The Hurricane Insurance Protection – Wind Index Endorsement covers a portion of the deductible of the underlying crop insurance policy when the county, or a county adjacent to it, is within the area of sustained hurricane-force winds from a named hurricane.

The Hurricane Insurance Protection – Wind Index (HIP-WI) Endorsement covers a portion of the deductible of the underlying crop insurance policy when the county, or a county adjacent to it, is within the area of sustained hurricane-force winds from a named hurricane that are published by the National Hurricane Center (NHC) at the National Oceanic and Atmospheric Administration (NOAA). The coverage provided by this hurricane wind crop insurance protection can be combined with the Supplemental Coverage Option (SCO) and the Stacked Income Protection Plan (STAX) when acreage is also insured by a companion policy.

Eligible Crops and Location

Eligible Crops and Location

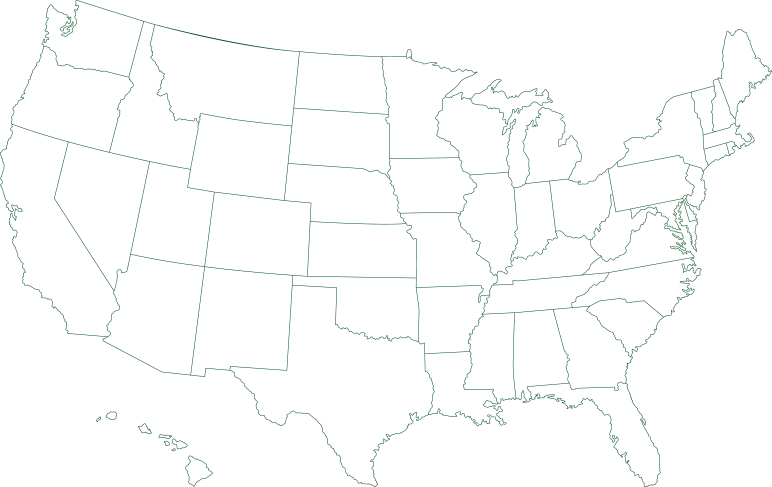

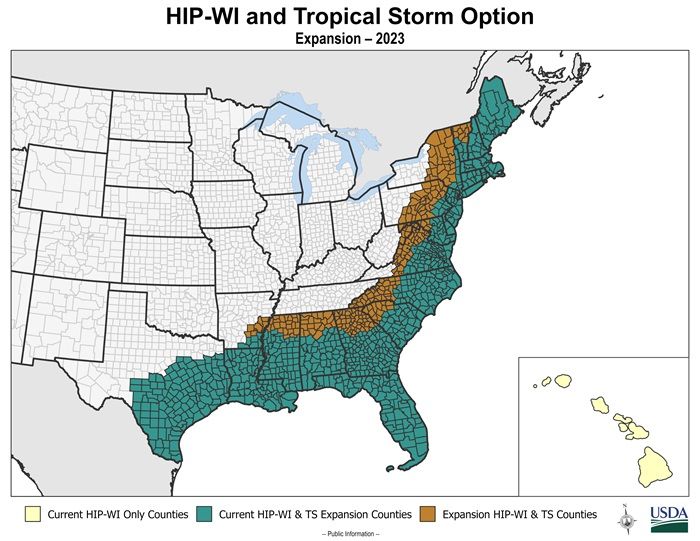

The HIP-WI Endorsement provides coverage for 70 different crops insured under the Common Crop Insurance Policy Basic Provisions for both Catastrophic (CAT) and additional coverage policies when provided in the actuarial documents. HIP-WI is available in counties in the vicinity of the Gulf of Mexico (Texas, Mississippi, Alabama, Georgia and Florida) and the Atlantic seaboard, as well as Hawaii.

Hurricane Insurance Eligibility Requirements

To be eligible for the HIP-WI Endorsement, you must:

- Have an insurance policy under the Basic Provisions with the same insurance provider;

- Elect HIP-WI on or before the underlying crop insurance policy sales closing date (SCD)

- Elect a HIP-WI coverage percentage; and

- Comply with all terms and conditions of the HIP-WI Endorsement.

Eligibility for the Tropical Storm Option (TS)

The Tropical Storm Option (TS) is an option to the HIP-WI endorsement that provides coverage for tropical storm weather events as defined by the Hurricane Data Provisions (HDP).

To be eligible for the Tropical Storm (TS) option, you must: *

- Meet all eligibility requirements for HIP-WI.

- Elect TS on or before the HIP-WI sales closing date (SCD).

- The TS option must be available in the actuarial documents.

*Please note there are additional requirements for the initial 2023 crop year. Please consult your trusted ProAg crop insurance agent or policy provisions for additional information.

HIP-WI Insurance Period

Generally, the insurance period for HIP-WI:

- Begins on the later of the sales closing date or earliest planting date of the crop; and

- Ends on the earliest of the end of insurance date or termination date (if there is no end of insurance date for the crop).

Is There a Waiting Period for Hurricane Insurance Protection?

The initial year HIP-WI is elected, coverage will not begin until 14 days after the sales closing date. If the underlying crop policy also requires a waiting period, the wait periods will run concurrently. For subsequent years, if you increase your HIP-WI coverage, the increase will not take effect until 14 days after the Sales Closing Date (SCD). If a loss event occurs within the 14-day waiting period, HIP-WI coverage will be based on the coverage percentage and coverage range for the previous insured year.

Acreage Reporting Requirements

You are not required to submit an acreage report for HIP-WI, because HIP-WI uses the underlying policy’s report. So, the number of eligible acres will be the number of acres reported on an intended acreage report, or the number of planted acres reported on the acreage report of the underlying crop insurance policy. If you file an intended acreage report, eligible acres will be limited to the actual acres you planted and reported on the underlying policy’s acreage report. If an acreage report is not required for the underlying policy, the crop’s equivalent of an acreage report will be used to determine the amount of insurance for HIP-WI.

Important Dates

Sales Closing and Cancellation …… Same as the underlying crop insurance policy

Is This Plan Right for You?

Contact your trusted ProAg crop insurance agent for assistance in comparing the risk management options available to you and your unique farming operation. Come grow with confidence today.

What Causes of Loss are Covered under HIP-WI?

The full value of HIP-WI Endorsement is paid if a county, or adjacent county, is within the area of sustained hurricane-force winds from a named hurricane based on data published by the National Hurricane Center. The counties where payments occur will be identified in the actuarial documents. It is possible that your individual farm may experience reduced revenue or reduced yield due to hurricane-related causes and you do not receive an indemnity under HIP-WI. You are not required to file a notice of loss.

Settlement of a Claim

An indemnity is due when the county loss trigger is identified for the insured county. Losses under HIP-WI will be paid within 30 days after Federal Crop Insurance Corporation (FCIC) releases the list of counties identified as meeting the county loss trigger.

"*" indicates required fields