The Enhanced Coverage Option (ECO) insurance policy option provides area-based coverage for a portion of the underlying crop insurance policy deductible.

*NEW* The premium cost is shared between you and the government, where the government pays 65 percent of the premium for yield and revenue policies

Offers up to 95% coverage, the highest subsidized MPCI coverage available

County-based, which benefits farmers whose yield and revenue correlate with the county

ECO can trigger an indemnity on only a 5% loss in revenue or yield (dependent upon the underlying MPCI plan)

Supplemental shallow-loss coverage

Overview of Enhanced Coverage Option (ECO) Insurance Option:

Similar to the Supplemental Coverage Option (SCO), the Enhanced Coverage Option (ECO) is a crop insurance policy option that provides additional area-based coverage for a portion of the underlying crop insurance policy deductible.

It must be purchased as an endorsement to the Yield Protection, Revenue Protection, Revenue Protection with the Harvest Price Exclusion, Actual Production History or Yield Based Dollar Amount of Insurance policy. ECO offers producers a choice of 90% or 95% trigger levels. The term “trigger” refers to the percentage of expected yield or revenue at which a loss becomes payable.

How Does the ECO Insurance Option Work?

ECO follows the coverage of the underlying policy. If a producer chooses Yield Protection or a yield-based policy, then ECO covers yield loss. If a producer chooses a Revenue Protection policy, then ECO covers revenue losses.

The amount of ECO coverage depends on the liability of the underlying policy. However, ECO differs from the underlying policy in how a loss payment is triggered. The underlying policy pays a loss on an individual basis and an indemnity is triggered when a producer has an individual loss in yield or revenue. ECO pays a loss on an area basis, and an indemnity is triggered when there is a decrease in the county-level yield or revenue.

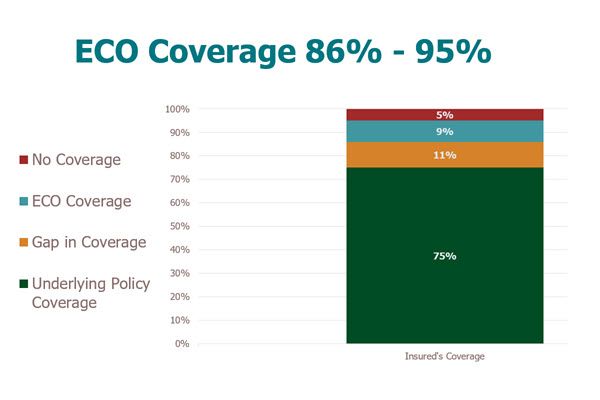

ECO has two trigger levels: 90% and 95%. ECO provides a band of coverage between the elected trigger level and 86%. If the county yield or revenue is reduced beyond the trigger level, the producer will receive an ECO indemnity. If the reduction in yield or revenue exceeds the 86% threshold, the producer will receive an indemnity equal to the full insured liability.

Quick ECO Endorsement Facts

- ECO sales closing date matches the underlying individual coverage.

- Separate premium and administrative fees for ECO by crop/county.

- *NEW* ECO’s subsidized rate is 65%

- Producers may purchase the Supplemental Coverage Option (SCO) along with ECO.

- Producers are not required to purchase SCO. They can leave a gap in coverage.

- ECO is not impacted by Farm Program decisions, including Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC).

- If a producer buys ECO, the producer may not:

- Purchase Margin Protection (MP), Margin Protection with the Harvest Price Option (MP-HPO), Area Revenue Protection Insurance (ARPI), Hurricane Insurance Protection Wind Index (HIP-WI), or other area plans.

- Apply ECO on acres that are already covered by Stacked Income Protection (STAX).

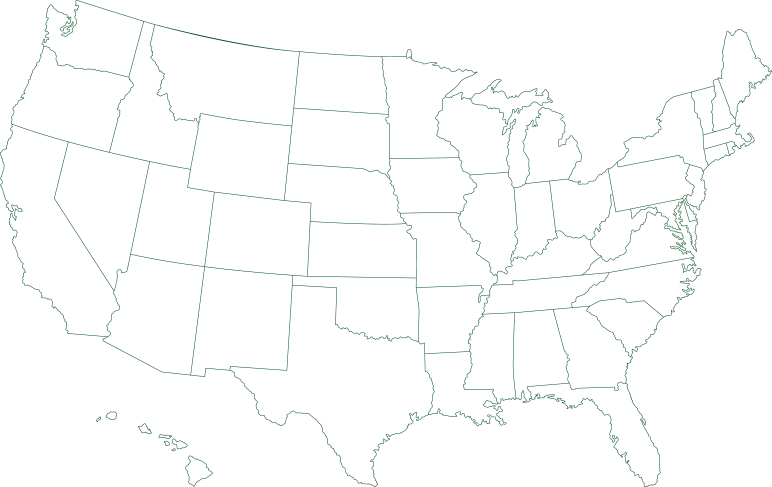

ECO Availability:

ECO is available for the crops below in most counties where these crops are grown. Additional crops will be added in subsequent years based on producer interest and data availability.

