USDA Agricultural Trade Outlook- FY20 Export Forecast Increased

On Monday, the USDA released its Outlook for U.S. Agricultural Trade, a quarterly report from the Department’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS). Today’s update includes highlights from the report, which was coordinated by Kamron Daugherty and Hui Jiang.

On Monday, the USDA released its Outlook for U.S. Agricultural Trade, a quarterly report from the Department’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS). Today’s update includes highlights from the report, which was coordinated by Kamron Daugherty and Hui Jiang.

The Outlook stated that, “U.S. agricultural exports in Fiscal Year (FY) 2020 are projected at $139.0 billion, up $2.0 billion from the August forecast, driven by higher soybean, pork, and dairy export forecasts. Soybean exports are up $1.2 billion to $18.0 billion as a result of higher unit values. Pork exports are raised $400 million, largely due to demand from China. Dairy product exports are up $300 million to $5.8 billion as volumes and unit values are expected to strengthen. The beef export forecast is reduced $200 million, reflecting lower unit values. Overall livestock, poultry, and dairy exports are forecast at $31.9 billion, $500 million higher than the August projection.”

More narrowly, FAS-ERS explained that, “FY 2020 grain and feed exports are forecast at $29.5 billion, down $600 million from the August forecast, due mainly to declines in corn and wheat.

Corn is forecast at $9.0 billion, down $400 million on lower volumes as U.S. exports face strong competition from Brazil, Argentina, and Ukraine.

“Corn producers in South America (Brazil and Argentina), Ukraine, and less so in Russia have been increasingly capturing the steady growth in global corn trade, and this trend is expected to continue. This shift in global corn production and exports in favor of these low-cost and favorably located corn producers has already altered global trade. The United Sates, once the foremost power in corn exports with a market share historically between 60 and 80 percent, has recently seen its share fall below 40 percent and is expected to continue losing its competitive edge to lower cost producers” (“A Deeper Look Into the USDA Crop Baseline Projections to 2028, With a Focus on Trade,” FDS-19k-02 USDA, Economic Research Service).

“Sorghum is up $100 million to $500 million on higher volumes. Feeds and fodders are forecast at $7.7 billion, unchanged. Wheat is forecast at $6.0 billion, down $300 million on lower volumes and unit values in light of strong international competition. U.S. wheat exports in the coming months will likely be constrained by large supplies in Russia, the European Union, and Argentina.”

“In 2019 and beyond, the growth in export sales from the EU and Argentina was expected to be robust, averaging about 3 percent per year” (“A Deeper Look Into the USDA Crop Baseline Projections to 2028, With a Focus on Trade,” FDS-19k-02 USDA, Economic Research Service.).

“Oilseeds and products are forecast at $27.1 billion, up $1.5 billion from the August projection. Higher unit values on lower U.S. production accounts for most gains, with value up $1.2 billion to $18.0 billion with a decline in projected U.S. production.

Additional sales to China since the beginning of the fiscal year have also strengthened U.S. prices. Despite these sales, soybean export volumes are unchanged.

“Soybean meal export volumes are lower on strong competition from Argentine exports. In addition, tight U.S. soybean oil stocks are expected to increase prices, limiting U.S. competitiveness.”

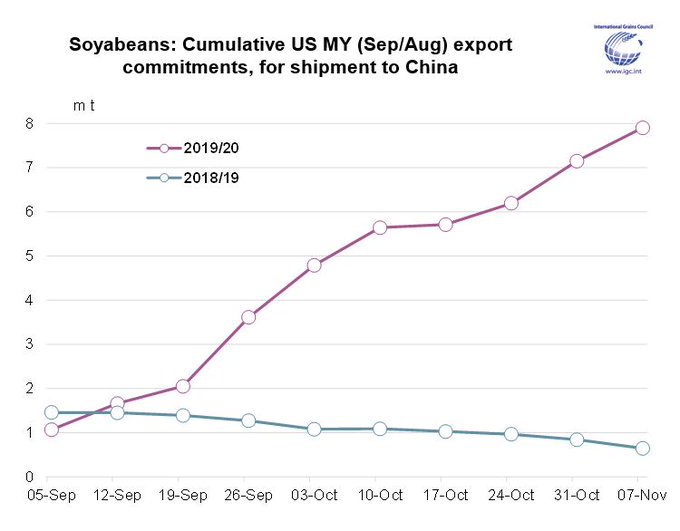

Purchases made during progressing bilateral trade negotiations have helped push MY19/20 US #soybean commitments for delivery to China to levels well above a year ago.

From a regional perspective, FAS-ERS pointed out that,

The export forecast for China is raised $3.5 billion from August to $11.0 billion, due to higher expected demand for soybeans and pork. Export sales of both are ahead of the same time last year.

“Forecast exports to Japan are lowered $300 million to $12.5 billion on reduced prospects for corn, pork, and beef. The forecast for South Korea is down $200 million to $8.3 billion as a result of lower beef unit value. Exports to Taiwan are forecast $200 million lower to $3.7 billion, on expectations of reduced export values of bulk commodities and beef.”

“The export forecasts for Canada and Mexico are unchanged from August at $21.5 billion and $19.8 billion, respectively,” the USDA report said; adding that, “Exports to the EU are forecast at $13.3 billion, which is $300 million lower than the August projection due to reduced demand for soybean and soybean products.”