U.S., China at Trade Impasse-President Trump Offers Policy Help for Farmers

Last week, the United States made good on a threat to increase trade tariffs on China. Some agricultural markets roiled on the news, and President Trump offered policy assistance to U.S. farmers in a series of Tweets on Friday morning. Today’s update looks at these issues in greater detail.

Last week, the United States made good on a threat to increase trade tariffs on China. Some agricultural markets roiled on the news, and President Trump offered policy assistance to U.S. farmers in a series of Tweets on Friday morning. Today’s update looks at these issues in greater detail.

Background- U.S. Imposes Tariffs, Trade Talks “Candid and Constructive”

Last week, President Trump followed through on his intentions of increasing trade tariffs on China. Wall Street Journal writers Bob Davis and Josh Zumbrun reported on the front page of Friday’s paper that, “The U.S. increased tariffs on $200 billion of Chinese goods to 25% Friday as President Trump ratcheted up pressure on Beijing and threatened to impose additional levies on virtually everything China exports to the U.S.

“The tariff hike went into force hours after U.S. and Chinese negotiators met Thursday in hopes of getting the troubled trade talks back on track. Discussions are set to resume Friday, but the White House said it had no plans to suspend the tariff increase, which will raise levies from the current 10%.”

Following up, on the front page of Saturday’s Journal, Bob Davis reported that,

U.S. and Chinese trade negotiators failed to break an impasse following two days of globally watched trade talks, as both sides tried to prevent sentiment from deteriorating further.

“In tweets Friday afternoon, President Trump said newly imposed 25% U.S. tariffs on $200 billion in Chinese imports would remain in place pending future negotiations. But he called the talks ‘candid and constructive’ and said his relationship with Chinese President Xi Jinping ‘remains a very strong one and conversations into the future will continue.’”

Los Angeles Times writers Robyn Dixon and Don Lee reported on the front page of Saturday’s paper that, “Trump said Friday that he was in no hurry for a deal. ‘There is absolutely no need to rush,’ he wrote in a Twitter message in which he praised the tariffs he’s already slapped on Chinese goods and touting how much more he can impose.”

Meanwhile, Alan Rappeport and Ana Swanson reported on the front page of Saturday’s New York Times that, “On Friday, the trade dispute appeared to be lurching toward an all-out economic war. China has threatened to retaliate with its own ‘countermeasures,’ which include ending purchases of American farm goods and establishing other nontariff barriers for companies trying to gain access to the Chinese market.”

Reuters writers Yawen Chen, Ben Blanchard and Ryan Woo reported on Friday that, “Three main differences remain in the China-U.S. trade talks, including the removal of all the additional tariffs, Chinese state media said on Saturday, following the end of the latest round of negotiations in Washington.

“The ruling Communist Party’s official People’s Daily and the official Xinhua news agency said that in addition to the lifting of the additional tariffs, the differences centred on trade purchases and a ‘balanced‘ text to any trade deal.”

Also, Yawen Chen and David Lawder report Friday at Reuters that, “China and the United States have agreed to hold more trade talks in Beijing, Vice Premier Liu He said as U.S. President Donald Trump ordered his trade chief to begin the process of imposing tariffs on all remaining imports from China.

‘Negotiations have not broken down,’ Liu, China’s chief negotiator in the talks, said in Washington on Friday, according to state television on Saturday. ‘Quite the opposite, I think small setbacks are normal and inevitable during the negotiations of both countries. Looking forward, we are still cautiously optimistic,’ Liu said.

Financial Times writers Christian Shepherd, Tom Mitchell and Nian Liu reported on Sunday that, “Chinese vice premier Liu He has denied that China backtracked on agreements made in trade negotiations with the United States, in Beijing’s first detailed response to Washington’s allegation that changes to negotiation texts prompted President Donald Trump to call for additional tariffs on Chinese goods.”

The FT writers explained that, “The Chinese government said last week that it would respond to Mr Trump’s move with new tariffs of its own but has so far been relatively calm in its response, as it believes a deal could still be within reach.

“Mr Liu told Chinese media at the weekend there had not been a breakdown in talks and that China had not ‘reneged’ on the deals, claiming that the two sides were still in the process of exchanging draft agreements when Mr Trump threatened higher tariffs.

“‘We believe that before an agreement is reached, any change is very natural,’ he said, according to Hong Kong-based Phoenix Media. ‘We did not backtrack. We had disagreements over how to write some of the text is all.’”

Agricultural Focus

Financial Times writer Gregory Meyer reported late last week that, “Soyabeans, a commodity sensitive to the state of Sino-US relations, have fallen below $8 a bushel for the first time since the financial crisis as uncertainty rises over trade talks between Washington and Beijing.”

“US-China tensions knock soyabeans to post-crisis low,” by Gregory Meyer. The Financial Times (May 9, 2019).

Mr. Meyer explained that, “Soyabeans for May delivery fell as much as 2.3 per cent to $7.95¼ a bushel on the Chicago Board of Trade, the lowest price for a near-month contract since December 2008. All futures contracts fell, with soyabeans deliverable after the US harvest in November dropping to $8.30 a bushel. Most farmers cannot break even at such prices.

“An Iowa State University analysis estimated costs per bushel for the most commonly planted soyabean varieties at between $8.86 and $9.21.”

Los Angeles Times columnist Michael Hiltzik indicated on Friday that, “China instead has been buying [soybeans] from Brazil, raising fears that a long-term shift in its import sourcing could leave U.S. producers permanently out in the cold. The result is that soybean prices have plunged, with futures falling below $8.13 a bushel, their lowest price in a decade.

