Revenue Protection Crop Insurance and Hedging in 2020

With the uncertainty revolving around COVID-19, grain marketing has come to the forefront of many producers’ minds. I have heard more than once, “at current price levels should I hedge my crop?”

However, it is important to remember that if you have purchased Revenue Protection Crop Insurance, your 2020 crop in field has been partially hedged. Let’s take a look at how crop insurance acts as a hedge when commodity prices decline during the growing season.

Revenue Protection

Revenue Protection (RP) uses futures markets to determine the price portion of the revenue calculation. Price information is collected twice, first being the “projected price,” which happens in the spring, before planting, followed by “harvest price,” which happens around harvest. These prices are used to calculate the “revenue guarantee” and the “revenue to count,” which are both important components in determining whether a payment will be paid to the producer. The revenue guarantee is the Actual Production History (APH) , multiplied by the producer’s selected coverage level and then by the projected price. Under an RP policy, if the harvest price is higher than the projected price, the revenue guarantee is recalculated using the harvest price. Revenue to count is calculated by multiplying the harvest price by the actual yield of the farm. Crop insurance indemnity payments are made if the revenue to count falls below the revenue guarantee.

Revenue Guarantee = APH X Coverage Level X MAX (Projected Price OR Harvest Price)

Revenue to Count = Harvest Price X Actual Yield

Crop Insurance Indemnity Payment = Revenue Guarantee – Revenue to Count

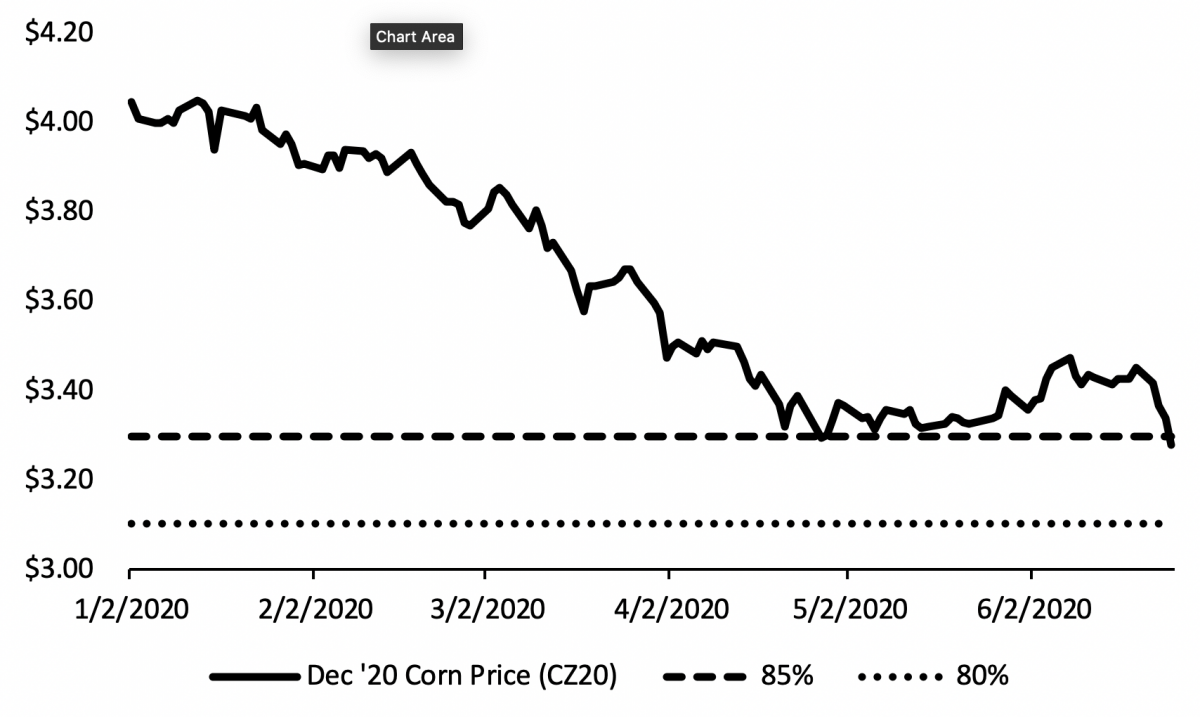

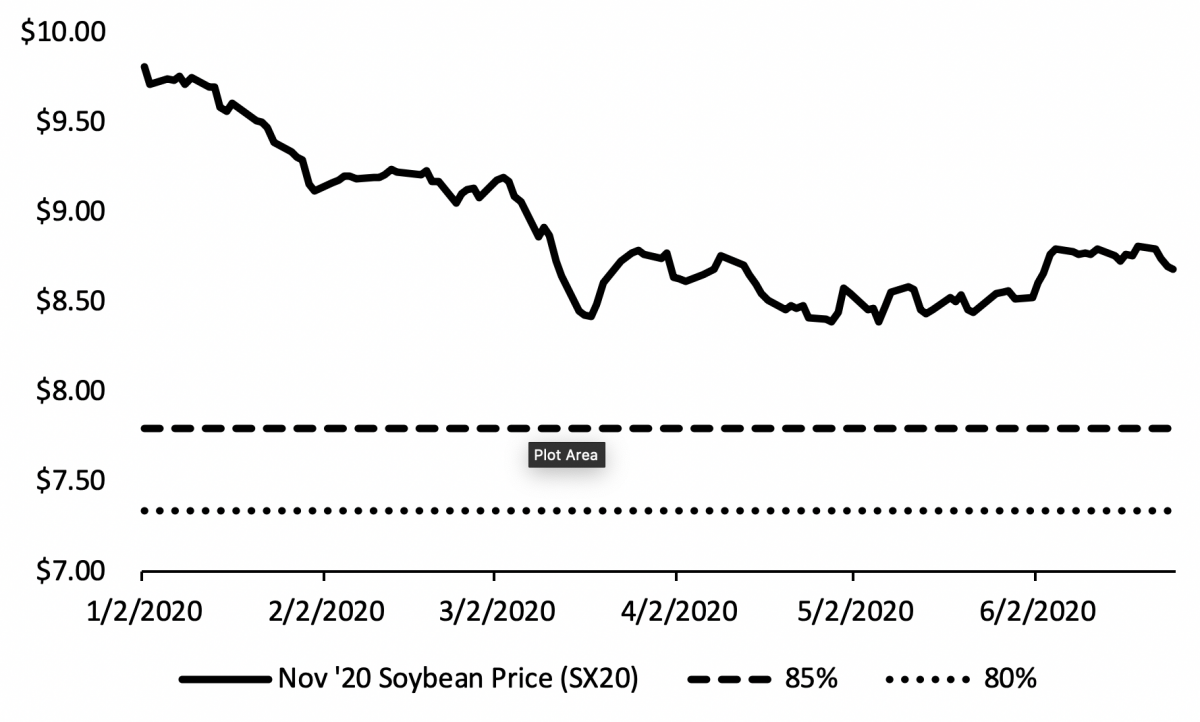

Corn prices for RP are based on the Chicago Board of Trade December corn futures contract (ZCZ20 for 2020). Soybean prices are based on the Chicago Board of Trade November soybean futures contract (ZSX20 for 2020). The projected price is the average of the contract for the month of February. The harvest price is the average of the futures contract for the month of October.

For 2020, the projected price for corn is $3.88 per bushel and for soybeans is $9.17 per bushel.

Crop Insurance as a Hedge

Revenue Protection acts as a hedge when the harvest price falls below the projected price by providing compensation via crop insurance payments for decreases in price. However, price at which the grain is hedged is also dependent on the coverage level and the actual yield on the farm. In years of declining price, the higher the coverage level, the higher the insurance guarantee and effective hedge price. RP policies can also trigger payments when the actual yield is low relative to the APH, leaving potential payments also coming from low yields. The infinite combinations of realized fall prices and actual yield make identifying the payment from hedging more difficult to identify.

