risk for agriculture and key commodities that many farmers grow in my district, and across the nation. Can you talk a little bit more about what the Farm Credit Administration has done to mitigate the negative effects that these tariffs have had on farmers?

“And you know, my personal opinion on this. I don’t want to see subsidies or bailouts for farmers. I think the most important thing is to get markets. Because you understand the way this works, if they lose a contract to somebody else, they just can’t turn on that contract right away. Once they lose that, it might be gone for a while. So I’d rather give them markets instead of subsidies or bail outs.”

Mr. Tonsager noted that, “Well, I think we’re being very much aware, and we’re anxious to be prepared for the issues associated with that. The Farm Credit System is credit providers. And the need for producers is if there are short term issues, and hopefully prices are short term issues, that the system is in a position to help producers get through that difficult time. So we’re following closely, the system is following it closely. We’re trying to help, or the system is attempting to help producers get through that difficult period, while paying attention to their long term situation. So we know that there’s issues that hopefully will be resolved, regarding trade, and that will help producers move forward.”

We haven’t even talked about the President trying to shut down the border. I mean if you want to talk about economic impact to our ag folks, that would have an extremely negative impact.

“Every day there’s more than 1.6, 1.7 billion dollars of trade between the U.S. and Mexico, that’s over a million dollars a minute on it. So that’s another issue, because Mexico’s a huge partner to the ag industry.”

Source: Keith Good, Farm Policy News