‘We’re getting a little taste now of what soybean prices will look like if this trade deal doesn’t come to fruition,’ University of Illinois agricultural economist Todd Hubbs said in his weekly crop report this week, ‘and it isn’t pretty.’

Michael Hirtzer reported last week at Bloomberg that, “On Friday, the U.S. Department of Agriculture said domestic soy inventories would be higher than analysts had predicted. The agency pegged 2019-20 inventories at 970 million bushels, the second-highest ever after a record 995 million in the current season.”

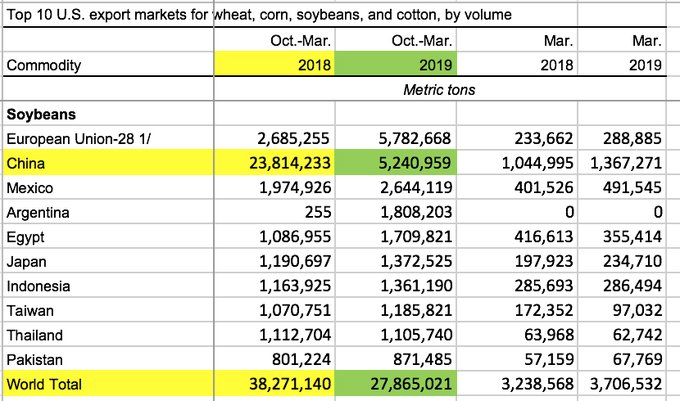

The article stated that, “Thursday’s report covers data through 2017 and highlights the stakes involved for trade-dependent farm country.

“Overall, Nebraska farm exports were $6.4 billion in 2017, almost $200 million less than the year before, according to the report. That drop was driven by a $130 million drop in soybean exports and a $140 million drop in corn exports.”

And Donnelle Eller reported on the front page of Saturday’s Des Moines Register that, “Prospects for improved prices are dimming, experts say, with record supplies, disease sweeping through China’s pig herd and cutting soy demand, and hope for a new U.S.-China trade deal slipping away.”

Wall Street Journal writer Josh Zumbrun reported on Friday that,

With a U.S.-China trade deal in danger of collapse, the Trump administration said it will begin work on a new program to provide aid to farmers—sending a signal to Beijing that Washington is preparing for a prolonged conflict.

“As negotiators for the U.S. and China continued talks Friday, President Trump said on Twitter that the U.S. could use tariff revenue to buy ‘agricultural products from our Great Farmers, in larger amounts than China ever did, and ship it to poor & starving countries in the form of humanitarian assistance.’”

The Journal article noted that, “Agriculture Secretary Sonny Perdue confirmed on Twitter that a new aid program is under way. Mr. Perdue tweeted that he spoke via phone Friday with Mr. Trump who ‘directed [the U.S. Department of Agriculture] to work on a plan quickly.’ Asked for further information, a USDA spokesman referred to the tweet.

“One option would be to revive programs from last year in which the Agriculture Department authorized $12 billion in initiatives that were designed to soften the blow to farmers. The programs consisted primarily of one-time subsidy payments to producers of affected crops.

“These programs didn’t have a humanitarian-aid component like that suggested by the president in his tweet.”

Also Friday, Reuters writers Humeyra Pamuk, Tom Polansek and P.J. Huffstutter reported that, “A new aid program would be the second round of assistance for farmers, after the Department of Agriculture’s $12 billion plan last year to compensate for lower prices for farm goods and lost sales stemming from trade disputes with China and other nations.”

“The American Farm Bureau Federation said it was too soon to throw its support behind the potential program, as did the American Soybean Association. But U.S. hog farmers were quick to support the idea of additional government purchases,” the article said.

Pamuk, Polansek and Huffstutter added that, “Until this week, the White House’s budget plans had called for a dramatic, 15% cut for USDA, calling its subsidies to farmers ‘overly generous.’”

The Reuters article also stated that, “Two possible outlets Trump could use for sending government-purchased agricultural goods to countries overseas include the Food for Progress food aid program, in which U.S. agricultural commodities are donated to developing countries, and the Food for Peace program, which also provides U.S. food assistance, according to farm economy experts.

“But Trump’s budget proposed cutting funding for both of those programs. In addition, many products hardest hit by the U.S.-China trade fight – such as soybeans – are used for animal feed, not food for human consumption.”

Bloomberg writer Aya Takada reported over the weekend that, “Agriculture Secretary Sonny Perdue wants China to be a customer of American farm products, even after Washington hiked tariffs on more than $200 billion in Chinese goods, and said retaliation by Beijing would prompt the U.S. to boost support to its farmers.

“‘Our biggest goal will be for China not to retaliate and stay at the table to negotiate a good deal,’ Perdue told Bloomberg News on Sunday, adding the U.S. will respond if China retaliates.”

The Bloomberg article stated that, “Perdue said the implementation of the program will take time, as the U.S. has a large stockpile of grain and oilseed. The U.S. Department of Agriculture released its closely watched monthly crop outlook on Friday, issuing the first guidance on supply and demand for the upcoming season, and forecast rising domestic stockpiles.

“Soybeans posted their biggest weekly loss in more than eight months in the week through May 10 as the USDA report exceeded analysts’ estimates for oilseed stocks. Corn also slumped as U.S. inventories were projected to swell to the most since the 1987-1988 season.

“U.S. Wants China to Be a Customer, Not to Retaliate, Perdue Says,” by Aya Takada. Bloomberg News (May 11, 2019).

“‘I cannot say for sure right now when purchases of those kinds of products will take place,’ Perdue said. ‘We have to look at the seasonality of all the crops across the spectrum and agree on which are hurt and damaged by China’s decisions.’”

Source: Keith Good, Farm Policy News