Yield Updating Decisions Under the 2018 Farm Bill

Landowners will have a one-time yield updating decision under the 2018 Farm Bill: 1) keep the current Price Loss Coverage (PLC) yield that is assigned to a crop on a Farm Service Agency (FSA) farm or 2) update based on farm yields from 2013 to 2017. This decision can be made for each program crop on each FSA farm, and the decision can differ across crops and across farms. PLC yields will impact PLC payments under the 2018 Farm Bill, but not Agricultural Risk Coverage (ARC) payments. To maximize PLC payments, the higher of the current or update yield should be chosen. We suggest considering updating even if ARC is chosen as the commodity title choice for 2019 and 2020, because PLC may be chosen in 2021, 2022, and 2023, and because the updated yield could carry over to farm bills in the future.

Landowners will have a one-time yield updating decision under the 2018 Farm Bill: 1) keep the current Price Loss Coverage (PLC) yield that is assigned to a crop on a Farm Service Agency (FSA) farm or 2) update based on farm yields from 2013 to 2017. This decision can be made for each program crop on each FSA farm, and the decision can differ across crops and across farms. PLC yields will impact PLC payments under the 2018 Farm Bill, but not Agricultural Risk Coverage (ARC) payments. To maximize PLC payments, the higher of the current or update yield should be chosen. We suggest considering updating even if ARC is chosen as the commodity title choice for 2019 and 2020, because PLC may be chosen in 2021, 2022, and 2023, and because the updated yield could carry over to farm bills in the future.

Background on Program Yields

Program yields for FSA farms have been around since the 1980s. In the 1980s and early 1990s, program yields were used to determine deficiency payments. Program yields were used to set direct payment rates under the 1996, 2002, and 2008 Farm Bills, and counter-cyclical payments under the 2002 and 2008 Farm Bills. For the 2014 and 2018 Farm Bills, program yields enter into the calculation of PLC payments. Because program yields now specifically apply to the PLC program, program yields are often referred to as PLC yields. History suggests that the PLC yields could be used in new programs instituted in future farm bills.

Each FSA farm with base acres in a program crop will have a PLC yield for that crop. How the current PLC yield came into being could go back to the 1980s. The 2002 and 2014 Farm Bills allowed landowners decisions relative to yields used to determine payments. Each updating opportunity had its own features, with some similarities to updating decisions under the 2018 Farm Bill. The 2002 Farm Bill did not allow updating. History suggests that decisions made about PLC yields under the 2018 Farm Bill could have long-lasting impacts into the future, and updating options may not exist in the future.

The PLC yield will enter into the calculations of PLC payments under the 2018 Farm Bill (see farmdoc daily, September 24, 2019, for a complete discussion of the decision). Higher yields will result in higher payments. Therefore, the incentive is to choose the higher of the current or update yield.

PLC yields do not enter into the calculations of ARC payments. Even if ARC is chosen as the commodity title choice, it seems prudent to update the PLC yield if the updated yield is higher than the current yield. Commodity choices between ARC and PLC will initially be made for 2019 and 2020, and then can be changed for 2021, 2022, and 2023 program years. An initial ARC choice could be changed to PLC in later years of the 2018 Farm Bill. Moreover, PLC yields could have impacts in future farm bills. In all previous farm bills, having a higher program yield has been a benefit. It is difficult to construct a scenario where having higher yields is not a benefit.

Yield Updating Decisions

Updating is the decision of the landowner, not the current producer on the farm. PLC yields can be updated until September 30, 2020. This differs from the March 15, 2020 deadline for determining ARC and PLC choices for 2019 and 2020. If yields are updated, the updated yield will not be used to determine 2019 payments. The current, non-updated yield will apply to 2019. Updated yields will apply in 2020 and years thereafter. If no action is taken, the current PLC yield will be applied to future years, at least for the remainder of this farm bill and potentially longer.

The decision is straightforward: choose the higher of the current or updated yield because the higher yield will result in the highest PLC payment. There are no downsides to having a higher yield under the 2018 Farm Bill. Separate decisions can be made for different program crops on an FSA farm. If an FSA farm has corn and soybeans as program crops, the corn yield could be updated while the soybean yield could not be updated. Updating decisions can vary across FSA farms.