For example, the revenue guarantee for a farm that selected a RP policy with 75% coverage and has APH of 200 is $582 (200 bushels per acre X 75% X $3.88 per bushel). If the farm has an actual yield that is equal to their APH of 200 bushels per acre, the harvest price (average of the December futures price for the month of October, not the cash price at the local elevator) would have to be less than $2.91 per bushel to trigger a crop insurance indemnity ($582 per acre/200 bushels per acre). In other words, if your farm’s actual yield equaled your APH then the harvest price would have to less than the projected price multiplied by your coverage level. These prices can be considered your expected hedge price (shown in Table 1).

If the same farm (with a revenue guarantee of $582) yielded less than their APH, say 190 bushels per acre, the harvest price would have to be less than $3.06 per bushel to trigger a crop insurance indemnity payment ($582 per acre/190 bushels per acre). Put differently, the expected hedge price would be $3.06 per bushel. Higher than the value when you produce your APH.

As you can see from these two examples, you are likely facing a range of potential expected hedge prices. We suggest you consider a range of actual yields: lower than your APH, equal to your APH and higher than your APH and calculated your expected hedge price for each scenario. As the crop year progresses, update your range of actual yields based on how your crop is looking.

We need to consider the net outcome. Producers pay a premium for crop insurance. The cost of these premiums varies not only by crop, practice (for example: irrigated or not) and coverage level, but also by county. The final hedge price would be less the premium cost per bushel.

Should you hedge your 2020 crop? Purchasing a RP crop insurance provides a hedge from low prices, where the payment trigger depends upon your selected coverage level and actual yield. Will prices continue to fall between now and harvest? The price path we have witnessed since early this year has been downward. Where it goes from here is unknown. What is known is your individual ability to survive experiencing even lower prices and what hedging you have done up to this point. If you are unable to survive lower prices, then we suggest some additional hedging.

How low can prices go from now to harvest? The answer is unknown, as the markets rarely experience events such as COVID-19. Using market information, we can construct price probabilities of possible prices for December 2020 corn contracts. Using this approach, there is a 10% chance of corn futures being less than $2.75 on Dec. 1. For Soybeans, there is a 10% chance of futures being less than $7.50 on Nov. 1. In our view, prices can go lower.

Source: Jessica Groskopf and Cory Walters, University of Nebraska CropWatch