* Starting with the 2025 Crop Year

** Where SCO is currently available in California and Arizona with 2026 Crop Year

- Alfalfa Seed

- Almonds*

- Apples*

- Barley

- Blueberries*

- Buckwheat

- Burley Tobacco

- Canola

- Citrus**

- Corn

- Cotton – including Ex. Long Staple

- Cultivated Wild Rice

- Dry Beans

- Dry Peas

- Flax

- Forage Production

- Grain Sorghum

- Grapes*

- Hybrid Corn Seed

- Hybrid Seed Rice

- Hybrid Sorghum Seed

- Millet

- Oats

- Peanuts

- Popcorn

- Rice

- Rye

- Safflower

- Sesame

- Silage Sorghum

- Soybeans

- Sugar Beets

- Sugarcane

- Sunflowers

- Tobacco – Cigar Binder, Dark Air, Fire Cured and Flue Cured

- Walnuts*

- Wheat

Coverage Example

A producer’s corn crop has an expected value of $765.00 per acre (170 bushels at $4.50 per bushel). A Revenue Protection policy with a 75% coverage level is purchased. This is the ‘underlying policy.’ The underlying policy covers 75% (or $573.75) of the expected crop value and leaves 25% (or $191.25) uncovered as a deductible.

At this point, the producer has the option to buy ECO coverage. Since the underlying policy is Revenue Protection, ECO will also provide revenue protection, except ECO’s payments will be determined at a county level. The ECO revenue coverage is described in the following table. ECO yield coverage performs in the same manner.

ECO Coverage Calculation for 95% Area Trigger Level

- ECO Endorsement begins to pay when the county revenue falls below this percent of its expected level

- 95%

- ECO Endorsement pays out its full amount when the county revenue falls to 86 percent of its expected level

- 86%

- Percent of expected crop value covered by ECO (Value 1 – Value 2)

- 95% – 86% = 9%

- Amount of ECO Protection (Percent of Expected Crop Value Covered by ECO x Expected Crop Value)

- 9% X $765.00 = $68.85

The ECO Endorsement begins to pay when the county average yield or revenue falls below 95% (or 90%, if that is the trigger level the producer elected) of its expected level. The full amount of the ECO coverage is paid out when the county average revenue falls to 86%.

The ECO Endorsement begins to pay when the county average yield or revenue falls below 95% (or 90%, if that is the trigger level the producer elected) of its expected level. The full amount of the ECO coverage is paid out when the county average revenue falls to 86%.

ECO insurance payments are determined only by county average revenue or yield and are not affected if the producer receives a payment from the underlying policy. Therefore, it is possible for a producer to experience an individual loss but not receive an ECO payment, or vice-versa. A producer may also receive a loss on both the underlying policy and ECO.

The dollar amount of ECO coverage is based on the percent of crop value covered. In this example, there are nine percentage points of coverage – from 95% to 86%. Nine percent of the expected crop value ($765.00) is $68.85 (9% x $765.00). Thus, the ECO policy can cover up to $68.85 of the $191.25 deductible amount not covered by the underlying policy. A producer may cover a portion of the remaining amount of the deductible with other coverage, such as the Supplemental Coverage Option (SCO).

Now consider an event where the actual county revenue falls to 89% of the expected value. This loss is six percentage points less than the trigger level elected (95% – 89% = 6%). This indicates a loss of 66.67% of the ECO coverage range (6% / 9% = 66.67%). This loss is then applied to the amount of ECO protection to determine an indemnity of $45.90 per acre (66.67% x $68.85 = $45.90).

Indemnity Overview

- ECO expected and final yields are based on RMA data, NOT producer yields.

- ECO indemnities will be paid in the summer following the crop year, NOT at harvest time.

- ECO and individual coverage trigger independently. It is possible for a grower to have:

- An ECO indemnity, but no individual indemnity

- An individual indemnity, but no ECO indemnity

- Indemnities from both programs

- No indemnities

ECO on a Revenue Protection policy example**:

The Expected Area Yield is 200 bu./acre and the Projected Price is $5.00/bu. The producer elects a 95% ECO coverage.

The Coverage Range is the selected ECO coverage level less 86%: 95% – 86% = 9% The producer has an Approved Yield of 210 bu./acre.

The ECO Amount of Insurance is determined as the Expected Revenue (using the insured’s APH) is multiplied by the Coverage Range: ($5.00 x 210 bu./acre) x 9% = $94.50/acre

For illustrative purpose, suppose the Premium Rate is 45%.

Total Premium is calculated by multiplying the ECO Amount of Insurance and Premium Rate: $94.50/acre x 45% = $43.00/acre

Premium Subsidies are determined by multiplying Total Premium by the Subsidized Rate: $43.00/acre x 44% = $19.00/acre

Producer Premium is determined by subtracting the Premium Subsidy from the Total Premium: $43.00/acre – $19.00/acre = $24.00/acre

The Harvest Price is $4.80/bu. and the Final Area Yield is 190 bu./acre.

Multiply these numbers to find the Final Area Revenue: $4.80/bu. x 190 bu./acre = $912/acre

The Loss Percentage is determined by taking the Loss Trigger (90%/95%) less the Final Area Revenue divided by the Expected Area Revenue: Max (95% – ($912/acre ÷ $1,000/acre = 3.80%), 0

The Payment Factor is determined as the Loss Percentage divided by the Coverage Range: 3.80% ÷ 9% = 42.22%

The Payment Factor is then multiplied by the ECO Amount of Insurance to determine the ECO indemnity: $94.50/acre x 42.22% = $39.90/acre

**Yields, prices, and rating data are examples only.

"*" indicates required fields