Dairy Revenue Protection Insurance – Risk Management for Today’s Dairy Operations

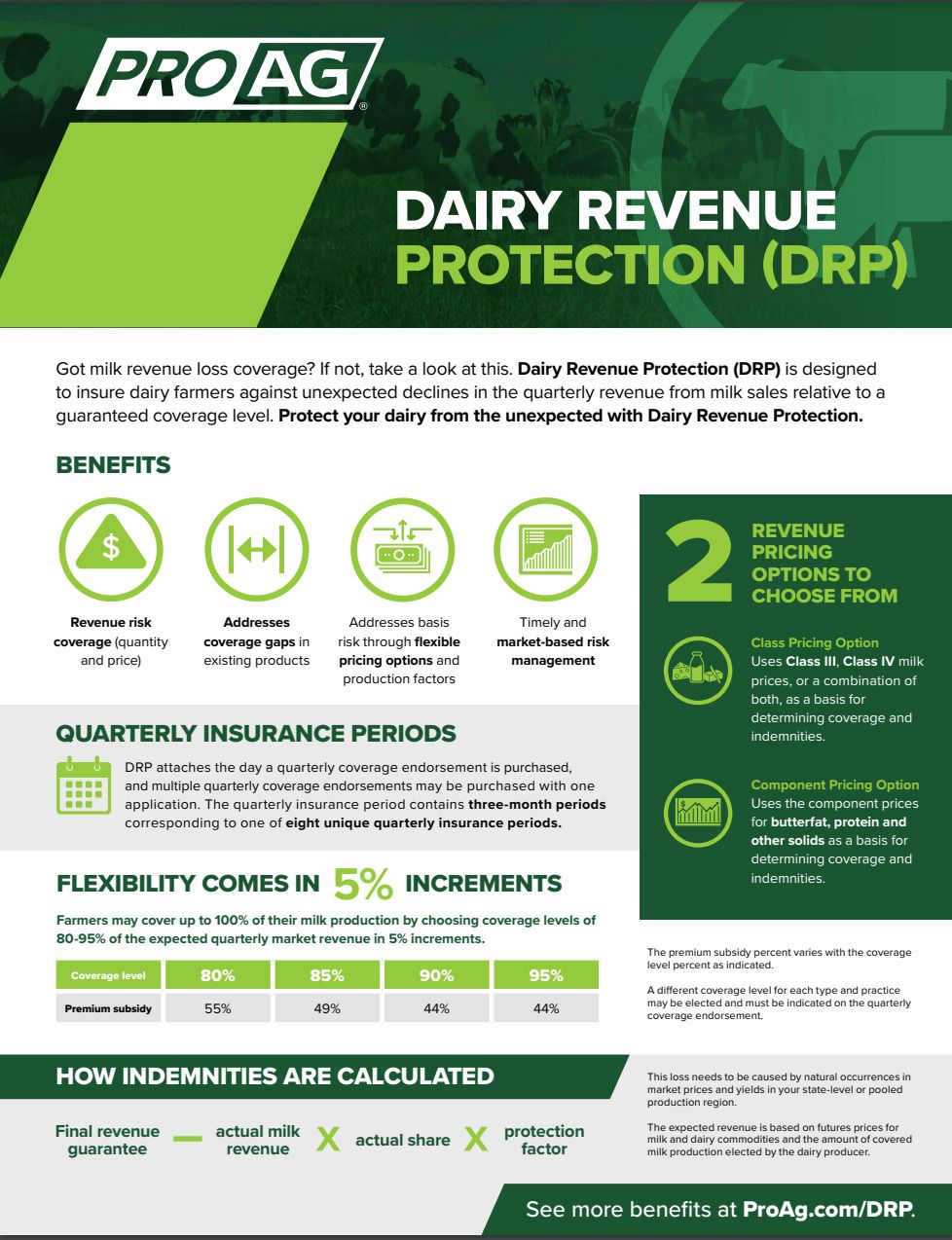

Dairy Revenue Protection (DRP) crop insurance is designed to insure against unexpected declines in the quarterly revenue from milk sales relative to a guaranteed coverage level. The expected revenue is based on futures prices for milk and dairy commodities and the amount of covered milk production elected by the dairy producer. The covered milk production is indexed to the state or region where the dairy producer is located.

DRP insurance is approved for sale in all counties in all 50 states.