The updated yield will be based on actual, farm yields from 2013 to 2017. Yield updating will be done as follows:

- Landowners (or farmers with power of attorney) will supply farm yields for all years from 2013 to 2017 for which the crop was grown on the farm. If the crop was grown on the farm, a yield must be supplied or a substitute yield will be used. FSA has yearly acreage reports for FSA farms. As a result, FSA has a record of crops grown on the farm.

- There are substitute yields for each crop. These substitute yields vary across counties, and are 80% of t-yields. T-yields are developed by the Risk Management Agency for used as substitute yields in crop insurance programs. In most cases, substitute yields will be lower than farm yields. The higher of the actual farm yield or the substitute yield will be used in updating calculations.

- An average of annual yields, the higher of farm yields or substitute yields, will be calculated. The average will be based on five yields if the farm grew the crop in all five years, four yields if the farm grew the crop in four years, and so on.

- The updated yield will equal the average, times a national yield factor times .9. National yield factors vary across crops. The national yield factor is .9 for corn and soybeans, and .9545 for wheat. As an example, take a farm with average corn yields from 2013 to 2017 of 200 bushels per acre. Corn’s national yield factor is .9. The updated yield is 162 bushels per acre (200 average x .9 national yield factor times 90%).

PLC Yield Updating Tool

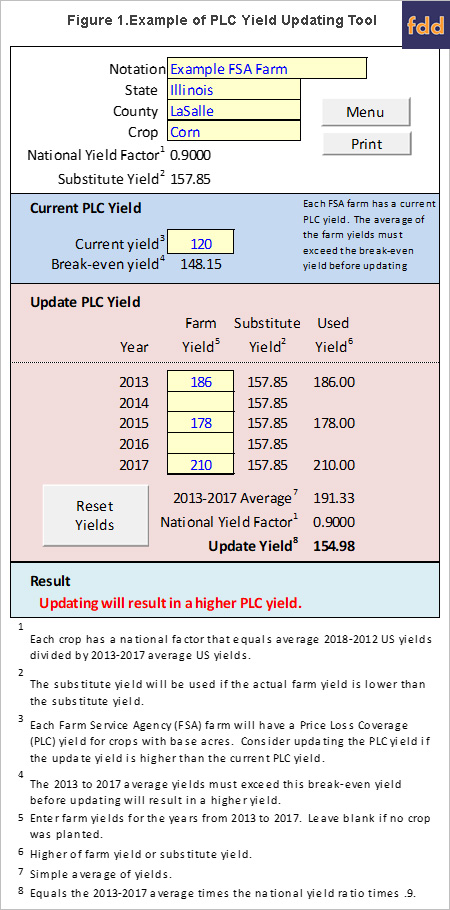

A PLC Yield Updating Tool is included in the 2018 Farm Bill Decision Tool, a Microsoft Excel spreadsheet that can be downloaded from the farmdoc website. Users will select a state/county/crop combination. The tool then will bring in the appropriate national yield factor and substitute yield. Users can enter farm yields in each year from 2013 to 2017. The updated yield will be calculated.

Figure 1 shows an example of corn in LaSalle County, Illinois. The national yield factor for corn is .9. The substitute yield for LaSalle County is 157.85 bushels per acre. The example farm has a current PLC yield of 150 bushels per acre. For updating to result in a higher yield, the 2013-2017 average of farm or substitute average must be above 185.19 bushels per acre. On the example farm, corn was grown in three years: 186 bushels per acre in 2013, 178 bushels per acre in 2015, and 210 bushels per acre in 2017. All actual yields exceeded the substitute yield of 157.85 bushels per acre. As a result, only actual yields are used in update calculations. The 2013-2017 average is 191.33 bushels per acre, resulting in an updated yield of 154.98 bushels per acre (191.33 average yield x .9 national yield factor x .9). The updated yield of 154.98 bushels per acre is higher than the 150 current PLC yield. The advice would be to update yields.

