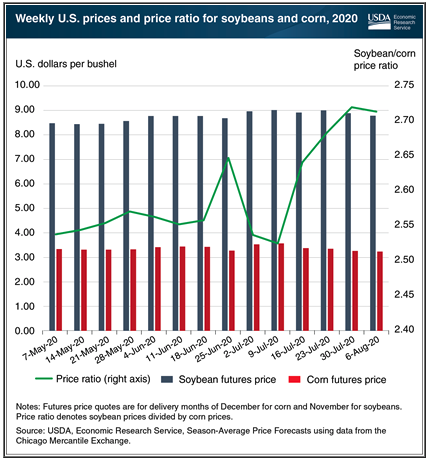

USDA-Soybean-to-Corn Price Ratio Signals Increasing Soybean Profitability

The soybean-to-corn price ratio is often used as one of several tools in measuring profitability of soybeans and corn.

The current ratio of U.S. soybean to corn prices has recently risen, sending a signal to farmers that the relative profitability of soybeans has increased over corn.

Soybeans and corn are crops that compete for acreage in production and are complements in feed use.

Their futures prices-the price of a contract to deliver a bushel of soybeans or corn at a certain time in the future-are used to calculate a ratio through dividing the soybean price by the corn price.

Higher price ratios indicate that soybeans are relatively more profitable than corn.

This ratio, which averaged 2.51 over the past 20 years, can tell farmers whether planting, harvesting, and storing one or the other crop might be advantageous.

The ratio can also be used by livestock producers to indicate the price direction for feed ingredients.

When the USDA, National Agricultural Statistics Service’s June 2020 Acreage report indicated that less corn acreage had been planted than expected in early spring, futures prices for corn in marketing year 2020/21 increased by 8 percent.

Soybean futures prices increased at the same time. Since late June, expectations of higher corn yields eroded the futures price for corn by 2.4 percent, while the price for soybeans increased by 1.1 percent.

This differential in prices led to an increase in the soybean-to-corn price ratio from 2.64 to 2.71, a 2.5 percent increase from late June.

This chart and associated data are drawn from the Economic Research Service’s Season-Average Price Forecasts data product.

Bullish outlook for soybeans

Continued hot and dry weather across much of the Midwest has been supportive of soybean futures.

Meanwhile, market analyst Darin Newsom says he sees “an incredibly bullish situation” developing in the soybean market.

“There’s something brewing out there. Is it reduced production? Most likely. Is it increased demand? That’s still a question market. But for right now we have an incredibly bullish situation, one that continues to grow more so every day,” Newsom says.

Commercial buying in soybeans is good, Newsom says, and the non-commercial side-the investment side-keeps adding positions as well.

“So we have a very bullish situation. It could get a little top-heavy if we don’t continue to see the fundamentals strengthen-then it could fall apart,” he says. “But for right now, we’ve got a very bullish market.”

Newsom says from a strictly technical point of view, his target on November soybeans is 9.25.

“At some point, though, it’s going to start looking a little bit overbought. Can it push higher? Absolutely. As I said, it’s got a very bullish structure right now. But from a technical point of view, the target I’m looking at right now is up around 9.25.”

Source: AgriMarketing