Will Off-Farm Income Weigh on Fragile Farm Economy?

Several weeks ago, we wrote about five macroeconomic factors to monitor in 2020. As one reader pointed out, surging unemployment claims could pose challenges for an already fragile farm economy. This week’s post is a look at off-farm income and potential challenges ahead, specifically the underlying demographics.

Off-Farm vs. On-Farm Income

The USDA has several metrics for segmenting producers. For the issue of off-farm income, we’ve found the typography segments insightful. Specifically, the USDA has three categories:

- Residence farms – which account for 54% of farm operations- are defined as having a primary occupation other than farming. Negative farm income is very common for this segment, and they are dependent on off-farm income.

- Intermediate farms– This group is defined as primarily engaged in farming and less than $350,000 in gross cash farm income. These are the smaller-scale operations and account for 38% of all farms. With $1,900 of on-farm income in 2018, off-farm income is critical for this segment as well.

- Commercial farms– This segment is those primarily engaged in farming, and more than $350,000 in gross farm sales. This group is just 8% of operations. On-farm income is much more significant for this segment. Furthermore, off-farm income is still substantial.

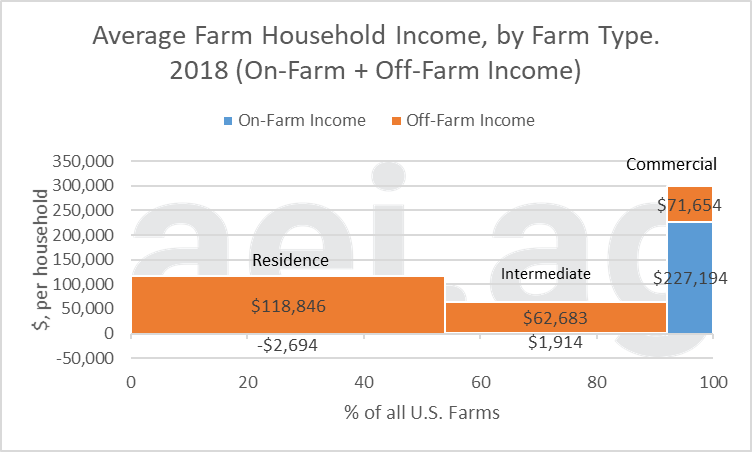

Figure 1 shows these segments and the components, on average, of farm household income. The horizontal axis corresponds with the size of each segment. On average, off-farm income is important for each segment. That said, the residence and intermediate farms (92% of farms) are especially reliant on off-farm income.

Keep in mind that total farm household income is used to meet several obligations, including family living expenses. Furthermore, producers also use the income to satisfy debt service obligations. In other words, the challenge many operations – and farm households- face isn’t being profitable, but profitable enough.

One last note, the demographic situation outlined in figure 1 is why median farm income is not a useful measure of farm financial health.

Figure 1. Average Farm Income by farm type, 2018. Data Source: USDA ERS, aei.ag calculations.

Distribution of Farm Debt

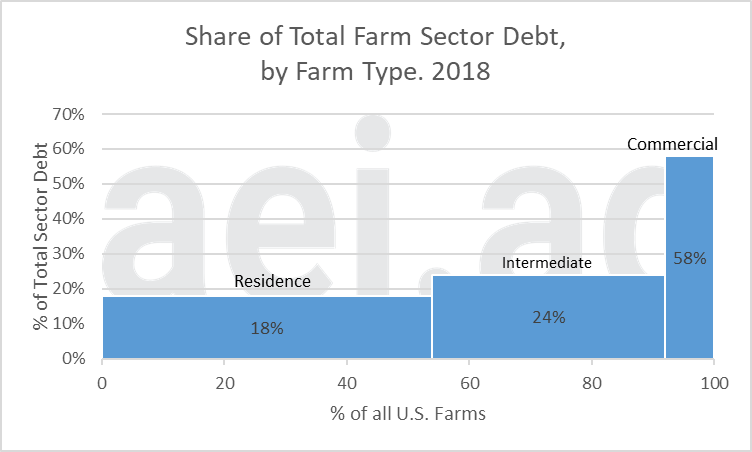

Using the same segments, the distribution of total farm sector debt is shown in Figure 2. Keep in mind that a majority of farms (nearly 64%) do not have debt.

Overall, there is a significant concentration of farm debt in the commercial segments. Roughly 8% of U.S. farms hold 58% of total farm debt.

On the other end of the spectrum, 42% of total farm debt is held by 92% of farms. These farms, however, are very dependent on off-farm income. Around 18% of total sector debt is held by residence farms which, on average, have very little on-farm income.

Figure 2. Share of Total Farm Sector Debt, by Farm Type, 2018. Data Source: USDA ERS, aei.ag calculations.

Wrapping it Up

Brent always reminds me that debts are not repaid at the sector – or segment- level. While these data can be insightful, they provide no insights as to what’s going on for any individual farm.

When thinking about on-farm vs. off-farm income, the first things to keep in mind are demographic. The USDA reports that – on average- that nearly 92% of farms are heavily dependent on off-farm income to meet their household obligations, including family living and servicing debt. Furthermore, while total farm sector debt is heavily concentrated at the commercial segment, 42% of total farm debt is held by those dependent on off-farm income (residence and intermediate farms).

In Part 2, we’ll consider trends in off-farm income and the potential implications of rising unemployment rates on the already fragile farm economy.

*This post was originally published for AEI Premium readers. The entire text can be accessed by users here, or via the risk-free 30-day trial here. Click here to learn more about AEI Premium.

Click here to subscribe to AEI’s Weekly Insights email and receive our free, in-depth articles in your inbox every Monday morning.

You can also click here to visit the archive of articles – hundreds of them – and to browse by topic. We hope you will continue the conversation with us on Twitter and Facebook.

Source: David Widmar, Agricultural Economic Insights