The 2020 Corn Yield Guide

Earlier this month, the USDA issued its first balance sheet estimates for the 2020/2021 marketing year. For corn, production came in at nearly 16 billion bushels due to large acreage (97 million) and an early yield estimate of 178.5. A lot can – and likely will – change between May and the fall, but it’s worth stepping back and considering the range of possibilities. This week’s post is a look back at historical yields to see what 2020 corn yields might have in store.

Background

Before jumping into the data, a couple of background notes. First, the USDA’s May WASDE yield figure was 178.5 bushels per acre. While this early, May estimate will occasionally catch some negative attention- “how can the USDA estimate yields before the crop is even planted?!” – it is important to keep in mind what this figure represents. In the footnotes, the USDA states:

“The yield projection is based on a weather-adjusted trend assuming normal mid-May planting progress and summer growing season weather, estimated using the 1988-2019 time period, and includes a downward stochastic adjustment to account for the asymmetric response of yield to July precipitation.”

In short, the USDA’s May yield estimate is a model projection that assumes normal planting progress and normal summer weather conditions.

For this week’s post, we considered corn yields over the same timeframe (1988-2019).

Historic U.S. Corn Yields

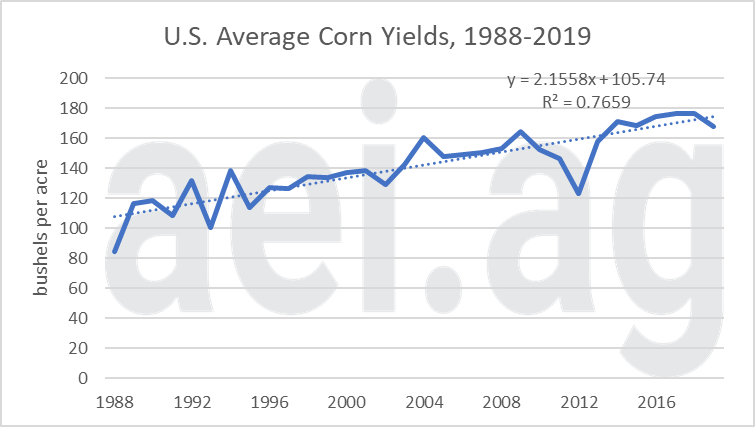

Figure 1 shows U.S. corn yields since 1988 and plots a linear trend line through the data. The upward slope of the trend line is nearly 2.2 bushels per acre. While the trend slope can seem small on an annual basis, over a few years this can add up. Over just five years, the rate of 2.2 bushels per acre per year would move trend yields up 11 bushels per acre. This can make it challenging to meaningfully compare yields over time.

One way to work around this is to measure and compare how well a given year performed relative to the trend-line. The gap between the trend and actual – or the departure from trend- is a comparable measure of how ‘good’ or ‘poor’ yields were. From Figure 1, the gaps in 2012 (-36.5) and 2004 (+17.9) stand-out as historical extremes.

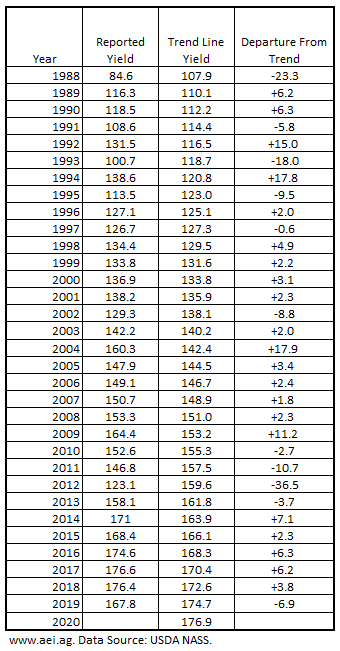

Table 1 shows the data points from Figure 1. Specifically, the ‘departure from trend’ column is the difference between the plotted trend-line and the reported yield.

Figure 1. U.S. Average Corn Yields, 1988-2019.

Table 1. U.S. Average Corn Yields, Trend Yields, and Departure from Trend. 1988-2019. Data Source: USDA NASS and aei.ag calculations.

What Might 2020 Have in Store?

While the growing season is barely underway, historical data can provide us with some context. First is the USDA’s initial estimate of 178.5. Again, their current assumptions include normal planting and summer growing season weather. Conditions can certainly deteriorate or improve from there.