Dairy Revenue Protection Policy Overview

Dairy insurance through DRP offers two revenue pricing options:

- The Class Pricing Optionuses a combination of Class III and Class IV milk prices as a basis for determining coverage and indemnities.

- The Component Pricing Option uses the component milk prices for butterfat, protein and other solids as a basis for determining coverage and indemnities. Under this option you may select the butterfat test percentage and protein test percentage to establish your insured milk price.

DRP policies function similar to crop revenue protection policies in that the dairy insurance revenue guarantee would be based on futures prices, expected production and market-implied risk.

Dairy Revenue Protection policies allow coverage levels from 80-95% of your expected quarterly revenue in five percent increments.

The dairy producer has six basic decisions to make on the DRP crop insurance policy:

- Select component or class pricing option

- Select a quarterly insurance period

- Declare milk production

- Select a coverage level (from 80 to 95 percent of the revenue guarantee)

- Declare the share percentage

- Select a protection factor (1.00 – 1.50)

The DRP insurance policy provides insurance for the difference between the final revenue guarantee and actual milk revenue, times your actual share and protection factor. This loss needs to be caused by natural occurrences in market prices and yields in your state-level or pooled production region. This policy does not insure against the death or other loss or destruction of your dairy cattle.

What are the Dairy Insurance Benefits?

Dairy Revenue Protection is an easy-to-use product which has few coverage declarations, minimal reporting requirements and eligibility for all dairy farmers. Premiums are established and offered daily using actuarially appropriate methods. Benefits to dairy producers of purchasing Dairy-RP include:

- The flexibility of producer options

- Revenue risk coverage (quantity and price)

- Addresses coverage gaps in existing products

- Addresses basis risk through pricing options and production factor

- Reduced complexity

- Timely and market-based risk management

DRP Quoting for ProAg Policyholders and Guests

Dairy Revenue Protection (DRP) quoting is now available online through our policyholder portal, myProAg™. Whether you are a guest or a current ProAg policyholder, you’ll have access by registering at my.proag.com.

Dive Deeper into DRP with these Articles

Recent Important Policy Changes

The following revisions are applicable for the 2026 and succeeding crop years for the DRP plan of insurance:

- Modified the termination date to January 31st and the premium billing date to the first day of the third month after the end date.

- Added language that outlines what is considered subsidy capture and specifies subsidy capture is not allowable. The new Insured’s Certification Against Subsidy Capture statement that needs to be signed reads: “I certify that I will not offset any insurance provided under this quarterly coverage endorsement through dairy contracts traded on commodity exchanges or with other means for the purpose of subsidy capture, and I acknowledge that if I violate this certification, I may be subject to administrative, civil or criminal sanctions.”

- Modified the natural disaster language to include animal disease as an event that prevents you from marketing milk, provided you give us written notice within 72 hours of the disaster or reportable animal disease.

- Increased minimum declarable butterfat test to 4.00 pounds, increased maximum declarable butterfat test to 6.00 pounds and increased minimum declarable protein test to 3.20 pounds.

Contact Us for Complete Policy Details

Additional information regarding Dairy Revenue Protection is available on the RMA website’s Livestock page, located at www.rma.usda.gov/livestock/.

We invite you to learn more from your trusted ProAg agent today about the Dairy Revenue Protection insurance program. Come experience the ProAg difference today.

Helpful DRP Links

- Monthly USDA AMS Announcement of Class and Component Prices

- Hoard’s Dairyman Dairy Mailbox, Milk, Cheese and Butter Prices

- CME Group Dairy Futures and Options

- USDA RMA Frequently Asked Questions on Dairy Revenue Protection

RMA Policy and Procedure Bulletins

- Dairy Revenue Protection Changes Effective for the 2026 and Succeeding Crop Years

- 2026 DRP Policy (26-DRP)

- 2026 DRP Insurance Standards Handbook

- 2025 DRP Commodity Exchange Endorsement (25-DRP-CEE)

Find a ProAg Agent

Pro Ag Management, Inc.* (collectively with its corporate affiliates, “ProAg®”) is a managing general agency representing several risk bearing insurance companies, including Producers Agriculture Insurance Company and U.S. Specialty Insurance Company and doing business as Pro Ag Insurance Services, Inc. in California, CA Entity License #0F34212. The insurance products described on this website may not be a complete list of all products offered and may not be offered in all states. The provided information does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by ProAg or any of its subsidiaries; always refer to the policy provisions. Actual coverages will vary based on the terms and conditions of the policy issued.