How MPCI Endorsements Add Peace of Mind to Your Operation

Purchasing extra protection combined with your regular crop insurance coverage might not always make the priority list. But think about the last time having extra protection really came in handy, on or off your farming operation. For example, adding that rental car coverage to your main auto policy might have seemed unnecessary until you found yourself in an accident and were thankful to have it.

Purchasing extra protection combined with your regular crop insurance coverage might not always make the priority list. But think about the last time having extra protection really came in handy, on or off your farming operation. For example, adding that rental car coverage to your main auto policy might have seemed unnecessary until you found yourself in an accident and were thankful to have it.

Adding endorsements to your multi-peril crop insurance (MPCI) coverage works the same. While MPCI is your main coverage, MPCI endorsements are supplemental options available for specific crops, situations and areas of the United States.

While many endorsements exist to fill in the gaps on your coverage, we’re breaking down the details behind four popular endorsement options — Hurricane Insurance Protection – Wind Index (HIP-WI), Enhanced Coverage Option (ECO), Margin Coverage Option (MCO), Supplemental Coverage Option (SCO), and Stacked Income Protection (STAX).

Available on: 30+ crops from canola to wheat

Federal subsidies available:

ECO: 80%

SCO: 80%

ECO and SCO exist to provide producers with expanded coverage options. Close to 9 million acres were enrolled in SCO protection in 2022, and more than 5 million acres in ECO. Both options have seen significant growth in total acres enrolled since their beginnings in the 2014 Farm Bill.

“The most important thing to know about ECO and SCO is that they are both area-based products,” says Whitney Redig, ProAg’s Regional Vice President for the Central Region. “If you’re in an area impacted by widespread drought, an extreme weather event such as the recent derechos, or there is a fluctuation in prices, these options could benefit you.”

Redig says that SCO and ECO liability is dependent on a producer’s underlying MPCI policy. This liability factor, as well as the coverage percentage that is chosen, allows producers to tailor their coverage uniquely to their needs. Based on yields in your area, producers receiving indemnity payments are then paid the following year.

“Do the research, talk with your agent and don’t be turned off due to the payment lag,” says Redig. “If there is another disaster that comes through, or prices fluctuate, consider how this benefit can keep the lights on in the shop and keep that family farm operation going.”

Redig, who witnessed the financial crisis of the 1980s impact her family farm, knows firsthand how critical the right elections are in overall coverage. She says filling in the gap of what your MPCI may not cover in full could make the difference between the success of your operation and being one disaster away from extremely tough decisions.

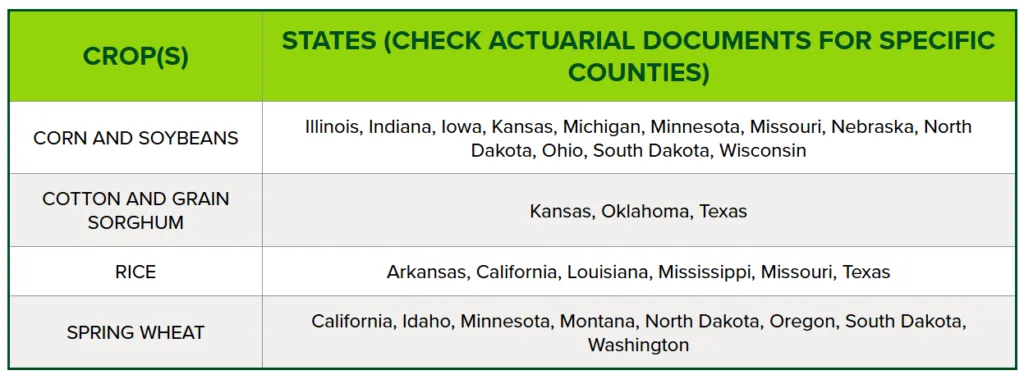

Available on: Corn, soybeans, cotton, grain sorghum, rice and spring wheat (see chart below)

Federal Subsidy Available: 80%

Margin Coverage Option (MCO) provides area-based coverage against an unexpected decrease in operating margin (revenue minus input costs) caused by reduced county yields, reduced commodity prices, increased prices of certain inputs or any combination of these perils. Because MCO is area-based (average for an area), it may not reflect your individual experience.

It uses the same expected and final area yields and harvest prices as the Supplemental Coverage Option (SCO) and Enhanced Coverage Option (ECO), but covers a band from 86% (where SCO coverage triggers) up to 90% or 95% of expected crop value. When combined with the Stacked Income Protection Plan (STAX) at the 90% area loss trigger, MCO covers a band from 90% to 95%.

Like SCO and ECO, MCO is based on your underlying policy plan of insurance. A payment may be made when the harvest margin for the county is lower than the trigger margin due to a decrease in revenue and/or an increase in input costs.

MCO is available in select counties for corn, cotton, grain sorghum, rice, soybeans and spring wheat in the states listed below. The sales closing date for corn, cotton, grain sorghum, soybeans and spring wheat is September 30. The sales closing date for rice varies by state and county.

Available on: Over 70 crops in counties within the vicinity of the Gulf of America and the Atlantic, as well as Hawaii

Federal subsidies available: 80%

Hurricane Insurance Protection – Wind Index Endorsement is a risk-management option for those exposed to hurricane-force winds. For those in hurricane areas, HIP-WI is a “win-win tool”, according to Joe Sharp, ProAg’s Regional Vice President for the Eastern Region.

“There is no acreage reporting or notice of loss which makes this endorsement especially attractive,” says Sharp. “The further inland you go, the cheaper it gets too. It makes sense to have it as the worst-case scenario is you don’t get impacted by a hurricane.”

Producers in hurricane-prone locations can go to USDA’s Risk Management Agency public database to see how their county has been triggered by hurricanes in the past. Leveraging this data, producers can make informed, cost-effective decisions for this MPCI endorsement that comes with a premium subsidy.

However, Sharp says one major HIP-WI misconception is worth noting.

“As soon as major wind happens, farmers think a payment is automatically coming,” says Sharp. “But one 75 mph wind gust doesn’t necessarily make the cut. The National Oceanic and Atmospheric Administration (NOAA) data must show your area had sustained hurricane-force winds for at least three minutes before an indemnity payment is triggered.”

The Tropical Storm Option (TS) has recently been added as an option to the HIP-WI endorsement that provides coverage for tropical storm weather events as defined by the Hurricane Data Provisions (HDP).

Available on: Upland cotton

Federal subsidies available: 80%

The Stacked Income Protection Plan is a cotton-only product that provides coverage for a portion of the expected county revenue. Sometimes the revenue can be based on multiple counties if more data is needed to establish expected yield and premium.

Michael Schulte, ProAg district sales manager, knows how critical STAX is for cotton producers.

“Most cotton farmers purchase STAX for themselves and their landowners,” says Schulte. “When you add a STAX payment to a year where breaking even is the best you can do, a bad year suddenly turns into a good year.”

With ongoing fluctuations in cotton prices and weather volatility, STAX provides peace of mind to ensure your operation is covered. Additionally, STAX is not subject to a cap.

“You can do your irrigated cotton one way and your dry land another way,” Schulte says. “STAX can be purchased on its own or in addition to your regular MPCI policy.”

Work with your agent

At the end of the day, adding endorsements to your MPCI insurance is not a one-size-fits-all conversation. Working with your agent or a trusted crop insurance provider is the best way to ensure you’re choosing the right endorsements for your operation.

ProAg is proud to offer these endorsement options and more. See what options are available in your state here.

* Not all coverage or products may be available in all jurisdictions. The description of coverage in this article is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by any of ProAg’s affiliated insurance companies.