National Yield Factors

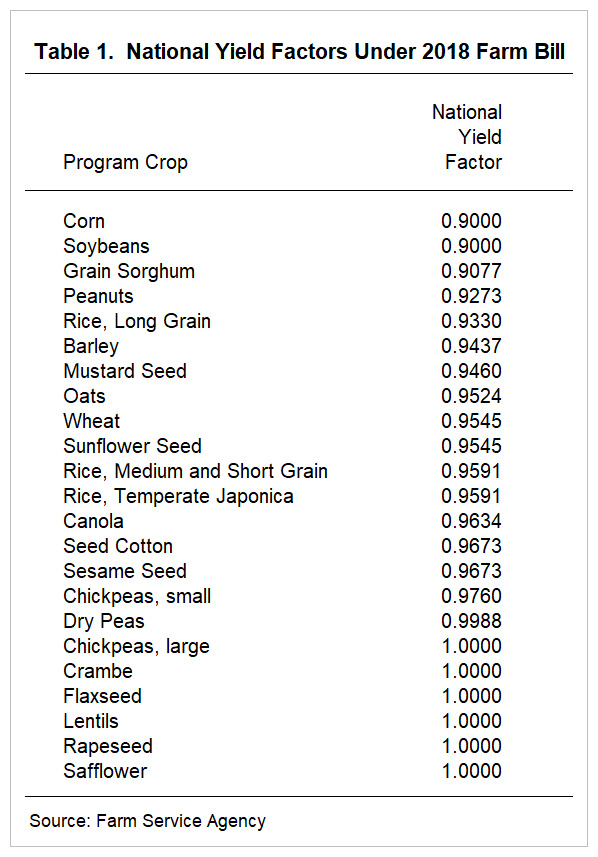

Table 1 shows national yield factors for all program crops. As can be seen, corn and soybeans have the lowest national yield factors of .9. The next lowest factor is for grain sorghum at .9077. The highest yield factor is 1.0 for large chickpeas, cranberry, flaxseed, lentils, rapeseed, and safflower.

The national yield factors place corn and soybeans at a disadvantage relative to the other crops. The 2013-2017 average for corn and soybeans will be discounted using a .81 factor (.9 national yield factor times .9). Large chickpeas, cranbe, flaxseed, lentils, rapeseed, and safflower will use a .90 factor (1.0 national yield factor x .9).

The 2018 Farm Bill stipulated that FSA calculate national yield factors based on the formula:

Average U.S. yield from 2008 to 2012 divided by average U.S. yield from 2013 to 2017

with limits of .9 and 1.0. If the above ratio resulted in a value below .9 for a crop, a value of .9 was used. This is the case for corn and soybeans. If the above ratio results in a value above 1.0, a value of 1.0 will be used. This is the case for large chickpeas, cranbe, flaxseed, lentils, rapeseed, and safflower.

The above formula results in lower national yield factors for crops that had higher yields from 2013 to 2017 relative to the earlier period from 2008 to 2012. Generally, crops with the highest yield trends will have higher yields in later periods. Why Congress chooses to penalize these crops is a good policy question. Note that this procedure hits the Midwest disproportionally more than other areas because corn and soybeans had much higher yields in the 2013-2017 period with corn and soybeans being the most important crops in the Midwest. More detail on PLC yield updating is provided in a farmdoc daily published on February 20, 2019.

Documentation

When updating, landowners will supply yields for the years from 2013 to 2017. Documentation for those yields will not need to be supplied to FSA at that point. Documentation could be requested for yields at some point in the future. Crop insurance records will serve as a suitable form of documentation.

Summary

Landowners have an opportunity to update PLC yields by September 30, 2020. Farmers on rented land likely will need to communicate with landowners concerning updating decisions. Updating the PLC yield if the updated yield is higher than the current yield seems like a prudent choice.

References

Schnitkey, G., C. Zulauf, K. Swanson, J. Coppess and N. Paulson. “The Price Loss Coverage (PLC) Option in the 2018 Farm Bill.” farmdoc daily (9):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 24, 2019.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. “Understanding the 2018 Farm Bill PLC Yield Update: Which Program Commodities Have a Higher Update Yield at the US Market Level?.” farmdoc daily (9):30, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 20, 2019.

Source: Gary Schnitkey, Krista Swanson, Nick Paulson, Jonathan Coppess, Ryan Batts and Carl Zulauf, Farmdocdaily