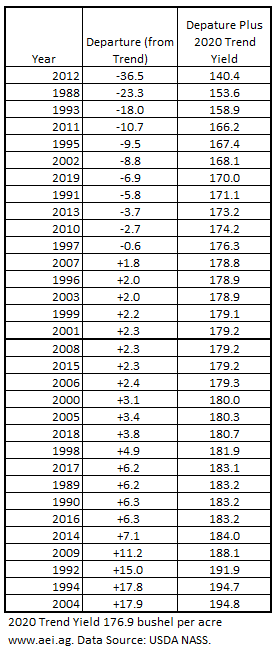

Another early data point to consider is the trend average. Using the trend-line from Figure 1, we can extrapolate to find the trend-average is 176.9 in 2020. Building off the trend-average, Table 2 provide a range of possible outcomes. Specifically, Table 2 ranks the departure from trend data in Table 1 from lowest to highest. In the third column, the annual departure from trend data is added to the 2020 trend yield (176.9). This adjusts historic yield performance to the current baseline.

Table 2 can be eye-opening. First, consider 2012. While yields in 2012 were posted at 123.1 (Table 1) and measured as a record -36.5 bushel departure from trend, similar conditions today (in 2020 terms) would be equal to 140.4. Most would expect this increase to take place, but it can be easy to lose track of the pace over several years.

Second, consider the bold line in the middle of the table (between 2001 and 2008). Exactly half of the data points lies above/below this line. More specifically, 50% of the data points have a departure from trend greater than 2.3bpa, and 50% have a departure less than 2.3bpa. While the trend-average is 176.9 (+0.0 departure from trend), above-trend yields are much more common than below trend-yields. In fact, for this dataset, above-trend yields occur around 63% of the time. Even the USDA’s May estimate (178.5) is below the 50/50 line.[1]

This brings us to our next point; the upper range of possible yields in 2020 is probably higher than most would guess. While the possibility of national corn yields of +190 bushels per acre seems unfathomable, yields +15 bushel above trend are in the range of historic outcomes. To that point, the data show such conditions have occurred three times in the past 31 years.

One last point to consider, which of the following statements is more likely to occur:

- The 2020 U.S. average corn yield exceeds 190 bushels per acre.

- The 2020 U.S. average corn yield falls below 150 bushels per acre.

Assuming we know little about the 2020 growing season and had access to Table 2, you would likely say the first statement is more likely. However, it seems that ‘2012-like events’ dominate our thinking and conversations when pondering “what-if” scenarios. For bullish yield scenarios, we should always consider the probability of such events occurring. Furthermore, we should also consider an opposite, bearish outcome with a similar probability of occurring.

Table 2. Corn Yield Departure from Trend, 1988 to 2019.

Wrapping it Up

While the growing season is just getting started, the goal of this corn yield guide is to provide a baseline of data to keep in mind. While the USDA’s May yield estimate (178.5) is above the trend-average (176.9), the USDA’s estimate is based on a model and is assuming normal planting pace and weather.

Most importantly, while both numbers might seem high- especially compared to the 2019 yield of 167.8, both are below the median of observations, or below the 50/50 threshold.

It’s helpful to keep the baselines in mind as the growing season and yield debates get underway. Specifically, think about the likelihood of yields being above (or below) trend. AFN users have been forecasting the probability of the national yield exceeding 177 bushels per acre. The consensus across user has moved higher in recent months, and is currently above 60%. (Update your forecast here, or learn more about AEI Premium and the AFN tool)

Click here to subscribe to AEI’s Weekly Insights email and receive our free, in-depth articles in your inbox every Monday morning.

You can also click here to visit the archive of articles – hundreds of them – and to browse by topic. We hope you will continue the conversation with us on Twitter and Facebook.

[1] “Trend average” is below the median because the yields are skewed towards the lower end. This is to say drought-conditions pull yields considerably lower than extremely good weather pushes yields higher. To this point, the lowest departure from trend yields (-36.5 in 2012, -23.3 in 1988) are larger in magnitude than the highest departure from trend yields (+17.9 in 2004, +17.8 in 1994).

Another way of considering this is looking at the five highest/lowest departure from trends, or the highest/lowest 15% of yields. The highest 15% averaged +13.8 bushels from trend, while the lowest 15% averaged -19.6 bushels from trend.

Source: David Widmar, Agricultural Economic Insights